Este artículo también está disponible en español.

Solana (SOL) is displaying resilience because it holds firmly above vital demand ranges, signaling the potential for an upcoming rally. Regardless of broader market indecision, with Bitcoin (BTC) struggling to regain upward momentum, Solana’s value motion suggests energy within the face of uncertainty. Buyers are carefully monitoring SOL’s means to keep up its present ranges, as a breakout might set the stage for substantial positive aspects.

Associated Studying

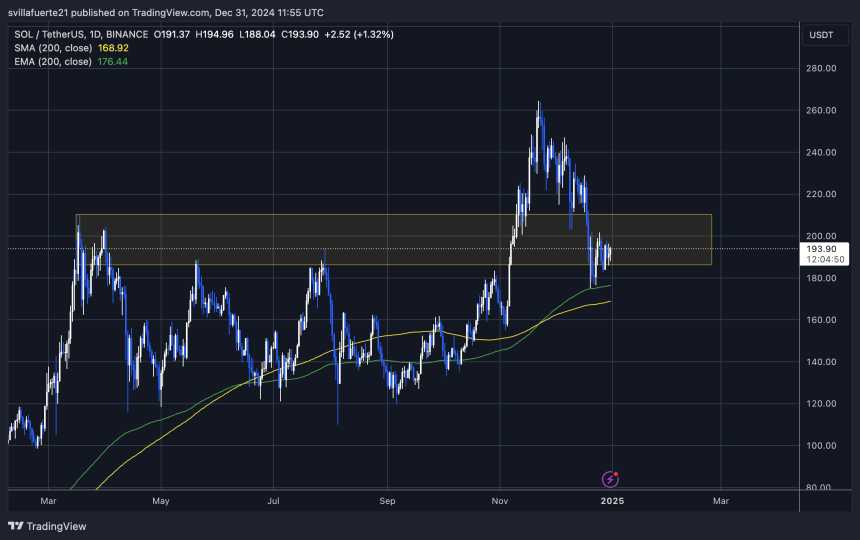

High analyst Ali Martinez just lately supplied technical insights highlighting Solana’s most vital help zone between $190 and $180. In keeping with Martinez, holding above this vary is essential for SOL to maintain its bullish momentum. A strong protection of this help might appeal to extra patrons, fueling a rally which may propel Solana to retest or surpass its current highs.

Nonetheless, your entire cryptocurrency market stays on edge as Bitcoin’s struggles proceed influencing sentiment throughout altcoins. For Solana, staying above its key help could possibly be the inspiration for a robust upward transfer, however dropping this zone could set off a deeper correction.

Solana Prepares For A Massive Transfer

Solana’s value motion has entered a vital section, suggesting {that a} important transfer is on the horizon. The query stays: will it break greater or face a deeper correction? Because the broader cryptocurrency market continues to grapple with uncertainty, Solana’s destiny appears tightly linked to Bitcoin’s (BTC) efficiency, making the approaching days essential for its trajectory.

High analyst Ali Martinez just lately shared an in depth technical evaluation on X, emphasizing the significance of Solana’s help zone between $190 and $180. This vary represents a key demand degree that might both pave the way in which for a bullish surge or function a breaking level for a possible retracement. Martinez factors out that holding above the $190 mark is crucial for sustaining bullish momentum, particularly as Bitcoin struggles to substantiate its subsequent route.

Solana’s short-term outlook is inextricably tied to Bitcoin’s habits. If BTC can preserve its present ranges or affirm a bullish continuation, Solana might experience the wave greater, probably reclaiming earlier highs and pushing into new territory. Nonetheless, if Bitcoin falters, Solana would possibly lose its footing and fall beneath the vital $180 degree, opening the door for a steeper correction.

Associated Studying

Market sentiment stays indecisive as buyers weigh the dangers and alternatives within the present surroundings. For Solana, holding above the $190 mark and a steady Bitcoin could possibly be the proper mixture to set off a rally. Till a transparent route emerges, SOL’s value will seemingly stay beneath shut scrutiny as merchants anticipate the subsequent massive transfer.

SOL Holding Robust Amid Uncertainty

Solana (SOL) is buying and selling at $194, displaying resilience by holding robust above a vital provide zone that has flipped into demand. This energy comes amid widespread market uncertaintyas merchants carefully monitor key ranges to anticipate Solana’s subsequent transfer. The $190 help zone has emerged as a pivotal space, offering a basis for potential upward momentum within the coming days.

If Solana manages to keep up its place above $190, the subsequent important problem lies on the $200 mark. Reclaiming $200 as a help degree can be an important victory for bulls, signaling renewed confidence in Solana’s value motion. This might set off a swift restoration, with the potential to drive the value towards new all-time highs within the close to future.

Nonetheless, the stakes stay excessive. A failure to interrupt above and set up $200 as a help might go away Solana susceptible to bearish stress. In such a state of affairs, the value would possibly expertise a deeper correction, testing decrease demand zones and shaking market sentiment additional.

Associated Studying

As Solana navigates this vital section, the $190 and $200 ranges are set to outline its short-term trajectory. Merchants and buyers alike are preserving an in depth eye on these benchmarks, ready for a decisive transfer.

Featured picture from Dall-E, chart from TradingView