Numerous turmoil within the East triggered a pointy worth decline on ETH USD and the worldwide crypto market over the weekend. A restoration try is on the best way, although key ranges want to interrupt earlier than bulls can cheer. And, after all, all we actually need is international peace. Comply with alongside as we analyse the charts under.

$ETH Main bounce again from sweeping all of the liquidity that was constructed up over the previous couple of weeks.

Actually good response thus far. From right here you wish to maintain on to $2.3K as help going ahead. If it might do this, we are able to assume it is a deviaton and vary retake which ought to… pic.twitter.com/H2HMVl9nR0

— Daan Crypto Trades (@DaanCrypto) June 24, 2025

Daan’s evaluation may be very near mine. I often choose posts that present one thing totally different, although his thesis doesn’t have a lot technical rationalization. We are going to go over the the explanation why, once we analyse the charts under.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

ETH USD Value Volatility: Technical Evaluation On Newest Strikes

(ETHUSD)

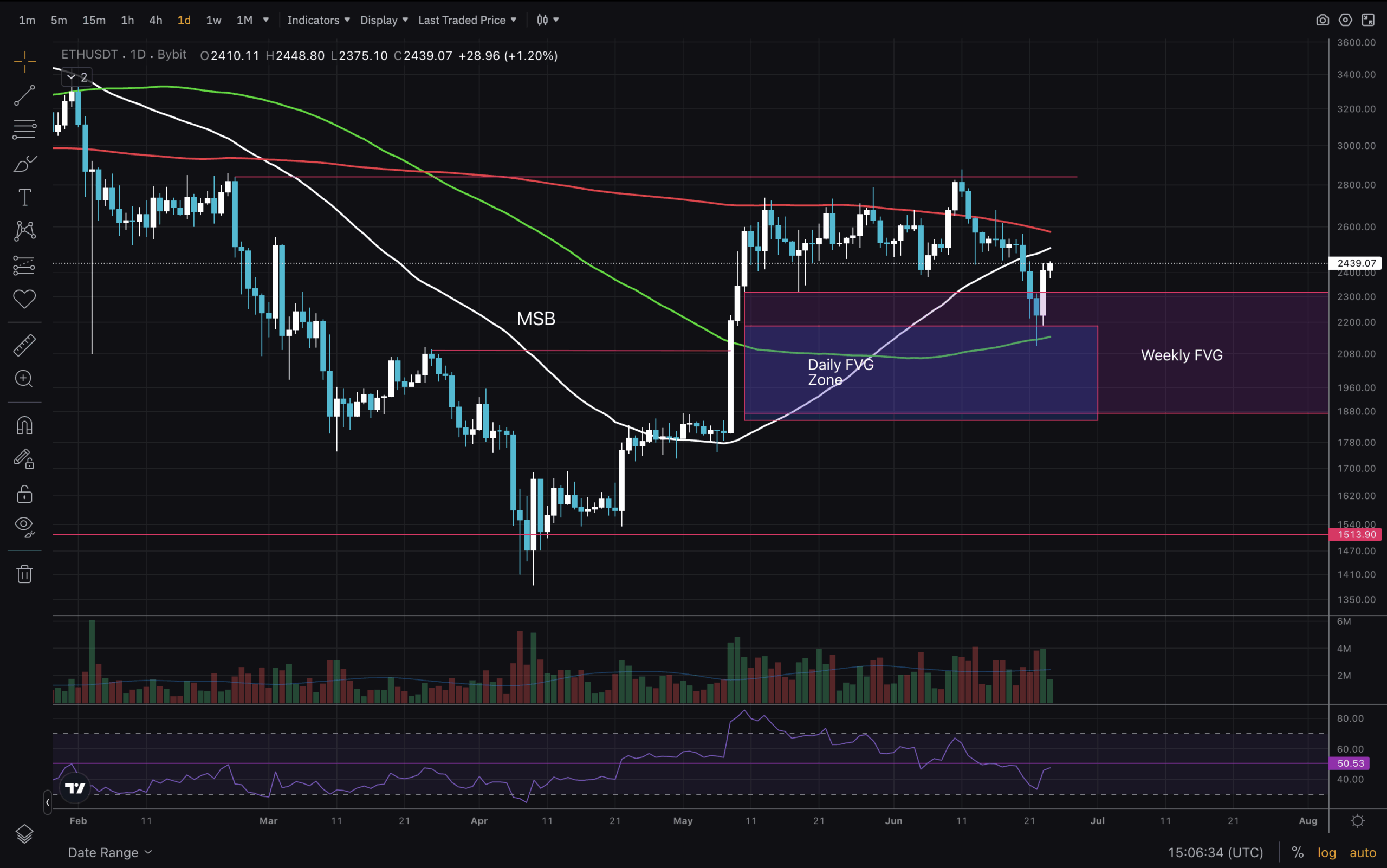

Take a look at final week’s article right here. I purposely saved all of the drawings on the charts and haven’t added something. This can be a good train as you be taught to do technical evaluation. The pair has efficiently stuffed each FVG zones and is beginning the week with nice power. Will the Bulls be capable to preserve the momentum going?

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

How Is ETH USD Shaping Up on The Each day Chart?

(ETHUSD)

On the Each day timeframe, ETH USD worth actions look moderately good. RSI is under and must reclaim the bullish higher half. MA100 obtained retested superbly and yesterday closed with a bullish engulfing candle.

Now it’s headed in the direction of MA50 and MA200 and nonetheless must reclaim MA200 earlier than we are able to see greater strikes on alts. Total, the construction right here stays bullish, as this dip fashioned a decrease excessive.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

(ETHUSD)

The 4H chart offers us one other fascinating perspective. RSI dipped to oversold and shortly recovered into the higher half. We’re nonetheless under all MA’s right here and positively wish to go above.

The response from the FVG hole appears to be like like a V-shaped restoration, which is a robust bullish indicator. We’re nonetheless not out of the water; now it’s too late to enter a place. I’d moderately wait it out and see what the market does subsequent.

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Replace

ETH USD Recovery On The Way: What Traders Watch For?

- Market construction stays bullish on 1D

- RSI on 4H went from oversold to bullish ranges shortly

- FVG zones are stuffed

- Nonetheless wants to interrupt and shut above MA200 on 1D for alt season.

The publish ETH USD Recovery On The Way: What Are Traders Watching For? appeared first on 99Bitcoins.