Michael Saylor’s Microstrategy has simply introduced a brand new Bitcoin buy that has taken the agency’s whole holdings to 439,000 BTC.

Microstrategy Has Purchased Another 15,350 BTC

A big purchaser that has had a relentless presence throughout this newest Bitcoin bull run has been Microstrategy. The cryptocurrency’s value has been racing up whereas the corporate has been accumulating and it appears even on the present highs the agency doesn’t really feel completed, because it has introduced a brand new buy.

Throughout this newest shopping for spree, the corporate acquired a complete of 15,350 BTC for about $1.5 billion at a median value of $100,386 per token between the ninth and fifteenth of December.

In a brand new publish on X, CryptoQuant neighborhood analyst Maartunn has shared a chart that visualizes the factors at which Microstrategy has made purchases over the last couple of months.

The six purchases that the agency has made throughout this bull run | Supply: @JA_Maartun on X

Out of those six buys, the newest buy is the smallest in BTC worth, however not so in USD worth, because it barely outweighs the 15,400 cash purchase from earlier within the month because of the asset’s value persevering with to see appreciation since then.

The whole Bitcoin holdings of Microstrategy have now risen to 439,000 BTC, because the under chart reveals.

The expansion within the Microstrategy BTC holdings over time | Supply: @JA_Maartun on X

From the chart, it’s seen that the agency’s shopping for throughout this bull run to date has been extra aggressive than in the course of the 2021 rally, making this newest accumulation spree the biggest that it has participated in.

In whole, the corporate has spent $27.1 billion to purchase its BTC over time, at a median value of $61,725. Thus, it appears Michael Saylor’s wager has been understanding, together with his agency sitting on earnings of greater than 72% on the present value.

In another information, as Bitcoin has set a brand new all-time excessive (ATH) past the $106,000 stage, the on-chain analytics agency Glassnode has shared how accumulation main as much as this milestone has appeared from the angle of its its new Price Foundation Distribution (CBD) device.

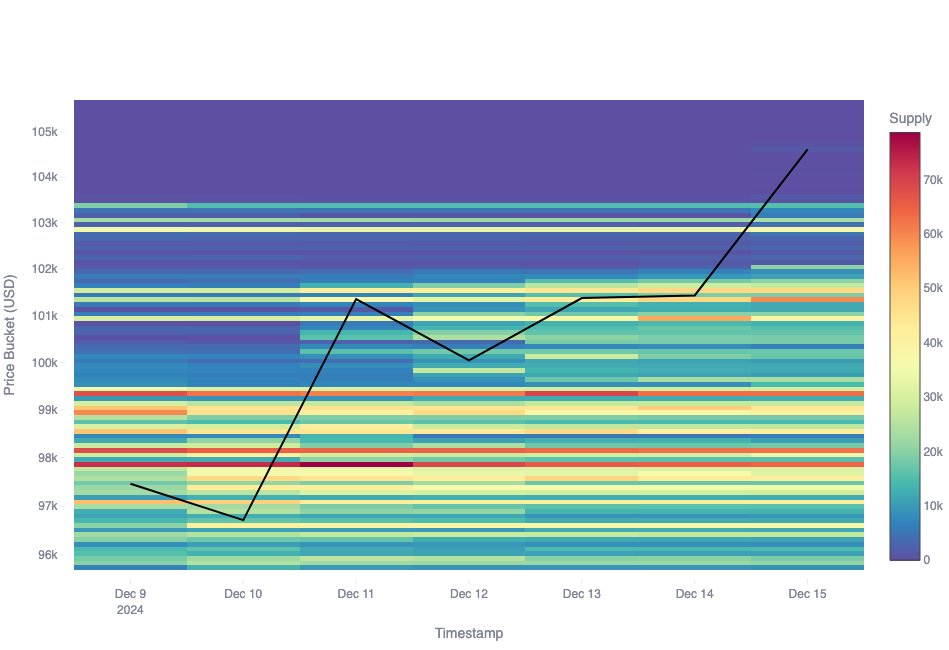

The distribution of the BTC provide throughout the assorted price foundation ranges | Supply: Glassnode on X

The CBD is an indicator that tells us how a lot of the cryptocurrency’s provide was final bought (primarily based on the final transaction value or Realized Value of every token in circulation) on the completely different value ranges.

As is seen within the chart, Bitcoin buyers participated in a notable quantity of shopping for and promoting between $96,000 and $100,000, with the $97,000 to $98,000 cluster notably standing out for internet hosting the associated fee foundation of 500,000 BTC.

Above the $100,000 stage, buying and selling exercise has continued, however to date, the buyers haven’t constructed up any important provide clusters but, with ranges above $103,000 being particularly skinny with cash.

BTC Value

On the time of writing, Bitcoin is floating round $106,400, up greater than 8% over the past seven days.

Appears to be like like the worth of the coin has shot up over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com