Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

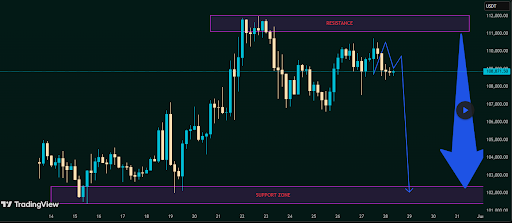

Bitcoin is exhibiting indicators of fatigue after reaching a brand new all-time excessive of $111,814 on Could 22. Since then, Bitcoin has had a number of failed makes an attempt to interrupt above this degree, which has led to a rise in bearish strain.

Over the previous a number of days, value motion has begun forming a sequence of decrease highs on the 4-hour timeframe, which, based on technical evaluation on the TradingView platform, is interpreted as a sign that bullish momentum could also be dropping steam.

Resistance Rejects Once more With Double High Threat

The analyst behind the TradingView put up highlighted the clear rejection sample close to the $111,000 to $112,000 zone, which Bitcoin has repeatedly examined since final week however has failed to interrupt via. This repeated failure to interrupt larger says that bullish momentum is fading quick, particularly as retail patrons at the moment are considerably hesitant to purchase at this zone.

Associated Studying: Crypto Market At the moment: 5 Bullish Catalysts To Watch That Say Bitcoin Price Is Going Increased

In accordance with the chart evaluation, the present value motion is starting to resemble a traditional double high construction, which is a technical formation that usually indicators a shift from bullish management to bearish dominance. Given the weakening follow-through on every upward try, this setup may very well be the early sign of a extra vital market reversal within the days forward.

With this in thoughts, the analyst illustrated this outlook with a projected zigzag path on a 4-hour candlestick timeframe chart, anticipating that one other rejection from the resistance band might set off a cascading transfer downward. Moreover, these a number of rejections have led to a simultaneous weakening of assist round $105,000, and this degree might give means at any time quickly.

Bitcoin May Drop To $102,000 Help Zone

If this projected zigzag path performs out, Bitcoin’s value might break decrease within the coming days and head towards a assist space situated between $101,000 and $102,000. This zone comes into focus as a result of it acted as a powerful assist degree between Could 14 and Could 19. Bitcoin finally discovered footing round this degree to stage a rebound that in the end pushed it to the all-time excessive of $111,900 reached on Could 22.

Associated Studying

Though the bull market narrative is nonetheless dominant in the long run, the present value motion has shifted the short-term tone of the market to bearish. This evaluation addresses that potential, and Bitcoin might revisit the $101,000 to $102,000 earlier than one other leg up.

On the time of writing, Bitcoin is buying and selling at $105,272, down by 2.5% up to now 24 hours. The $106,800 assist degree has already given means, and the main target is now on holding above $105,000. If Bitcoin fails to carry above $105,000 within the coming buying and selling periods, it might result in a cascading downturn in direction of $101,000 through the weekend.

Featured picture from Getty Photos, chart from Tradingview.com