The Ethereum value is undoubtedly in a greater place in latest weeks than it was within the 12 months’s first quarter. Nevertheless, the “king of altcoins” seems to be caught in a loop — one involving repeated pushbacks at a particular value degree.

After driving the week’s bullish momentum, the Ethereum value confronted vital downward strain above $2,700 and has since crashed to round the place it began the week. Beneath is the underlying issue for ETH’s struggles above $2,700.

What’s Taking place To ETH’s Price Above $2,700?

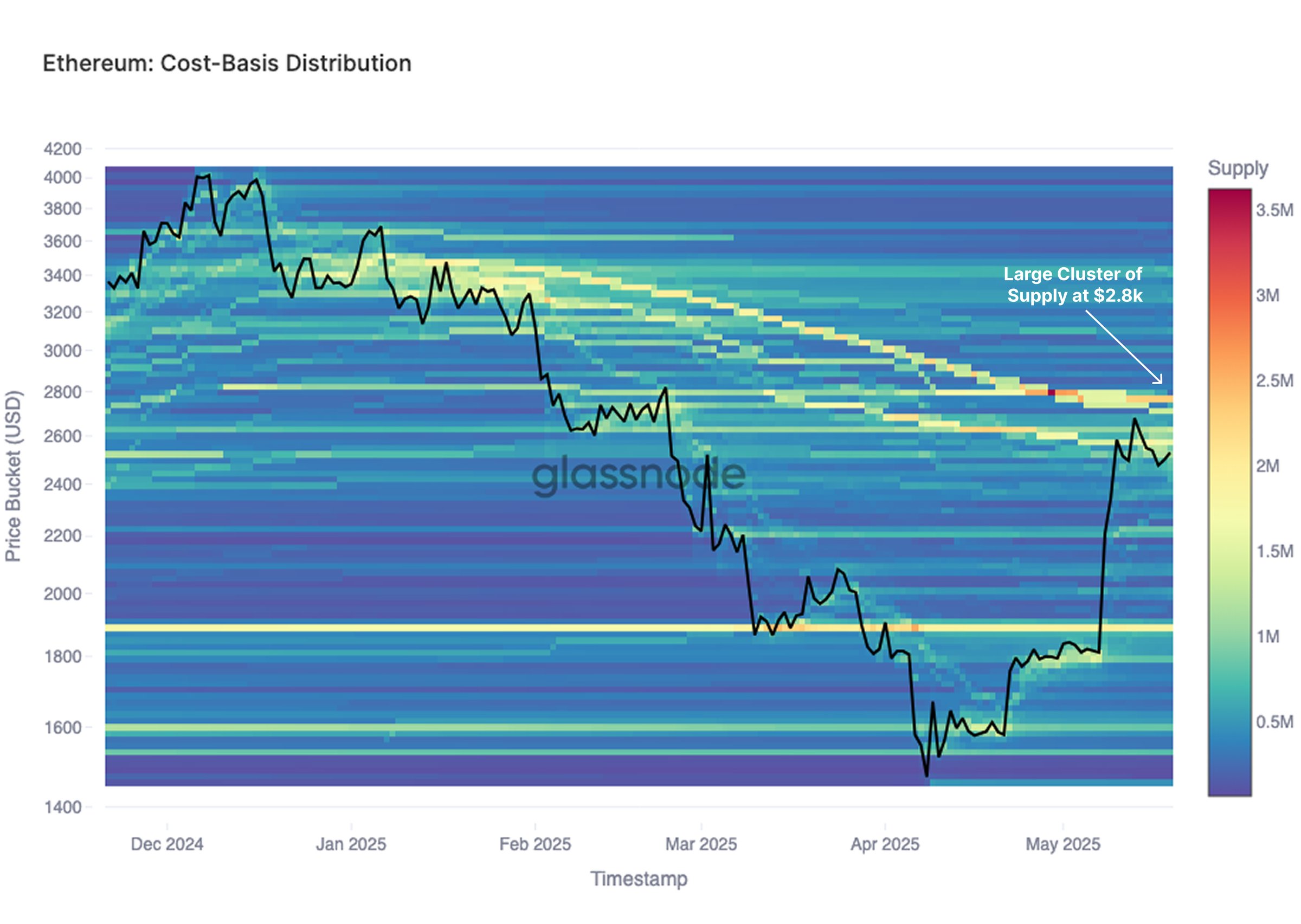

In a Might 24 submit on X, blockchain analytics agency Glassnode shared recent on-chain insights into the motion of the Ethereum value over the previous few days. In line with the crypto platform, the subsequent most vital degree for the worth of ETH lies at round $2,800.

The rationale behind this on-chain statement is the cost-basis distribution of the ETH provide. The related metric right here is value foundation distribution (CBD), which displays the whole Ethereum provide held by addresses with a median value foundation inside particular value brackets.

Supply: @glassnode on X

As proven within the chart above, the CBD metric makes use of a heatmap with mounted value bracket ranges (on the vertical axis) for a given interval (on the horizontal axis). This indicator provides insights into pattern shifts in investor value foundation over a particular interval.

Glassnode famous that there’s a vital cluster of investor cost-basis distribution across the $2,800 Ethereum value degree. Mainly, this means that a number of traders acquired their cash round this value area.

Going additional, Glassnode defined that the Ethereum value could witness vital sell-side strain because it approaches the CBD cluster round $2,800. This phenomenon is predicated on the propensity of a number of beforehand underwater traders to look to dump their property close to breakeven.

This on-chain revelation explains why the Ethereum value has been going through rejection above the $2,700 mark over the previous few weeks. For the second-largest cryptocurrency to interrupt above this provide barrier, the demand for ETH across the CBD cluster should outweigh the promoting strain.

Ethereum Price At A Look

As of this writing, the Ethereum token is valued at round $2,0, reflecting a lower than 1% decline up to now 24 hours.

The value of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.