Chainlink has outperformed the remainder of the sector with a pointy rally in the course of the previous week. Right here’s what’s driving this, in keeping with on-chain knowledge.

Chainlink Worth Has Been Sharply Transferring Up Lately

The previous few weeks have been a wonderful time for LINK traders, because the asset has virtually tripled in worth as in comparison with the beginning of November. At first of this week, the coin noticed a little bit of a setback, however the sharp bullish momentum has already resumed within the final couple of days.

Under is a chart that reveals what LINK’s efficiency has been like over the previous few months:

The worth of the coin appears to have quickly been transferring up not too long ago | Supply: LINKUSDT on TradingView

From the graph, it’s seen that after a leap of over 47% from the underside earlier within the week, Chainlink has managed to interrupt above the $28 mark. The asset now sits at weekly earnings of greater than 22%, making it one of the best performer among the many high cryptocurrencies by market cap.

Talking of market cap, LINK is now the twelfth largest within the sector by way of this metric, sitting simply above Shiba Inu (SHIB).

Appears to be like just like the market cap of the coin is $17.7 billion in the mean time | Supply: CoinMarketCap

As is seen within the above desk, the subsequent asset to beat for Chainlink is Avalanche (AVAX). Its market cap remains to be $3.5 billion greater than LINK’s, so it might be some time earlier than a flip occurs, assuming the bullish momentum doesn’t die out.

As for what has been fueling the cryptocurrency’s surge, maybe on-chain knowledge can present some hints.

LINK Sharks & Whales Have Been Busy With Their Accumulation

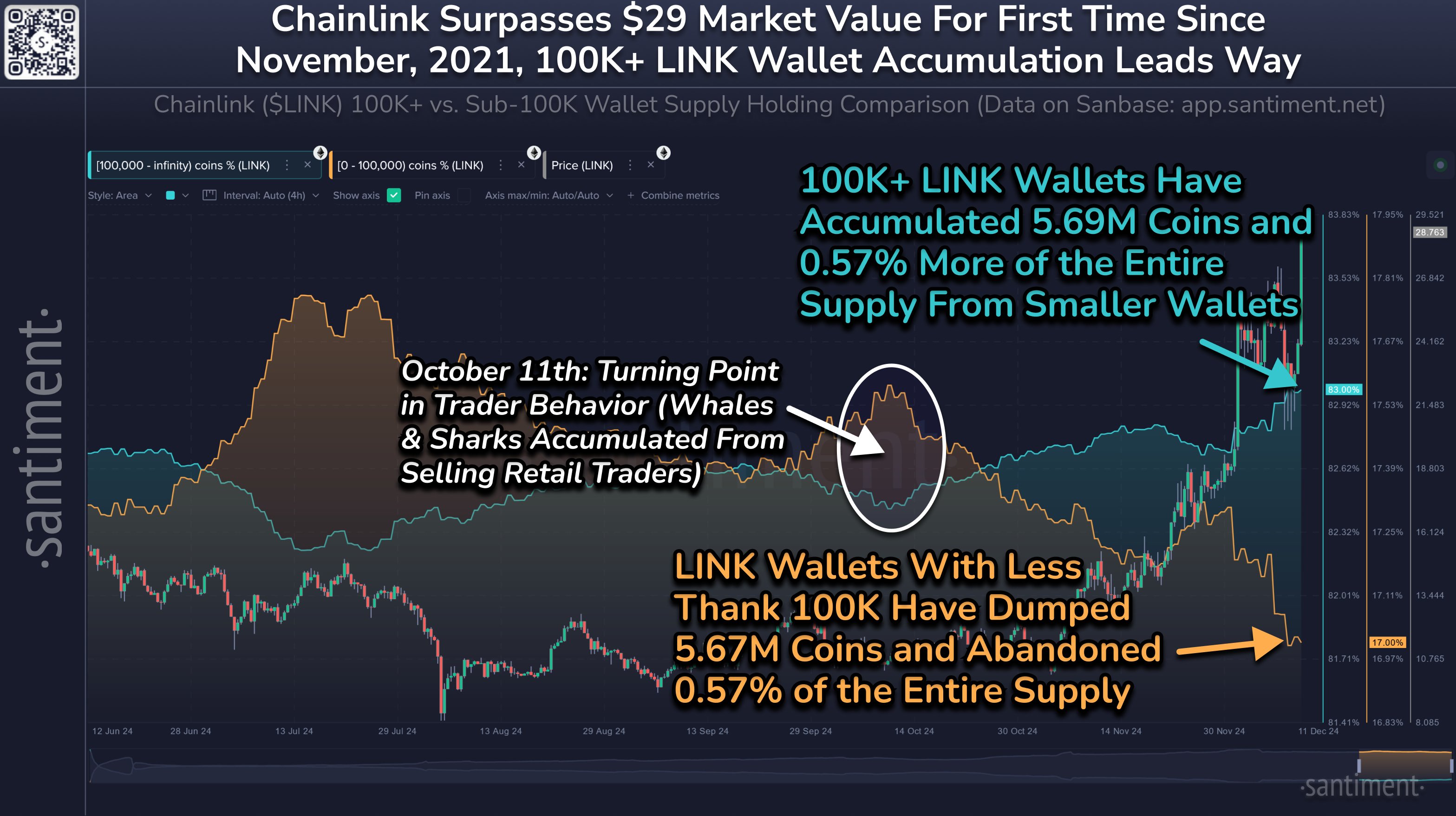

In a brand new submit on X, the on-chain analytics agency Santiment has mentioned how the habits has differed between the small and enormous entities on the LINK community not too long ago. The indicator of relevance right here is the “Supply Distribution,” which retains monitor of the overall quantity of Chainlink that the members of a given pockets group are holding proper now.

Within the context of the present subject, the 2 tackle ranges of curiosity are 0 to 100,000 cash and 100,000+ cash. On the present change fee, the 100,000 boundary between the 2 teams converts to about $2.8 million.

Addresses who maintain higher than this worth are thought-about the important thing traders of the market, referred to as the sharks and whales. Thus, the Provide Distribution for the group tracks the habits of the massive traders.

Now, right here is the chart shared by the analytics agency that reveals how this indicator compares between the sharks and whales and the common traders:

The metric seems to have gone reverse methods for the 2 cohorts | Supply: Santiment on X

As displayed within the above graph, the small Chainlink traders have been promoting over the past couple of months, probably as a result of they didn’t suppose LINK would flip itself round.

The sharks and whales, nonetheless, smelled the chance and acquired a complete of 5.69 million cash from this group. As Santiment explains,

All through the historical past of crypto, massive wallets scooping up cash from impatient or panicked retail merchants is often a recipe for market cap rises.

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com