In a dialog on The Scoop, David Bailey, chief government of Bitcoin Inc. and confidant of US President Trump, mapped out a trajectory that he believes will carry the world’s first cryptocurrency from rebel expertise to main reserve asset “much sooner than people think.” Talking with host Frank Chaparro, Bailey described a confluence of political opportunism, sovereign-scale mining, and balance-sheet securitisation that, in his view, is steadily eroding the previous financial order.

Bailey didn’t mince phrases in regards to the scale of the transition. “We are on a path for Bitcoin becoming the reserve asset of the world,” he stated, including that the timetable is accelerating. The declare framed a dialogue that ranged from US President Donald Trump’s newly found “Bitcoin president” persona to Bhutan’s dependence on block-subsidy income and SoftBank’s entrance into the treasury-stock arbitrage sport.

Bitcoin Becoming Reserve Asset Sooner Than Expected

Bailey recounted his first assembly with Trump at Trump Tower, the place he and others tried to fold Bitcoin into the president’s platform. The encounter, he stated, revealed an instinctive political antenna. Trump “has this ability to sort of flip his persona […] from joking and having a good time […] to business Trump, decision time.” What started as a meme-driven overture has, in Bailey’s telling, advanced right into a reflexive marketing campaign plank: “Six months go by and now he’s the crypto president, he’s the Bitcoin president.”

That pivot issues, Bailey argued, as a result of the constituency is already electorally important. “Crypto Americans […] are 90 million people, 80 million people,” he advised Chaparro. Trump, he added, believes the cohort is “more fervent and there’s more of us than gun owners.” The implication is that Bitcoin’s ideological freight—“the politics of not wanting politics,” as Bailey put it—has begun to accumulate typical muscle on the poll field.

If politics offers the narrative, vitality offers the money circulation. Bailey stated sovereign mining has crossed an inflection level, estimating that “about 50 countries” now run public-private mining ventures drawing on extra producing capability. Scale, he instructed, is not trivial: qualifying nations are “using like 100-plus megawatts of power,” with some “using gigawatts.”

The Himalayan kingdom of Bhutan is Bailey’s canonical instance. Bitcoin mining there now accounts for “50% of the GDP of the country […] it might even be higher.” Such dependence, he argued, turns hash-rate exports right into a pillar of fiscal solvency, nevertheless it additionally up-ends competitors for business miners. Competing with a sovereign that “has no cost basis for its energy” compresses margins for everybody else.

Sovereign accumulation naturally follows sovereign manufacturing, Bailey contended. As soon as a authorities controls block rewards, the inner query shifts to custody, sale-versus-retention, and institutional mandate.

Whereas solely El Salvador and the Central African Republic have publicly adopted Bitcoin as authorized tender or reserve asset, Bailey asserted that “sovereign money is flowing into [the] Bitcoin market already in pretty significant size,” a few of it routed via sovereign-wealth funds slightly than central banks.

He linked that circulation to an emergent national-security framing. “Is it a national-security issue for your country not to have [… ] the dominant reserve asset? Yeah, definitely.” Defence institutions, he hinted, have begun weighing whether or not Bitcoin strengthens or undercuts present safety doctrines, a debate he expects to floor in US congressional testimony later this yr.

The Technique Template

On the company stage, Michael Saylor’s Technique stays the reference mannequin. Bailey stated Saylor’s playbook—issuing fairness or debt, shopping for Bitcoin, letting market-capitalisation premia offset dilution—has already been copied “widely all over the place.” By his rely, “we’re probably pushing 200” listed corporations operating variations of the technique; he initiatives “many hundreds” by year-end. The provision-demand penalties are, in Bailey’s view, clear: “There’s just not enough Bitcoin marginally to be satisfied at this price. The price is going to have to go way up.”

The mechanism will not be with out systemic threat. Bailey likened the corporate-Bitcoin commerce to the closed-end belief construction that when ruled GBTC, whereas emphasising an important distinction: working corporations can repurchase their very own shares in the event that they slip to a reduction. Even so, he warned that widespread share-collateral lending may propagate leverage throughout fairness markets, making a extreme Bitcoin drawdown a possible set off for world deleveraging. “A bear market in Bitcoin could cause financial contagion […] and there’s really nothing anyone can do to stop it.”

All through the interview Bailey returned to institutional fragility. “These institutions are way weaker and way more fragile than people appreciate,” he stated of the standard financial order. But fragility cuts each methods: the identical leverage that speeds Bitcoin’s ascent multiplies the hazards of a reversal. Nonetheless, Bailey’s backside line remained unambiguous. “We [ultimately] dictate to the Federal Reserve what their future is,” he stated, as a result of the “drums of war beat towards [Bitcoin’s] inevitability.”

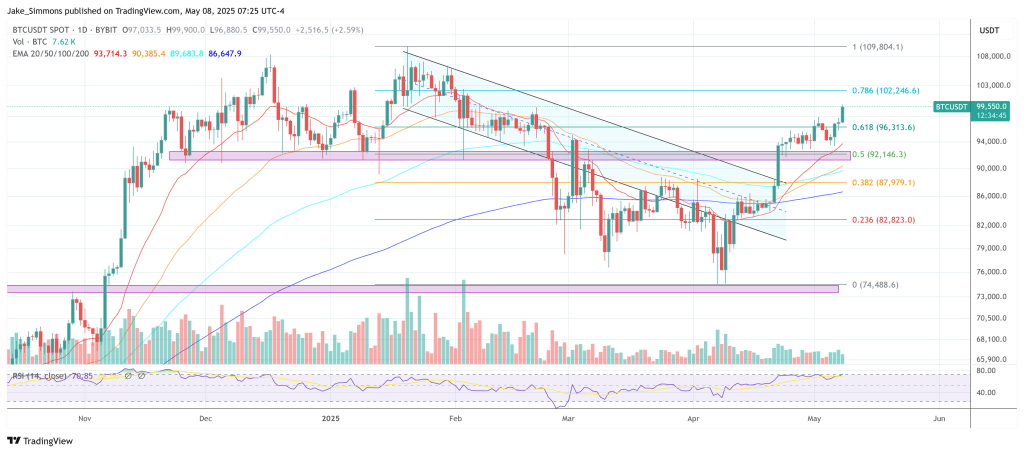

At press time, BTC traded at $99,550.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.