Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

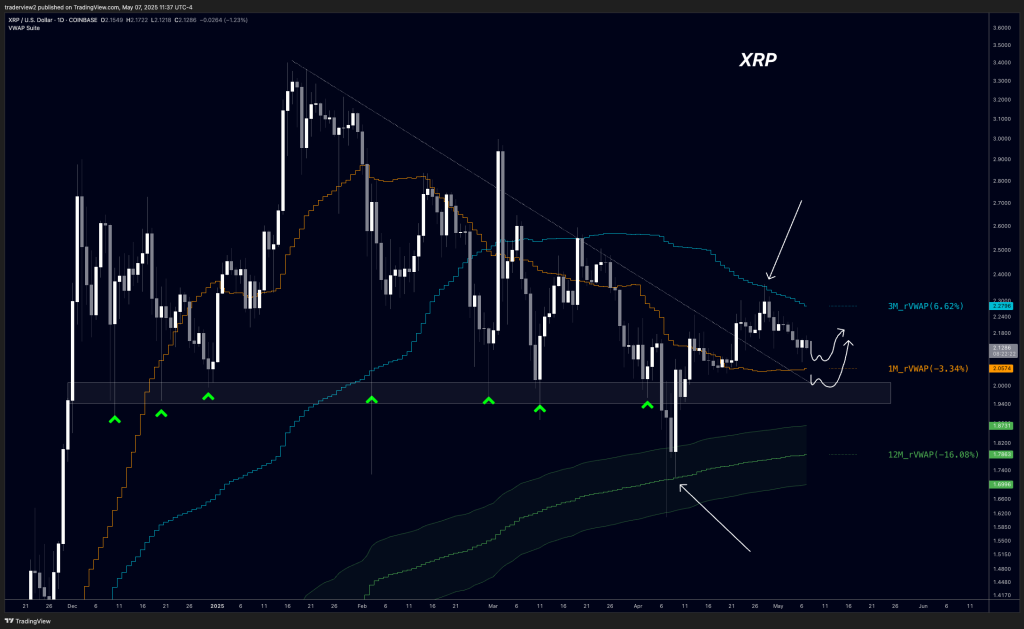

XRP is drifting again to the decrease boundary of a five-month buying and selling vary, but the higher-time-frame construction stays intact, in accordance with a each day chart printed on Might 7 by analyst Dom (@traderview2). The chart covers late-December 2024 by way of the primary week of Might 2025 and reveals XRP after breaking above a descending pattern line that originates on the January 16 excessive close to $3.40.

XRP Is ‘Holding Strong’

Dom’s evaluation hinges on a trio of anchored Quantity-Weighted Common Costs, or VWAPs, that are plotted as adaptive bands on the chart. VWAP represents the typical worth of an asset over a specified interval, weighted by buying and selling quantity; in essence it tells merchants the extent at which the majority of transactions have occurred.

As a result of massive institutional desks usually benchmark execution high quality in opposition to VWAP, the road tends to behave as dynamic assist or resistance when worth retests it. When the anchor level is shifted—from the beginning of the month, quarter or yr, for instance—every VWAP presents a lens on how supply-and-demand has advanced over that discrete window.

Associated Studying

The cyan line marks the quarterly anchored VWAP, at present located at $2.2796, a stage that rejected worth final week and precipitated the continued pullback. The orange line denotes the month-to-month VWAP, now at $2.0574, and worth is hovering simply above it; Dom sketches a curved route suggesting {that a} constructive bounce right here might propel XRP again towards the mid-$2.20s.

Beneath, a inexperienced ribbon captures the yearly anchored VWAP at $1.8731, flanked by its standard-deviation envelopes at $1.7863 and $1.6996. The April 7 capitulation wick bottomed exactly into that yearly imply earlier than snapping larger, underscoring its significance as a structural foothold.

“The VWAPs continue to play perfect, local low was yearly VWAP, rejection last week was off quarterly VWAP and now we are heading to retest the monthly VWAP,” Dom states.

The Key Support Zone

Horizontal motion is equally telling. Since early December the market has ranged between roughly $1.94 and $2.05, a zone highlighted on the chart by a gray rectangle and 6 inexperienced arrows flagging prior deflections. Dom characterises the current retreat as a “healthy retest” of that flooring; solely a decisive each day shut beneath the band would tilt the bias decisively bearish.

Associated Studying

Till then, XRP is, in his phrases, “already strong” relative to different large-capitalisation altcoins which have damaged comparable ranges, though it’s quickly exhibiting weak point versus a surging Bitcoin dominance index. “XRP is still holding its range from Dec (no other large cap is anywhere near that) so it’s already been strong while others just bled. BTC.D is on a terror run and BTC is just dominating the flows,” Dom writes through X.

Technicians will give attention to two intersecting signposts over the approaching periods: whether or not bulls can defend the $2.00 deal with and whether or not the month-to-month VWAP can once more flip from resistance to short-term assist. A failure at any of these checkpoints opens the door for a deeper voyage towards the yearly VWAP round $1.87, whereas a profitable protection would reinforce the narrative that the bigger consolidation stays merely a pause inside a still-valid structural up-trend.

“I am expecting a reaction off this range low, losing that would be where things turn bearish/murky, but for now, it’s a healthy chart,” Dom concludes.

At press time, XRP traded at $2.20.

Featured picture created with DALL.E, chart from TradingView.com