Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

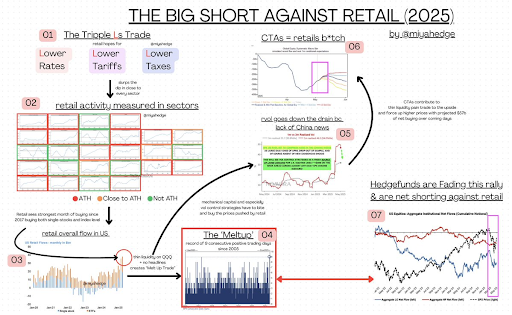

Market commentator Miya has outlined an fascinating idea on why the Bitcoin value is poised to hit $110,000 by the top of the 12 months. The professional alluded to present macro situations and the way it’s certain to favor the flagship crypto on the finish of the day.

Why The Bitcoin Value Will Hit $110,000

In an evaluation titled ‘The Big Short against Retail,’ Miya predicted the Bitcoin value to achieve $110,000 by the top of the 12 months. On the identical time, the professional expects the S&P 500 to drop to 4,700. She opined that the inventory market is heading in the direction of a foul summer time, which is why she expects a decrease low on the SPX however a “pristine” Bitcoin.

Associated Studying

Mainly, Miya expects the Bitcoin value to learn from any potential downtrend within the inventory market, with buyers viewing it as a flight to security. She remarked that the market is heading in the direction of a horrible macro state of affairs, which might trigger shares to crash. These predictions got here because the professional commented on the 9 consecutive inexperienced days that shares have loved and why she believes it received’t final lengthy.

The market commentator famous that Donald Trump has made three major guarantees to the market: decrease charges, tariffs, and taxes. These guarantees are anticipated to be saved, and she or he claims that the market is pricing them in as a positive factor. Merchants are presently betting on a charge reduce in June, whereas the US and China are set to satisfy to agree on a decrease tariff. Decrease taxes might come following a profitable tariff coverage.

Due to this, the inventory market has been on a nine-day-long uptrend, whereas retail merchants have made earnings by shopping for the dip. Nevertheless, Miya has warned that the market isn’t as robust because it seems to be and will quickly blow up, with the Bitcoin value benefiting when this projected crash occurs.

Why The Inventory Market Is Sure To Crash

The professional famous that this false concept of up-only offers retail buyers the phantasm of complacency, as they do proper now with their $57 billion bid on prime of retail gathered shares. Nevertheless, she remarked that ultimately, this can unfold with the “containership recession trade” hitting the US in 5 days. BTC is predicted to be a hedge in opposition to this macro state of affairs, which might result in a Bitcoin value surge.

Associated Studying

Miya defined that every one the ‘Magnificent 7’ earnings within the final season have been massively skewed and had been “useless information,” that means they can’t be relied on to point out a powerful market. She added that TMT companies that manufacture bodily {hardware} often manufacture in waves, so the precise impacts will present up of their H2 capex over Q1 outcomes, that means the influence of tariffs hasn’t precisely began kicking in.

On the time of writing, the Bitcoin value is buying and selling at round $96,500, up over 2% within the final 24 hours, in line with information from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com