Information reveals the Bitcoin Funding Rate has remained unfavorable in the course of the newest worth rally, an indication that quick conduct is dominant.

Bitcoin Funding Rates Are Red At The Second

In a brand new submit on X, on-chain analyst Checkmate has talked concerning the development within the Funding Rate of Bitcoin. The “Funding Rate” refers to an indicator that retains monitor of the quantity of periodic charge that futures market merchants are exchanging between one another proper now.

When the worth of this metric is constructive, it means the lengthy contract holders are paying a premium to the quick contract ones with a purpose to maintain onto their positions. Such a development suggests a bullish sentiment is shared by the vast majority of traders on derivatives platforms.

Alternatively, the indicator being underneath the zero mark implies the quick holders are outweighing the lengthy ones and a bearish sentiment is the dominant one.

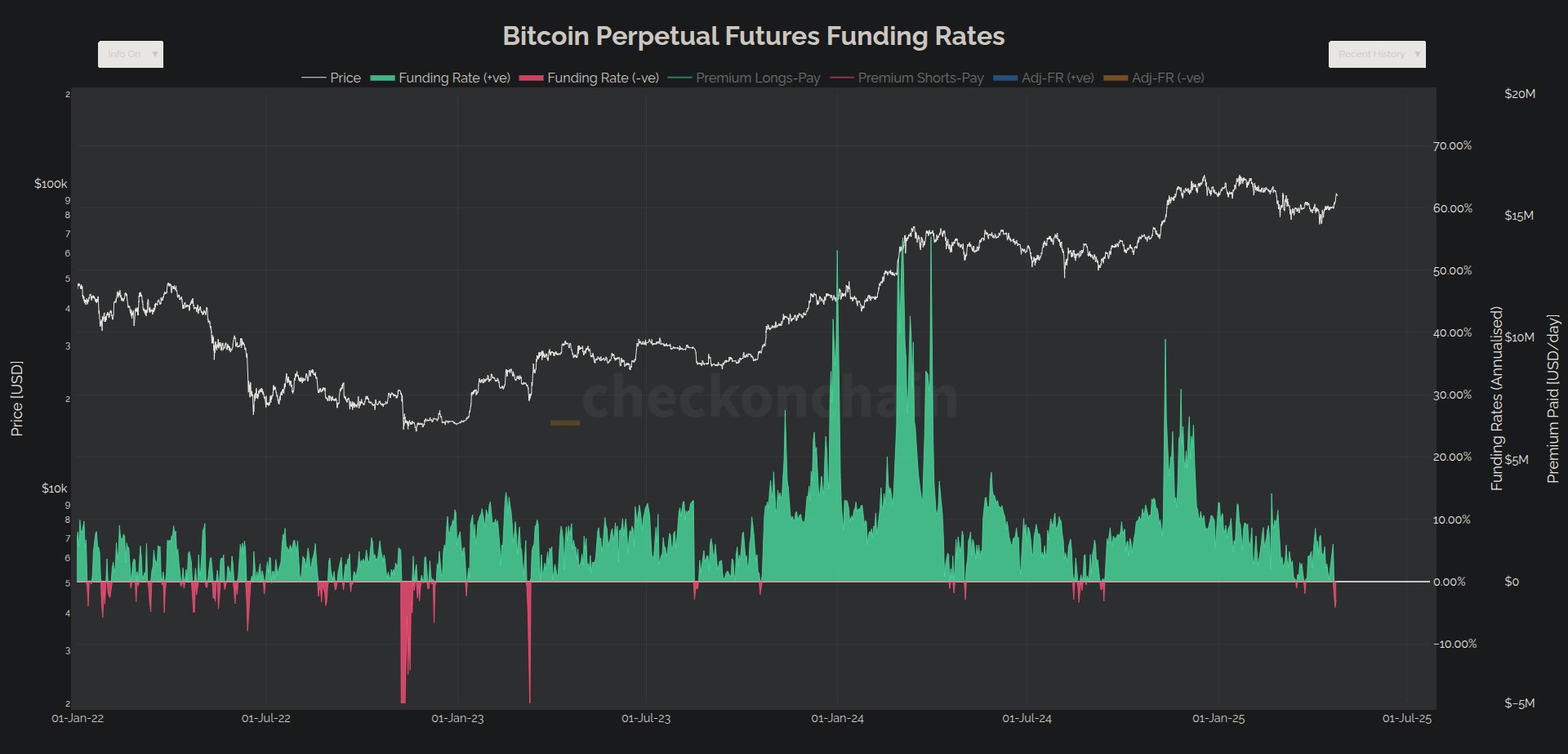

Now, right here is the chart shared by the analyst that reveals the development within the Bitcoin Funding Rate over the previous couple of years:

The worth of the metric appears to have dipped into the unfavorable area in current days | Supply: @_Checkmatey_ on X

As is seen within the above graph, the Bitcoin Funding Rate has slipped into the unfavorable territory just lately, which suggests quick conduct has develop into extra dominant on the exchanges.

This development has curiously come whereas BTC has been going via a restoration rally. It would naturally counsel that the futures market customers don’t suppose that this run would final.

This bearish mentality can really play to the good thing about the cryptocurrency, nonetheless, as if demand retains the rally going, these shorts would find yourself discovering liquidation, thus appearing as gasoline for the run.

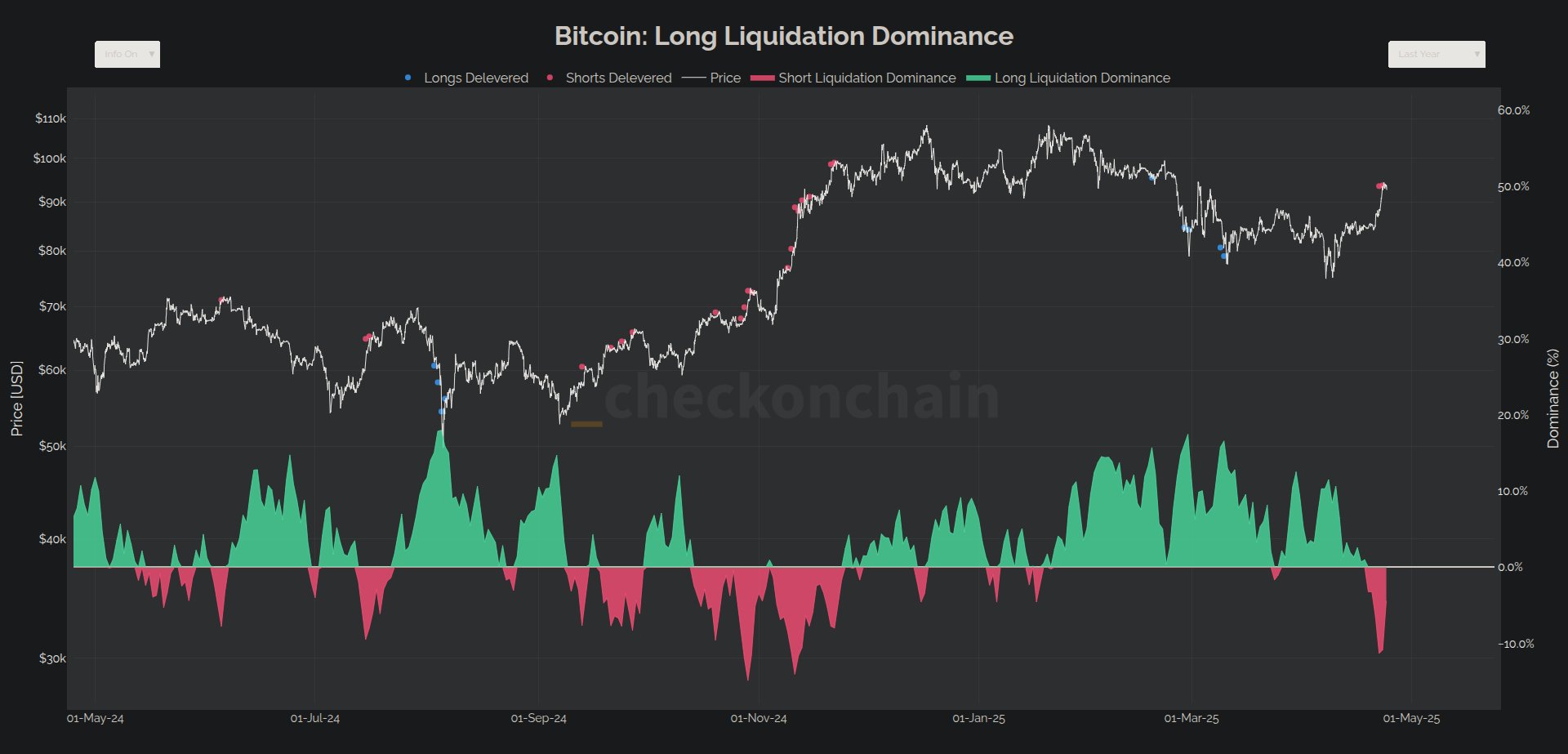

As Checkmate has famous in a reply submit, the market has already seen important quick liquidations just lately.

The development within the lengthy vs quick liquidation dominance over the previous yr | Supply: @_checkonchain on X

It now stays to be seen whether or not this development of a brief squeeze would proceed within the coming days, doubtlessly permitting the Bitcoin worth restoration rally to maintain up.

Whereas futures market customers could also be getting bearish bets up, the general sentiment within the cryptocurrency sector has turned bullish following the worth surge, because the Concern & Greed Index suggests.

How the Concern & Greed Index has modified over the past twelve months | Supply: Various

The Concern & Greed Index is an indicator created by Various that makes use of numerous market elements to find out the sentiment current among the many traders of Bitcoin and different digital property. The metric is at present sitting at a price of 63, which means a grasping mentality is dominant among the many merchants.

BTC Price

On the time of writing, Bitcoin is buying and selling round $93,200, up greater than 9% within the final seven days.

The development within the BTC worth over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Various.me, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.