Crypto market uncertainty leads to unfavorable year-to-date returns for altcoins within the high 10, together with Solana. Amid merchants’ fearful sentiment and the financial fallout from President Donald Trump’s tariff bulletins, Solana bucks the market-wide decline with a gentle climb prior to now 10 days.

Solana (SOL) worth may obtain a lift from the U.S. Federal Reserve’s determination to start out decreasing rates of interest once more quickly. Merchants anticipate three to 4 quarter proportion level cuts in 2025.

Solana worth forecast

Solana ended its downward pattern on March 10 and has been consolidating round $135, a key stage for the Ethereum different token.

On the time of writing, SOL trades at $138.75.

SOL rallied practically 20% prior to now week and practically 8% prior to now month. With $125.82 being the help stage for the altcoin, it coincides with the higher boundary of an imbalance zone on the SOL/USDT every day worth chart.

Two key momentum indicators, RSI and MACD help a bullish thesis in Solana. The inexperienced histogram bars above the impartial line and RSI sloping upwards with a studying of 56 counsel an underlying optimistic momentum in SOL worth uptrend.

Solana may rally 13.33% and take a look at the $152.90 stage, a key resistance and beforehand a key help for the altcoin. If Solana efficiently flips the $152.90 stage from resistance to help, a rally in direction of resistance at $180, a sticky resistance for the altcoin all through March and the primary two weeks of April 2025.

SOL on-chain evaluation

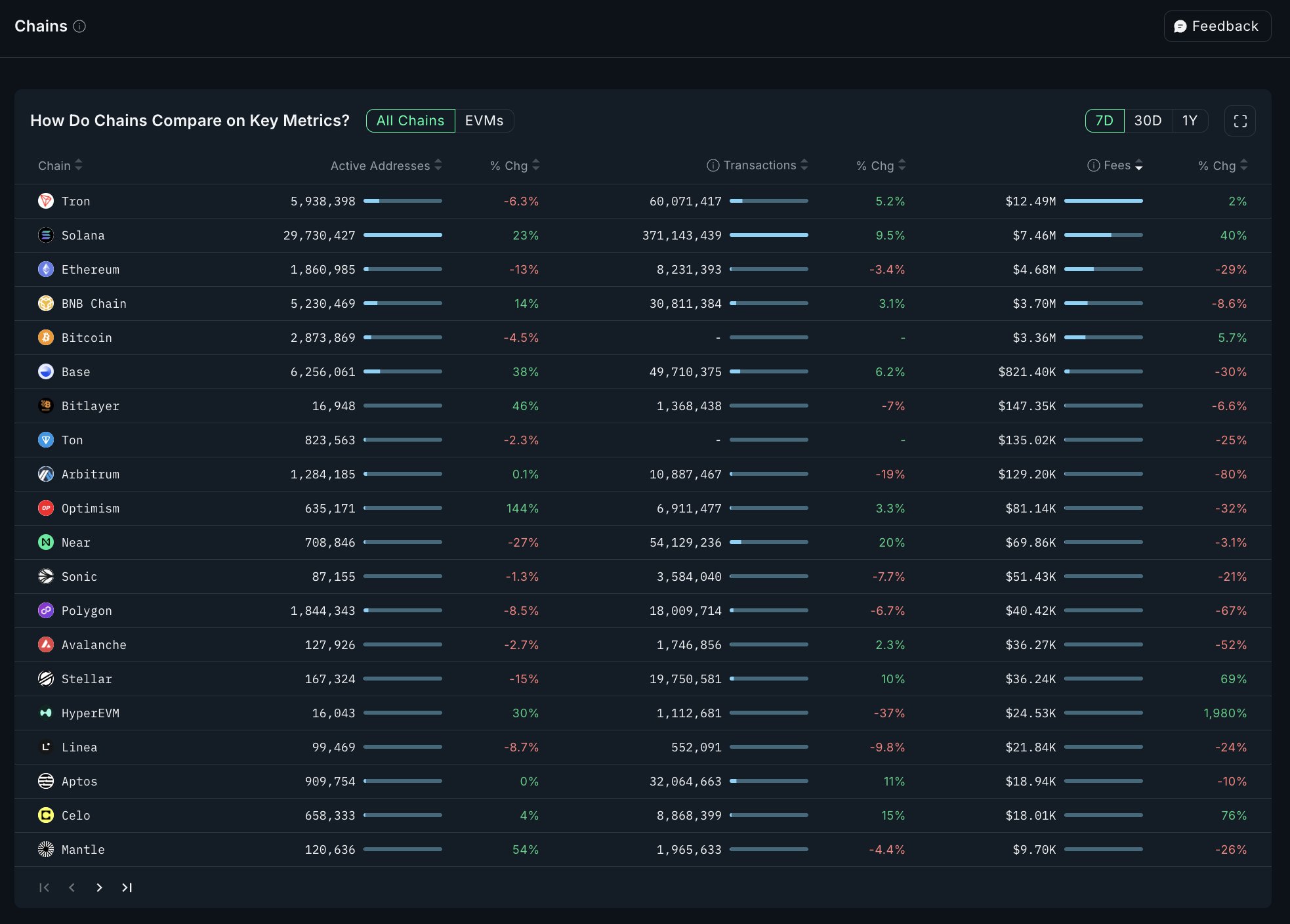

On-chain information from Nansen compares exercise throughout Solana, Base and Ethereum. SOL leads with over 4 million lively addresses prior to now seven days. Base is second and Ethereum ranks lowest.

Greater rely of lively addresses reveals the token’s relevance and demand amongst market members.

Evaluating DEX quantity throughout the three chains, Solana leads with over $5.48 billion, whereas Ethereum ranks second at $975 million and Base follows with $465 million.

When it comes to transactions, Solana leads with 52 million transactions prior to now seven days, whereas Ethereum and Base lag behind, based on Nansen information. That is in step with information for lively addresses.

When it comes to charges generated by the highest 5 chains, Solana is second greatest with a 17% improve in lively addresses, practically 9% improve in transactions and 42% acquire in charges generated within the final seven days, per Nansen information.

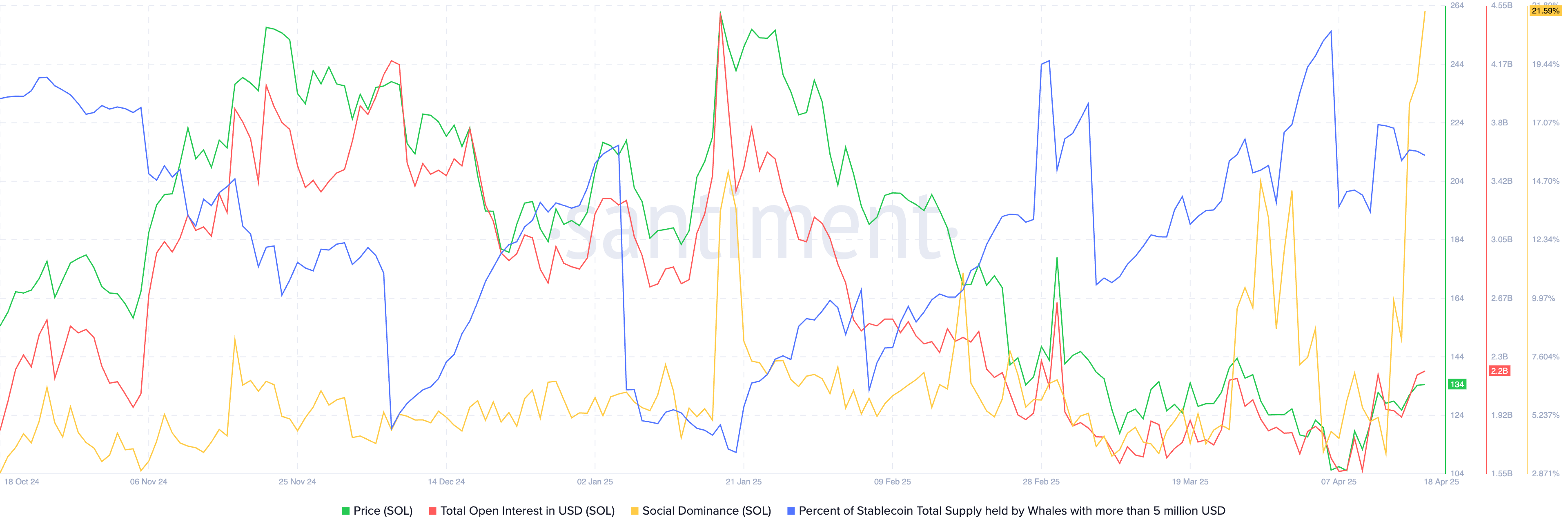

Santiment information reveals a big spike in social dominance on Friday, up from 8.30% on April 15 to 21.59% on April 18. Alongside an increase in social dominance, complete open curiosity in Solana climbed, when it comes to USD.

This suggests that the whole worth of open lengthy and quick positions in Solana has elevated in the identical timeframe, supporting a thesis for a rally in Solana worth.

SOL weekly worth efficiency

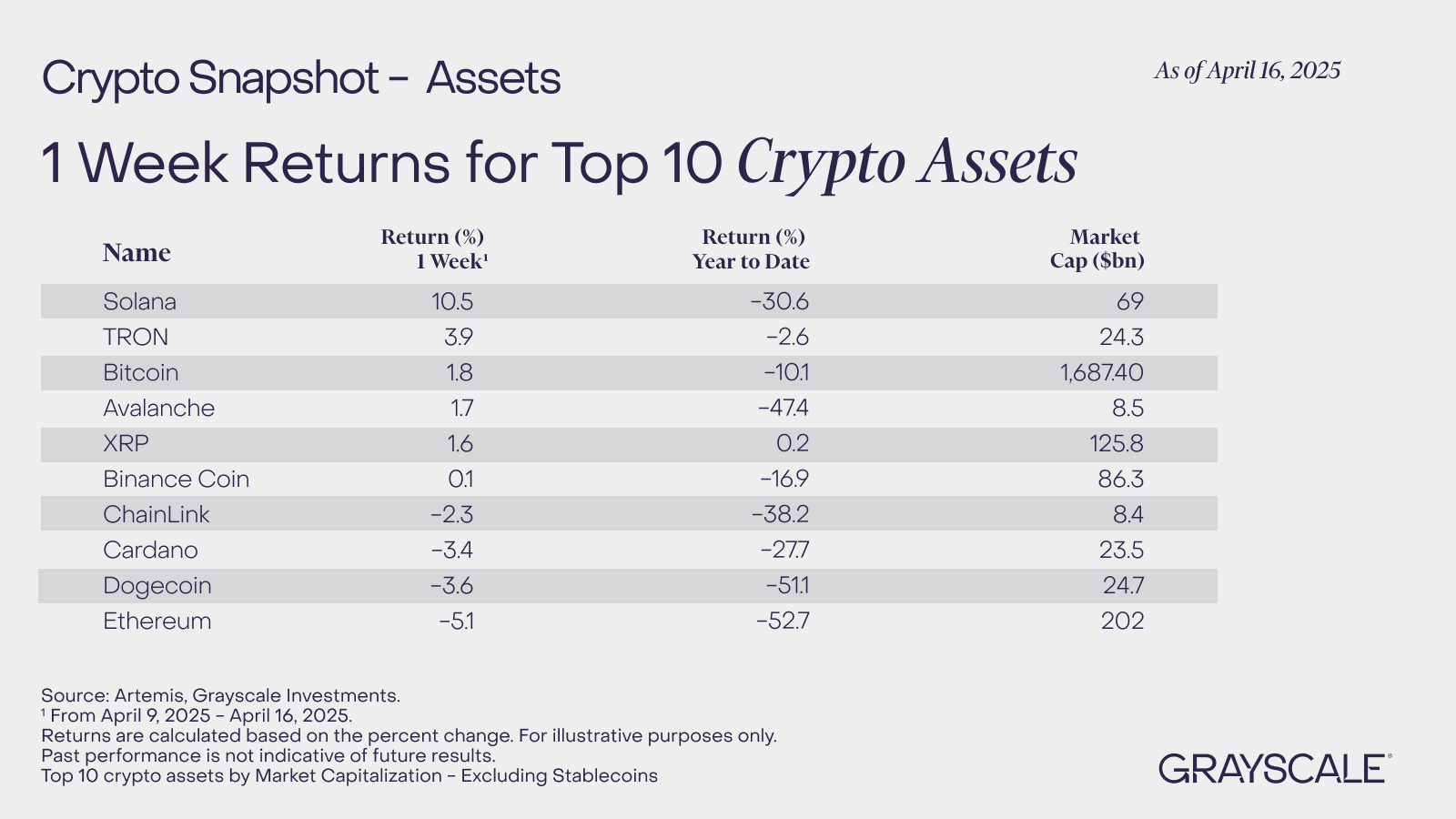

Grayscale, one of many largest different asset fund managers in contrast the returns for high 10 cryptocurrencies for every week. Knowledge reveals Solana climbed 10.5% whereas year-to-date returns are a unfavorable 30.6%, at a market capitalization of $69 billion.

Solana leads the highest 10 cryptocurrencies its its weekly good points, XRP leads in year-to-date returns the place SOL lags. The flashcrashes in Bitcoin worth and the market correction in crypto dragged down Solana worth, wiping good points from 2024 and contributing to unfavorable year-to-date returns.

Solana vs. Layer 1 and Layer 2 chains

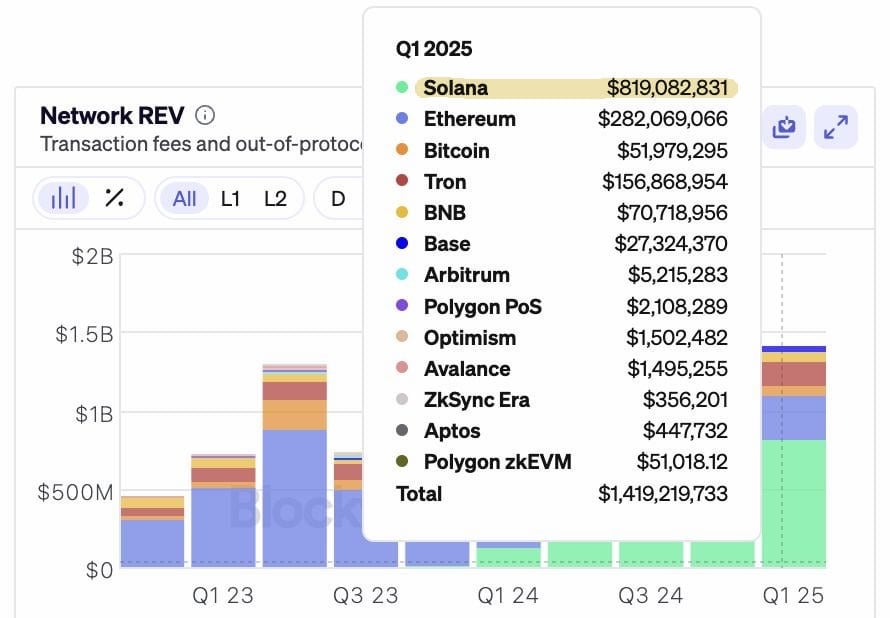

When Solana’s community income is in contrast with Layer 1 and Layer 2 chains like Ethereum (ETH), Bitcoin (BTC), TRON (TRON), it reveals SOL outperformed its opponents.

SOL’s community income for the primary quarter of 2025 is $819 million, Ethereum and TRON are the inside the high three whereas Bitcoin lags with $51.97 million income in Q1.

When Solana’s income generated prior to now seven days is in contrast, it reveals that the Ethereum competitor continues to guide and ranks among the many high 5 chains, per Nansen information.

SOL continues to dominate amongst opponents with the best income era. If SOL worth is equated to its income era, the token is probably going undervalued and will yield additional good points subsequent week and within the second quarter of 2025.

Catalysts driving good points in Solana

Solana’s community builders will not be alone of their efforts to scale the SOL infrastructure to make it sooner, extra resilient, and scalable.

Coinbase, one of many largest centralized exchanges, introduced its system improve to course of Solana transactions in a fashion that reinforces processing throughput, improves efficiency, and optimizes operational controls.

Coinbase shared the replace on X and knowledgeable the group of merchants of their dedication to boosting the Solana community infrastructure to extend reliability for end-users as nicely.

The trade unveiled plans to proceed investing within the Solana community and its growth sooner or later.

Solana ETF filings and their progress in H1 2025 are one other key market mover. An approval from the U.S. SEC may catalyze a rally in Solana within the second quarter of the 12 months.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.