Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

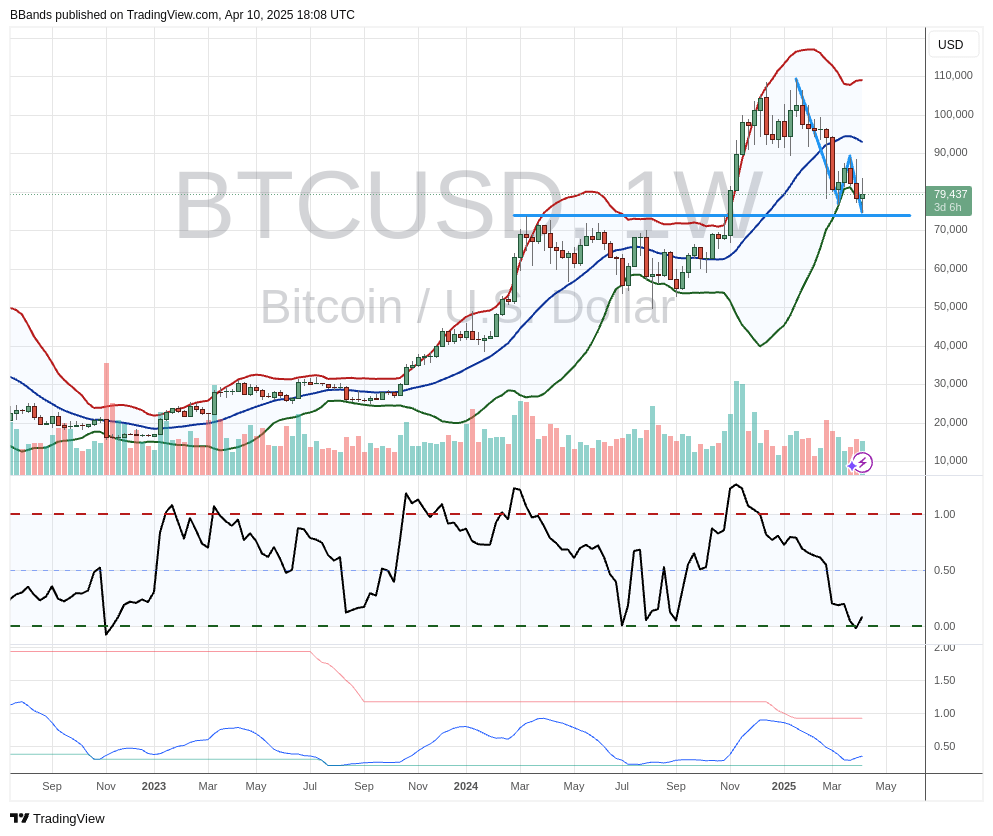

Legendary technical analyst John Bollinger has highlighted what he calls a “classic Bollinger Band W bottom” that could be forming on the Bitcoin pair BTC/USD. In accordance with him, BTC seems to have discovered help within the $74,000 space, organising the attribute double-dip lows that outline a W-shaped reversal sample. Notably, Bollinger careworn that the setup nonetheless must be confirmed: “Classic Bollinger Band W bottom setup in BTCUSD. Still needs confirmation”.

Is The Bitcoin Bottom In?

The chart exhibits Bitcoin navigating a decline from its mid-January excessive close to $110,000, with latest worth motion clustered across the decrease band of the Bollinger Bands. The higher band sits at $108,837, whereas the decrease band sits at $77,138, suggesting a comparatively big selection of volatility on a weekly foundation. The Bollinger’s mid-line is near $93,000.

Associated Studying

Bollinger’s indication of a W-bottom relies on the formation of two distinct troughs in fast succession, as seen in each the value information and the oscillator readings under the chart. The primary trough materialised as BTCUSD fell from its then excessive of round $90,000 to the mid-$76,000 space, then rallied earlier than sliding again to a comparable help space round $74,500. The repeated dip into this horizontal help stage has thus far held, which Bollinger identifies as a possible base for a bullish reversal – though he cautions {that a} definitive transfer above the intervening swing excessive close to $90,000 would assist validate this traditional chart sample.

Different market clues embody barely decrease buying and selling volumes, suggesting that the extreme promoting that drove bitcoin down from its latest peak could also be easing. The chart’s momentum oscillator, which tracks overbought and oversold circumstances, helps this thesis, forming a backside close to its decrease border. Though this alignment with worth motion suggests a doable backside, many technical analysts are searching for the oscillator to rise convincingly above its midpoint to verify that momentum has certainly shifted in favour of patrons.

Associated Studying

Bollinger bands themselves, invented by John Bollinger, measure volatility by inserting envelope traces above and under a transferring common. When these bands widen, the market sometimes experiences giant worth swings; after they slim, volatility decreases. In Bitcoin’s case, they’ve remained comparatively large, reflecting the cryptocurrency’s dramatic vary from under $20,000 to 6 figures over the previous two years.

Whereas speak of a W-bottom has sparked optimism amongst bullish merchants, Bollinger’s reminder that it “still needs to be confirmed” highlights the significance of stable follow-through in worth motion. If Bitcoin can break above $90,000 on sturdy quantity, the long-awaited affirmation of this sample can be inside attain. Till then, the W-bottom is only a chance.

At press time, BTC traded at $81,366.

Featured picture created with DALL.E, chart from TradingView.com