Bitcoin has seen an institutional capital inflow on a scale beforehand unfathomable. Billions of {dollars} are flowing into Bitcoin ETFs, reshaping the liquidity panorama, inflow-outflow dynamics, and investor psychology. Whereas many interpret this motion as sensible cash executing complicated methods backed by proprietary analytics, a shocking actuality surfaces: outperforming the establishments won’t be as troublesome because it appears.

For a extra in-depth look into this matter, take a look at a current YouTube video right here:

Outperforming Bitcoin – Make investments Like Establishments

Canary In The Bitcoin Coal Mine

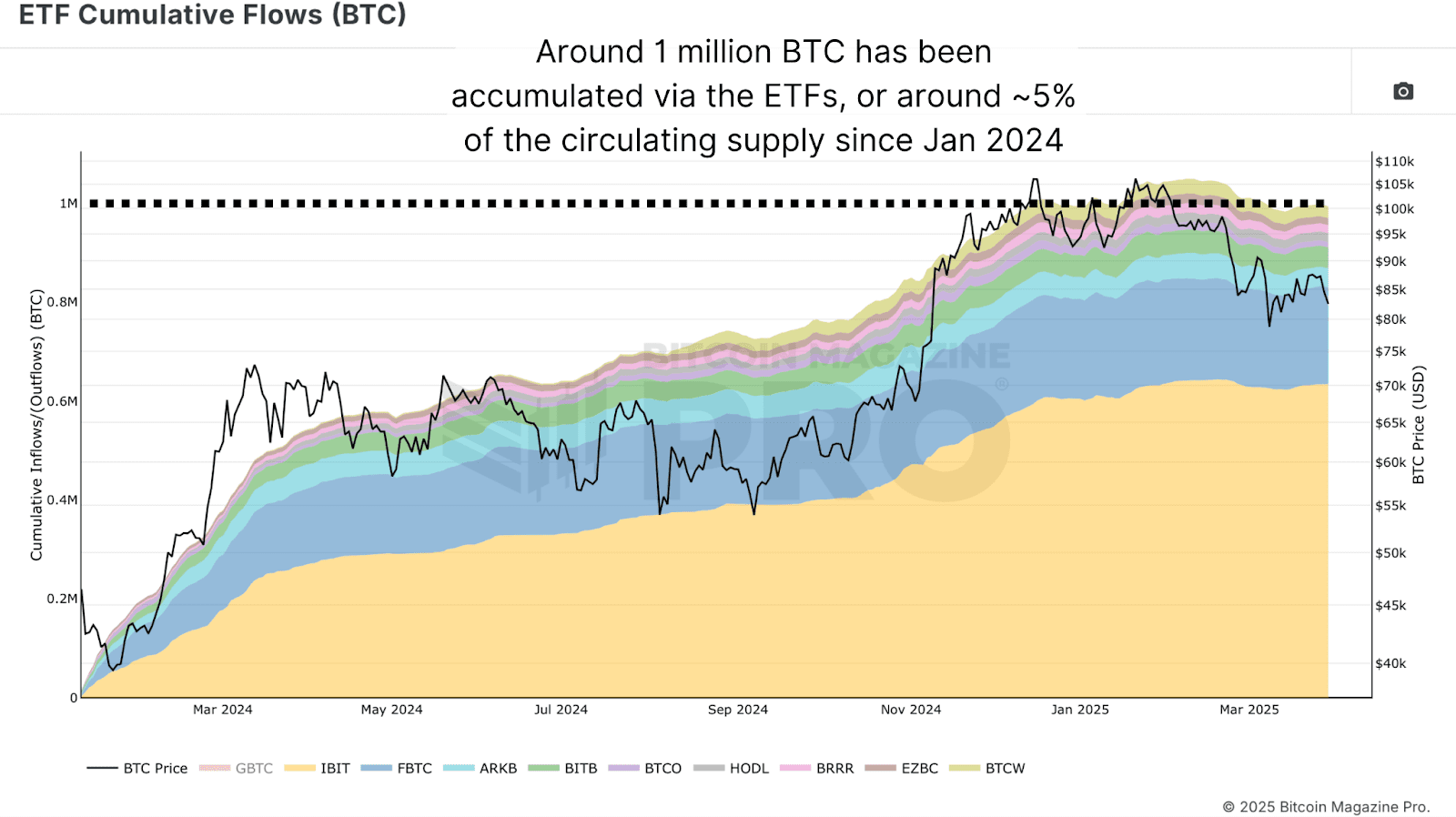

One of the vital revealing datasets accessible immediately is every day Bitcoin ETF move knowledge. These flows, denoted in USD, provide direct perception into how a lot capital is getting into or exiting the Bitcoin ETF ecosystem on any given day. This knowledge has a startlingly constant relationship with brief to mid-term value motion.

Importantly, whereas these flows do impression value, they don’t seem to be the first movers of a multi-trillion-dollar market. As a substitute, ETF exercise features extra like a mirror for broad market sentiment, particularly as retail merchants dominate quantity throughout development inflections.

Surprisingly Easy

The common retail investor usually feels outmatched, overwhelmed by the info, and disconnected from the tactical finesse establishments supposedly wield. However institutional methods are sometimes easy trend-following mechanisms that may be emulated and even surpassed with disciplined execution and correct danger framing:

Strategy Guidelines:

- Buy when ETF flows are constructive for the day.

- Promote when ETF flows flip destructive.

- Execute every commerce at every day shut, utilizing 100% portfolio allocation for readability.

- No complicated TA, no trendlines, simply observe the flows.

This system was examined utilizing Bitcoin Journal Professional’s ETF knowledge ranging from January 2024. The bottom assumption was a primary entry on Jan 11, 2024, at ~$46,434 with subsequent trades dictated by move adjustments.

Efficiency vs. Buy-and-Hold

Backtesting this primary ruleset yielded a return of 118.5% as of the tip of March 2025. By distinction, a pure buy-and-hold place over the identical interval yielded 81.7%, a decent return, however a close to 40% underperformance relative to this proposed Bitcoin ETF technique.

Importantly, this technique limits drawdowns by lowering publicity throughout downtrends, days marked by institutional exits. The compounding good thing about avoiding steep losses, greater than catching absolute tops or bottoms, is what drives outperformance.

Institutional Habits

The prevailing delusion is that institutional gamers function on superior perception. In actuality, nearly all of Bitcoin ETF inflows and outflows are trend-confirming, not predictive. Establishments are risk-managed, extremely regulated entities; they’re usually the final to enter and the primary to exit primarily based on development and compliance cycles.

What this implies is that institutional trades have a tendency to bolster present value momentum, not lead it. This reinforces the validity of utilizing ETF flows as a proxy sign. When ETFs purchase, they’re confirming a directional shift that’s already unfolding, permitting the retail investor to “surf the wave” of their capital influx.

Conclusion

The previous 12 months has confirmed that beating Bitcoin’s buy-and-hold technique, one of many hardest benchmarks in monetary historical past, is just not unattainable. It requires neither leverage nor complicated modeling. As a substitute, by aligning oneself with institutional positioning, retail traders can profit from market construction shifts with out the burden of prediction.

This doesn’t imply the technique will work eternally. However so long as establishments proceed to affect value by way of these giant, seen move mechanics, there’s an edge to be gained in merely following the cash.

In case you’re taken with extra in-depth evaluation and real-time knowledge, take into account testing Bitcoin Journal Professional for beneficial insights into the Bitcoin market.

Disclaimer: This article is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.