Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Dogecoin is buying and selling round a key demand zone as the complete crypto market battles renewed promoting stress. Among the many hardest-hit segments are meme cash, which have seen sharp pullbacks in latest days. Dogecoin, the unique and most acknowledged meme token, continues to observe a persistent bearish pattern — one that won’t reverse until present ranges maintain agency.

Associated Studying

Investor sentiment throughout the house stays cautious, with rising macroeconomic uncertainty and weakening momentum dragging costs decrease. For Dogecoin, this second is very vital, as its worth motion now hovers simply above the decrease boundary of a long-term parallel channel.

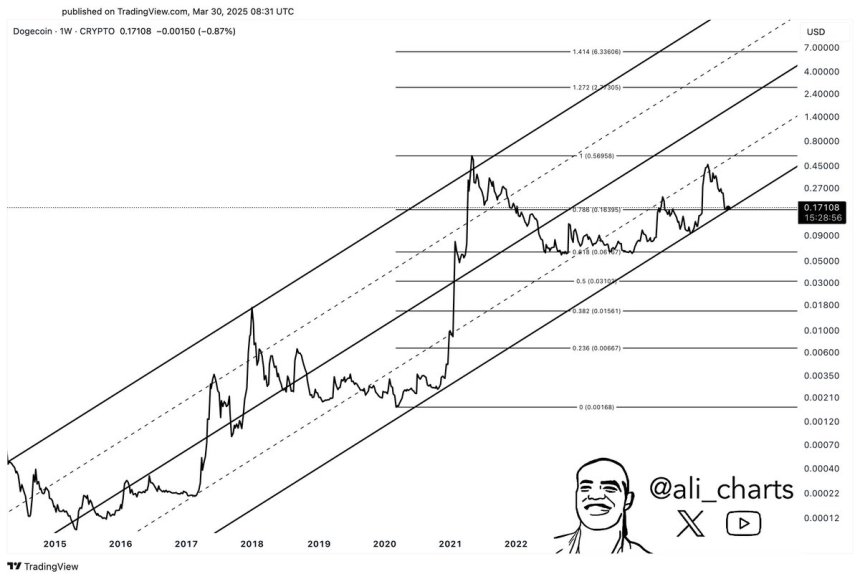

Crypto analyst Ali Martinez shared technical insights revealing that Dogecoin continues to be holding above this significant assist degree. Based on Martinez, a spike in demand from this zone might act because the launchpad for a rally towards the mid or higher vary of the channel — doubtlessly providing much-needed aid for DOGE holders.

Whereas broader market situations stay fragile, Dogecoin’s construction suggests it nonetheless has room to rebound — however provided that consumers step in quickly. As worth compresses close to assist, the following transfer might outline the token’s short-term pattern in a market crammed with uncertainty.

Dogecoin Down 66% As Market Uncertainty Weighs On Sentiment

Dogecoin is presently buying and selling underneath heavy stress, down roughly 66% from its multi-year excessive close to $0.48. Regardless of temporary makes an attempt at restoration, underwhelming worth motion and bearish sentiment proceed to tug DOGE decrease, with bulls struggling to seek out momentum in an more and more unstable market. The broader macroeconomic backdrop isn’t serving to both — rising rates of interest, geopolitical instability, and commerce battle tensions have all contributed to a high-risk atmosphere throughout world monetary markets.

This turbulence is having an outsized influence on speculative property, and meme cash like Dogecoin stay a few of the most weak. The present situations counsel that heightened volatility could turn into the brand new norm for the foreseeable future, rising the danger of additional draw back for DOGE until sturdy assist holds.

Martinez’s technical outlook on X notes that the $0.15 degree is now important for Dogecoin bulls. Based on his evaluation, DOGE continues to commerce simply above the decrease boundary of a long-term bullish channel — a construction that has held agency by way of a number of market cycles.

Martinez emphasizes {that a} spike in demand at this degree might set off a pointy rally, doubtlessly pushing DOGE towards the mid or higher vary of the channel, between $4 and $7. Whereas this will likely appear formidable given present sentiment, the long-term setup stays technically intact — however bulls should step in now to keep away from an entire breakdown.

Associated Studying

DOGE Bears Push Bulls to the Edge

Dogecoin is buying and selling at $0.16 after dealing with intense promoting stress over the previous a number of days, dropping greater than 20% in underneath per week. The sharp decline has positioned bulls in a tough place, with momentum clearly favoring the bears. The worth construction stays decisively bearish, and if DOGE fails to carry the vital $0.15 assist degree, a dramatic collapse might observe — doubtlessly sending the meme coin into decrease demand zones not seen in months.

The $0.15 mark now stands because the final line of protection for bulls, because it aligns with a key long-term assist degree inside a broader bullish channel. Shedding it could doubtless set off panic promoting and ensure a breakdown in market construction.

Nevertheless, if Dogecoin can keep assist above $0.16 and appeal to renewed shopping for curiosity, there’s nonetheless potential for a short-term restoration. A bounce from present ranges might spark a rally towards the $0.20–$0.25 vary — a zone that beforehand acted as sturdy resistance and will provide the primary actual check of any upward momentum.

Associated Studying

With market volatility excessive and sentiment shaky, DOGE’s means to carry present ranges will probably be key to figuring out whether or not that is simply one other dip — or the beginning of one thing worse.

Featured picture from Dall-E, chart from TradingView