Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin merchants are making ready for a jam-packed and doubtlessly turbulent week. From looming tariffs to whale-sized BTC bid exercise, listed here are 5 main components that market contributors have to carry on their radar.

#1 US Tariffs Poised To Escalate On April 2

The worldwide stage is bracing for what US President Donald Trump has dubbed “Liberation Day” on April 2. In response to The Kobeissi Letter (@KobeissiLetter), the administration’s plan for “reciprocal tariffs” guarantees to be a watershed second in ongoing worldwide commerce disputes.

“President Trump has been discussing this Wednesday, April 2nd, for weeks. This is a day that he has named ‘Liberation Day’ where widespread new tariffs are coming. We believe April 2nd will be the biggest escalation of the trade war to date,” The Kobeissi Letter writes by way of X.

These tariffs will layer on prime of a slew of current US duties that span metal, aluminum, Canadian items, Mexican items, and plenty of Chinese language imports. The Kobeissi Letter factors out that 25% levies on auto imports and on international locations buying Venezuelan oil may even take impact this week. With retaliatory measures from Canada, China, the EU, and Mexico within the pipeline, they warn of a “massive trade war,” intensifying uncertainty for world markets.

Associated Studying

Past commerce specifics, the approaching days may see inflation strain intensify because of greater shopper prices on imported items. Citing an uptick within the Financial system Coverage Uncertainty Index, The Kobeissi Letter highlights: “Policy uncertainty is currently above just about any crisis in modern US history. We are seeing ~80% HIGHER uncertainty levels than 2008. As a result, market swings are widening, and we expect an extremely volatile week.”

Add in President Trump’s newest threats concerning Iran—the place “secondary tariffs” and potential levies on Russian oil are on the desk—and there are a number of worldwide flashpoints that will feed into market volatility.

#2 Bitcoin Whale Exercise

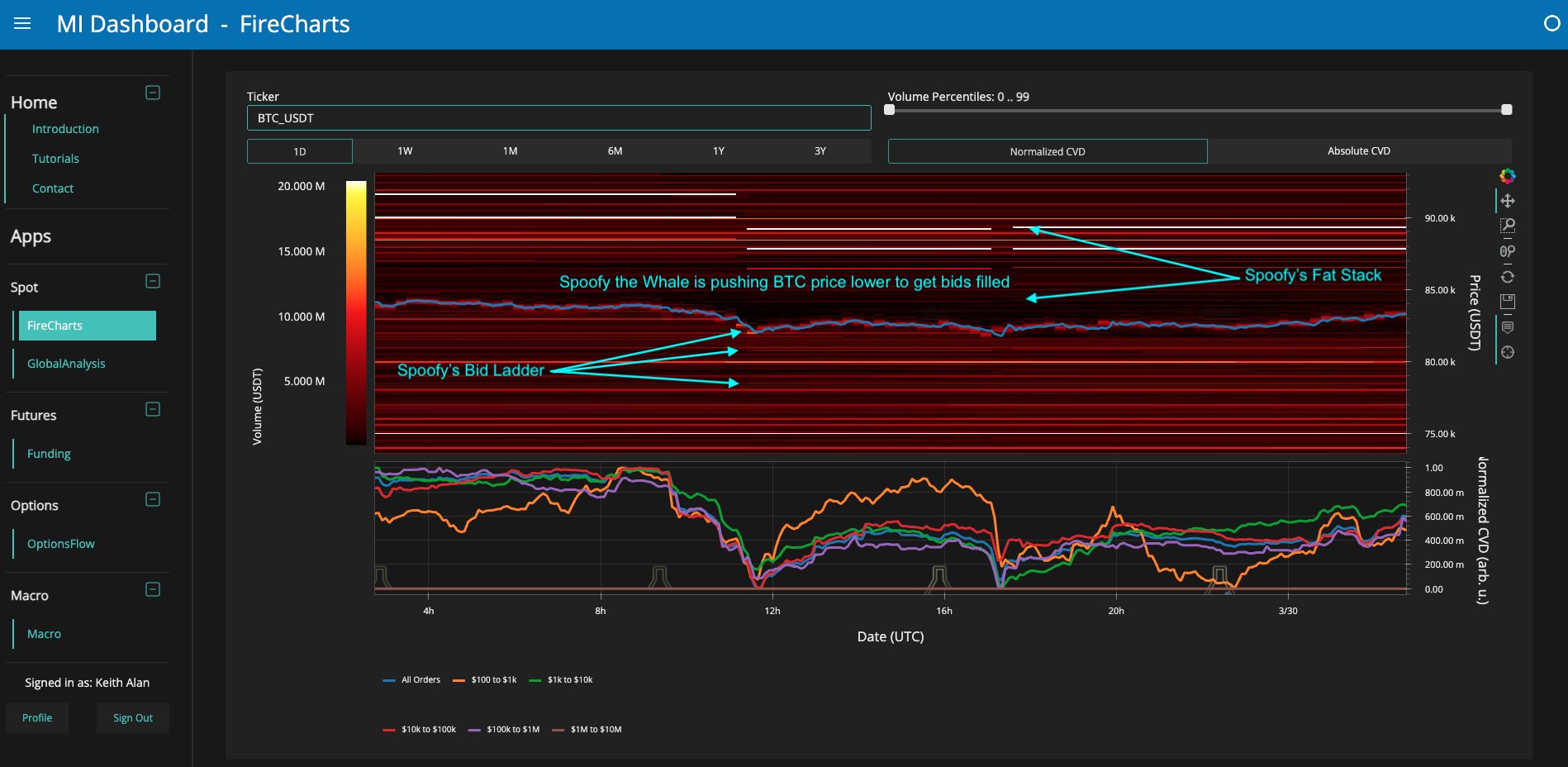

Within the Bitcoin enviornment, large-scale liquidity maneuvers stay a focus. Keith Alan (@KAProductions), co-founder of Materials Indicators, drew consideration to a possible whale technique in motion—attributed to a determine he dubs “Spoofy the Whale.”

“My first clue that something was up came with a sequence of micro movements that seemed to be a little different than his typical price adjustment of his massive blocks of ask liquidity. At a closer look I noticed a ladder of BTC bid liquidity perfectly aligned and moving with the ask liquidity. While I have no real way of confirming that it is the same entity using ask liquidity to herd price into their own bids, it certainly appears that Spoofy has been buying this dip and has bids laddered down to $78k,” Alan wrote on Sunday.

He additionally famous the convergence of a number of information occasions—Sunday’s weekly shut, Monday’s month-to-month shut, and the anticipated tariff implementation midweek—that will catalyze additional value swings. Whereas acknowledging BTC may nonetheless go decrease, he underlined the whale’s obvious dedication to accumulating at present ranges: “In the grand scheme of things, none of this means BTC price can’t go lower, but it does mean that the whale that has been suppressing BTC price for the last 3 weeks is using a DCA strategy to buy this dip…and so am I.”

#3 Bitcoin Bearish Flag Breakdown

Technical analyst Kevin (@Kev_Capital_TA) is warning merchants to maintain a detailed eye on pivotal help ranges following a bearish flag breakdown: “We were tracking this bearish flag pattern all last week and as we can see we had a breakdown of that weakness. If BTC does lose the golden pocket here at $81K and follows through with that measured move target, then the $70K–$73K range … would be the ‘Measured Move’ target.”

Nonetheless, Kevin posits that, given widespread destructive sentiment round April 2 (“Armageddon Day” in some corners of the media), there’s a risk of a contrarian twist: “Will the Tariff implementation on April 2nd be a rare ‘sell the rumor buy the news event’? … Everyone thinks the world is suddenly going to end.”

Associated Studying

He additionally added: “A little bit of long liquidity at the $78K-$80K level but a lot of juice in the $87K-$89K (Dark Yellow) range for market makers to transact in right before the CNBC proclaimed “Armageddon Day” on April 2nd. Makes me surprise.”

#4 Seasoned Gamers Accumulate

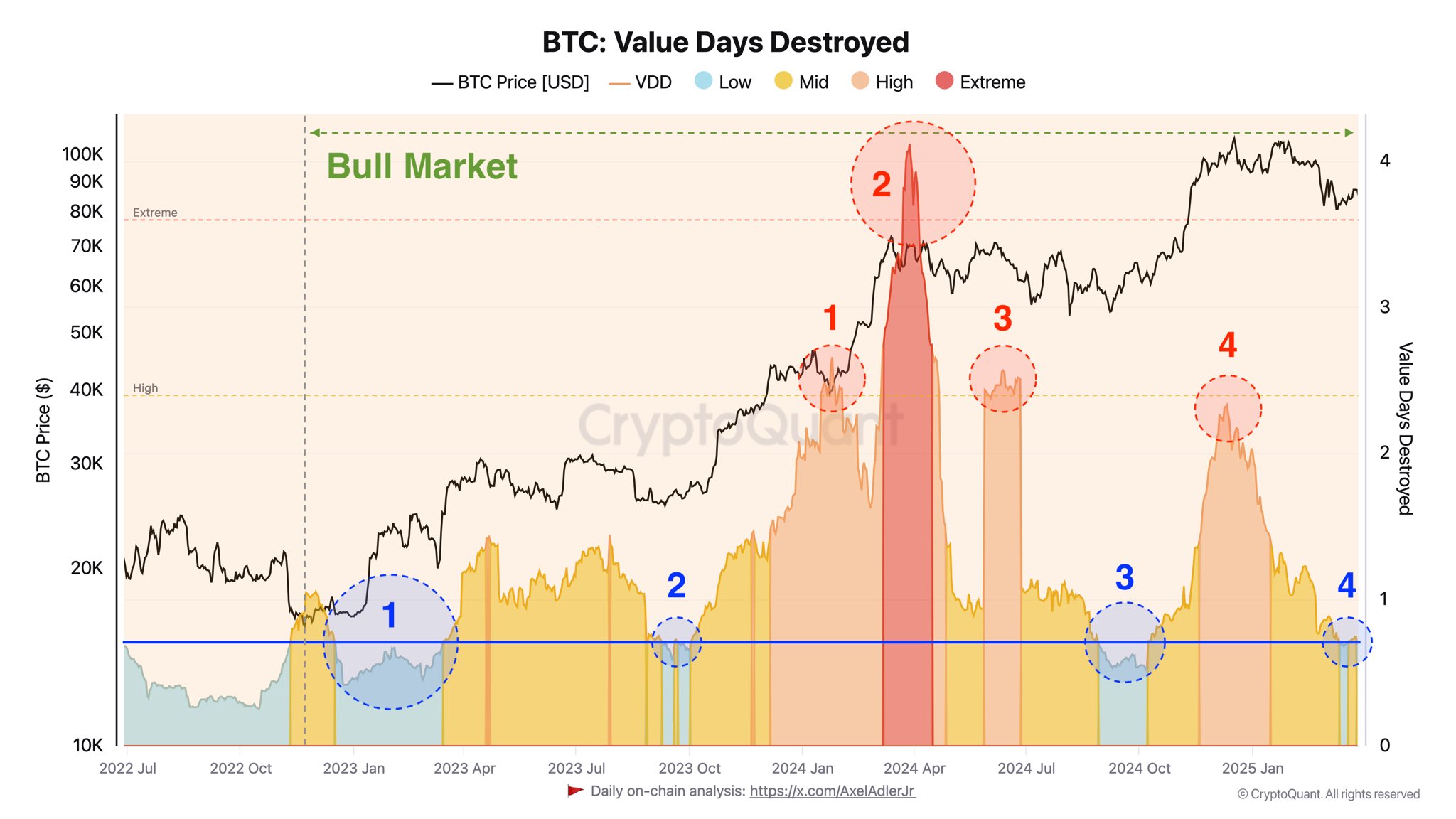

From an on-chain perspective, Axel Adler Jr, an analyst at CryptoQuant, observes that skilled market contributors are shifting into a brand new accumulation part. Drawing from the Worth Days Destroyed (VDD) indicator, Adler identifies a collection of 4 distinct accumulation intervals since early 2023, marking the present cycle as ripe for potential long-term upside:

“The absence of significant selling in the current phase demonstrates the confidence of these experienced players that the current BTC price level is not favorable for profit-taking.” Adler underlines that historic knowledge reveals low VDD intervals usually precede value will increase, suggesting a bullish medium-term outlook—offered macro components, together with world financial coverage shifts, don’t derail market sentiment.

#5 CME Hole

Lastly, merchants want to observe the CME (Chicago Mercantile Trade) hole formation, which has been a notable characteristic in Bitcoin’s value motion. Rekt Capital (@rektcapital) highlighted the latest filling of a spot between $82,000 and $85,000: “BTC has filled the general CME Gap area from $82k–$85k. Moreover, Bitcoin will probably develop a brand new CME Gap over this weekend … Which could set BTC up for a move into at least $84k next week.”

CME gaps usually act as magnets for value motion, and Rekt Capital’s evaluation suggests a potential retracement to fill newly fashioned gaps or a continuation transfer that takes BTC greater, relying on how broader market forces unfold this week.

At press time, BTC traded at $82,010.

Featured picture created with DALL.E, chart from TradingView.com