Bitcoin is as soon as once more underneath strain, buying and selling beneath essential demand ranges as bearish momentum builds. After a short interval of optimism and a minor upswing, promoting strain has returned, dragging BTC decrease and elevating issues a couple of deeper correction. The shift in sentiment comes as broader monetary markets stay fragile, with ongoing macroeconomic instability and geopolitical uncertainty persevering with to shake investor confidence.

Regardless of makes an attempt to reclaim greater floor, Bitcoin has failed to carry key ranges, and momentum now favors the bears. Merchants and analysts are intently watching the subsequent resistance zones, which can seemingly decide the short-term course of the market.

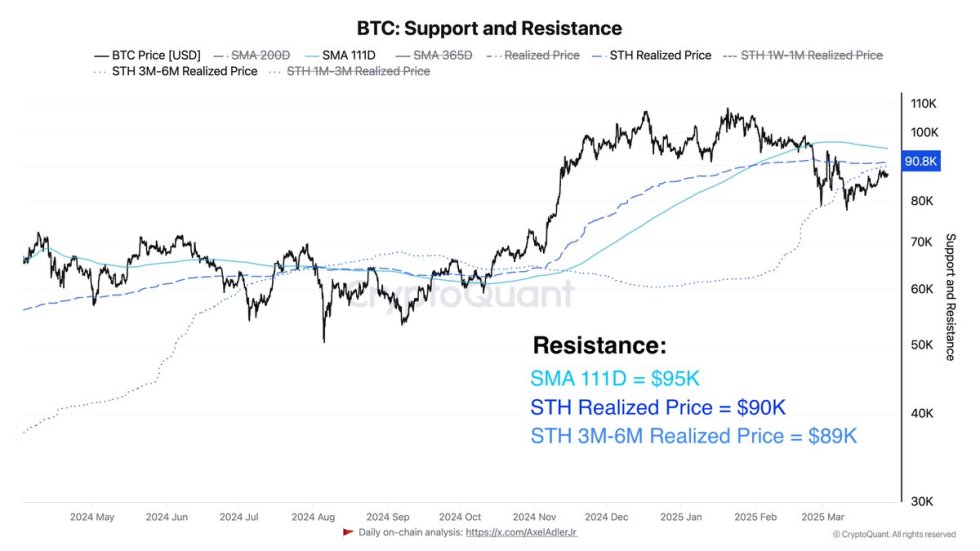

In accordance with on-chain knowledge from CryptoQuant, Bitcoin now faces three important resistance ranges. The primary sits at $89,000, representing the realized worth for short-term holders within the 3–6-month vary. The second key degree is $90,000, the general realized worth for all short-term holders. Lastly, the $95,000 degree marks the 111-day Easy Shifting Common (SMA), which has traditionally acted as a powerful barrier throughout trending markets.

Bitcoin Bulls Attempt To Reclaim Essential Resistance

Bitcoin is now down greater than 22% from its all-time excessive, and present worth motion suggests the decline will not be over. After a short interval of consolidation and minor rallies, BTC has continued to weaken, struggling to search out robust demand at key assist ranges. Bulls are underneath strain to step in and defend present costs earlier than the downtrend deepens additional. With no robust restoration push, the broader pattern could proceed to tilt in favor of the bears.

The broader macroeconomic setting stays extremely unstable, with fears of a commerce conflict and rising world tensions rattling monetary markets. Danger property, together with cryptocurrencies, have been significantly susceptible. As traders search security, capital continues to stream out of high-volatility property like Bitcoin, compounding the current sell-off.

Prime analyst Axel Adler not too long ago shared essential technical insights on X, highlighting the resistance ranges that Bitcoin should overcome to regain momentum. In accordance with Adler, Bitcoin at present faces three important resistance factors: $89,000, representing the three–6-month Quick-Time period Holders’ Realized Worth; $90,000, the general Realized Worth for all Quick-Time period Holders; and $95,000, which aligns with the 111-day Easy Shifting Common (SMA). These ranges now act as main boundaries to any bullish restoration.

A profitable breakout above these resistance zones would seemingly verify energy within the present bullish pattern and sign a possible reversal. Nonetheless, till these ranges are reclaimed, Bitcoin stays susceptible. The approaching days can be essential as bulls try and regain management and restore confidence throughout the crypto market. In the event that they fail, deeper losses may observe — pushing BTC additional away from its current highs.

BTC Holds $85K: Technical Ranges To Watch

Bitcoin is buying and selling at $85,000 after shedding a key assist zone round $85,500, the place each the 200-day transferring common (MA) and 200-day exponential transferring common (EMA) beforehand aligned. This breakdown has weakened the broader market construction and positioned BTC in a susceptible place as bearish momentum begins to construct. For now, bulls should maintain the $85,000 degree to keep away from a deeper retrace and preserve an opportunity at restoration.

If patrons can defend this degree and reclaim management, the subsequent important goal is $90,000 — a resistance zone that is still important for confirming a brand new bullish section. A decisive push above $90K would sign renewed energy and doubtlessly restore confidence throughout the market.

Nonetheless, if Bitcoin fails to carry $85K, promoting strain is prone to speed up, with the subsequent key assist sitting close to the $81,000 degree. A drop beneath that threshold may set off a extra important correction and deepen bearish sentiment. As worth consolidates close to a important technical zone, the approaching days can be essential for figuring out short-term course. Bulls should act shortly to stop additional draw back and reclaim momentum earlier than bears tighten their grip in the marketplace.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.