Blockchain oracles join real-world information to decentralized networks, and RedStone Crypto (RED) is stepping as much as problem the Chainlink (LINK) hegemony.

By 2025, Chainlink, Pyth, and RedStone Crypto are shaping the oracle panorama, every with its personal edge. Right here’s how they evaluate.

Key Similarities Throughout Chainlink, Pyth, and RedStone Crypto

Chainlink,

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Price

Quantity in 24h

<!–

?

–>

Price 7d

, and

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Price

Quantity in 24h

<!–

?

–>

Price 7d

might method it in a different way, however they ship the identical core promise: exact and reliable value feeds for main belongings throughout main blockchains.

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Price

Quantity in 24h

<!–

?

–>

Price 7d

might dominate the oracle area, however RedStone is grabbing headlines. By assembly the demand for quick, exact DeFi information, this upstart has sparked extra intrigue than its established rival.

Previous: Basis and Early Improvement

2021: Idea and Basis

RedStone was based with the purpose of constructing a versatile and environment friendly oracle system that addresses the constraints of conventional oracles. The challenge centered on… pic.twitter.com/LtK677uESL

— CryptoJournaal (@CryptoJournaal) March 25, 2025

To separate these, it is best to think about the next for RedStone:

- Are they a legit competitor to Chainlink? Not but, they’ve a methods to go. LINK is the biggest crypto by market capitalization within the oracle cash sector.

- Will it pump more durable than Chainlink within the quick time period? Seemingly sure. They have already got. On this crypto area, hype and hypothesis are every part, and RED is on the come-up.

This area is can be desperately attempting to ship Chainlink an L in its own residence. That’s why Pyth Community and Wormhole, two different Oracle rivals, the previous outperformed Chainlink this month.

RedStone Price Motion

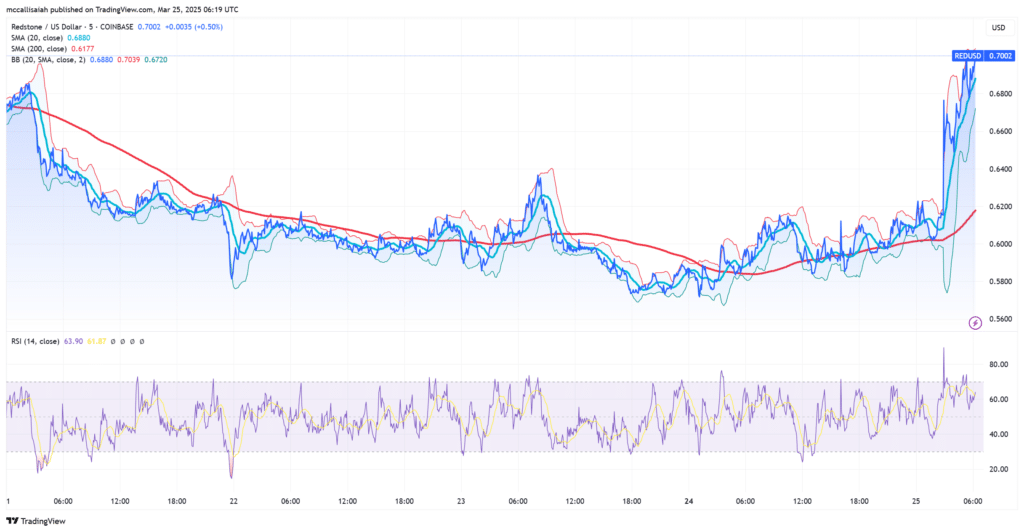

Redstone’s breakout is gathering steam. A golden cross simply fashioned with the 20-day SMA ($0.6880) overtaking the 200-day SMA ($0.6177), including weight to its bullish momentum.

The RSI is nearing overbought territory at 64, whereas quantity spikes verify consumers are backing the transfer. If the worth clears $0.70 with robust follow-through, $0.74-$0.75 might be the subsequent goal. Help is regular at $0.66.

What Units RedStone Crypto Aside From the Relaxation

Whereas the similarities create a robust basis of utility, the variations between these three gamers spotlight their distinctive strengths. Right here’s a better have a look at what makes every oracle distinct:

-

Chainlink: Chainlink, the veteran, champions reliability and aggregators in its Push mannequin, servicing juggernauts like Venus and Aave.

-

Pyth Community: Pyth strikes quick, constructed across the Pull mannequin, honing in on perpetual markets and staking with the assistance of Wormhole.

-

RedStone Crypo: RedStone flips the script, combining each fashions for unmatched flexibility, delivering low-latency, gas-efficient feeds for cutting-edge use circumstances like Proof of Reserves.

DeFi’s spine is constructed on oracles, every with a definite edge. Chainlink secures its legacy with confirmed reliability; Pyth focuses on velocity; and RedStone pushes boundaries with adaptability and cross-chain precision. All of them have a robust probability of performing nicely if we enter a bull market.

EXPLORE: 20+ Subsequent Crypto to Explode in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Blockchain oracles exhibits RedStone Crypto (RED) is stepping as much as problem the Chainlink (LINK) hegemony.

- Alternatively, Pyth strikes quick with the assistance of Wormhole.

- $LINK remains to be the biggest cryptocurrency by market capitalization within the oracle cash sector.

The publish Is RedStone Crypto a Legit Competitor to Chainlink? RED Price is Undervalued appeared first on 99Bitcoins.