Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

On Monday, Ethereum (ETH) recovered the $2,000 help, fueled by the market’s restoration. After hitting a two-week excessive of $2,104, an analyst famous that the cryptocurrency might finish March positively.

Associated Studying

Ethereum Nears Green Monthly Close

In the previous 24 hours, Ethereum surged 6.2% from the $1,980 mark to $2,104. The beginning-of-week restoration made ETH retest the $2,100 resistance for the primary time in per week and close to its essential value vary.

Amid the latest efficiency, Rekt Capital famous that the cryptocurrency’s value motion is “not that far away” from turning the draw back deviation right into a draw back wick within the month-to-month timeframe.

ETH dropped under the $2,196-$3,900 vary on March 9, plunging to $1,750 within the following days, its lowest stage since November 2023. After retesting a historic demand enviornment, “Ethereum is now only +5% away from positioning itself for a reclaim of its Macro Range,” the analyst defined.

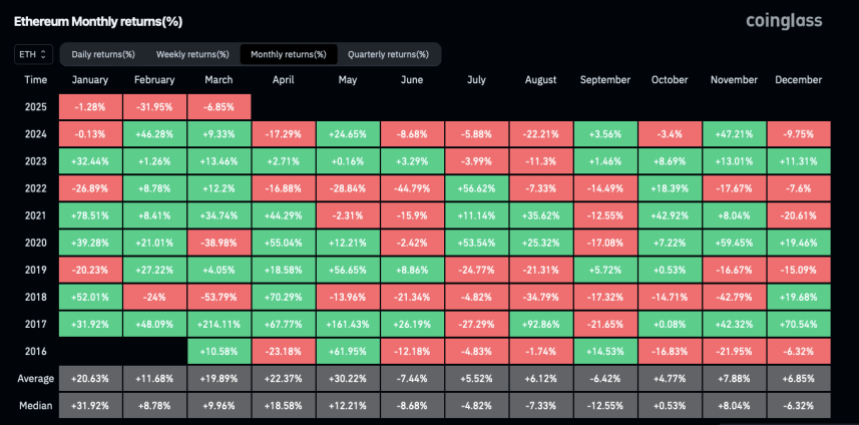

Reclaiming this stage earlier than March closes would see “this entire sub-$2,200 downside end up as a downside wick.” Furthermore, CoinGlass knowledge reveals Ethereum’s present value motion is 6.8% away from turning March inexperienced.

The cryptocurrency opened the month at $2,237, and a detailed above this stage might finish its three-month bleeding streak. Nonetheless, if it fails to shut March with constructive returns, ETH might expertise 4 months of crimson for the primary time since 2018.

The “King of Altcoins” has seen its worst Q1 in seven years, at the moment down 37.46% from its 2025 opening. Nonetheless, Ethereum has traditionally seen a bullish Q2, solely closing the second quarter in crimson on two events.

A restoration of ETH’s Macro Vary lows might see the cryptocurrency climb again to the vary’s highs within the coming three months.

Can ETH Recuperate 2,200?

Analyst Ali Martinez identified the important thing ranges to observe, suggesting that Ethereum’s most vital help zone is between $1,886 and $1.944, the place greater than 3 million traders purchased round 6.12 million ETH.

In the meantime, its most important resistance is between $2,250 and $2,610, the place 12.28 million addresses gathered 65 million ETH.

He added that “a decisive break above this area would negate the bearish outlook.” Equally, Crypto Jelle highlighted that ETH is making an attempt to reclaim the important thing $2,200 resistance, which might gasoline a “monster deviation” if recovered.

Analyst Ted Pillows recommended that Ethereum’s manipulation part “is almost over.” Beforehand, the analyst asserted that ETH’s chart displayed a Energy of Three (Po3) sample within the making, signaling that the cryptocurrency is within the manipulation part.

Associated Studying

In response to the analyst, “A breakout above $2,200 and an expansion phase will start.” He famous that the breakout may very well be attainable as ETH retested its multi-year trendline help, which has solely been retested 3 times since 2021.

The final two occasions, “they marked the cycle bottom,” which might recommend that Ethereum’s bleeding is poised for a restoration if it repeats its historic efficiency.

As of this writing, Ethereum trades at $2,090, a 4.3% surge within the every day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com