This quarter’s ‘State of Crypto Report’ has been made potential by the help of KCEX change. Their dedication to fostering understanding within the crypto house aligns with our mission at 99Bitcoins, and we’re grateful for his or her partnership.

The crypto market was one of many strongest-performing markets within the second quarter. On this ‘Q2 2025 Crypto Market Report,’ we discovered most U.S. fairness indices stayed beneath 15% in quarter-to-date (QTD) positive aspects, solely the S&P 500 Data Expertise sector stood out with an 18.4% rise; the broader S&P 500 gained simply 7.37%. In distinction, the crypto market outperformed all of them with a powerful 21.72% return.

This marks a strong restoration for crypto after a troublesome Q1, throughout which the market dropped by 18%. If we zoom out in the marketplace cap chart, we discover that the crypto trade did higher this time than within the second quarters of earlier years. For example, it had fallen 14.44% in Q2 2024 and a steep 53.78% in Q2 2021. Nonetheless, regardless of the spectacular rebound, the full crypto market cap in Q2 2025 was nonetheless about 12.40% beneath its all-time excessive of $3.71 trillion.

99Bitcoins discovered that buyers’ curiosity in crypto picked up in Q2. In April, blockchain-related mentions in SEC filings hit a file excessive of 5,830, seemingly because of the Trump administration’s pro-crypto method. Could stayed sturdy with 5,590 mentions, however by June, the quantity dropped to round 2,150.

The spike in April exhibits that many corporations have been getting extra concerned in blockchain, probably launching new crypto merchandise or forming partnerships. Some can also have added extra danger warnings to their merchandise as a result of investor exercise was rising. General, Q2 gave the impression to be a time when corporations have been on the brink of profit from anticipated help from the federal government.

Crypto Market Tendencies Q2 2025: Abstract

The second quarter, identical to the primary, was dominated by geopolitical tensions, financial slowdown, recession fears, elevated cash provide and greed. However what actually stood out was the sharp rise in curiosity from institutional buyers.

In contrast to previous bull markets, retail buyers confirmed much less curiosity in Bitcoin this time. In truth, out of 10 specialists 99Bitcoins spoke to, 9 stated that retail merchants have been shifting their consideration to altcoins. Bitcoin, however, appears to be turning into a favourite amongst establishments, although many fiduciaries have but to enter the market.

Whereas analyzing totally different blockchain layers, we additionally discovered improvement exercise on layer-2s was larger than on layer-1s, with many initiatives selecting Ethereum’s various, like Solana, for scalability and financial comfort. One space that caught our eye was DeFAI (Decentralized Finance AI), a rising house that mixes synthetic intelligence with DeFi. Whereas it’s nonetheless early days for DeFAI and the market is basically dominated by memecoins, specialists imagine the potential for innovation on this subject is large.

Cryptoforex Market Efficiency Q2 2025

After dropping to a yearly low of 15 (excessive concern) on 11 March, market sentiment shortly bounced again in April and stayed within the greed zone for over 60 days, because of the 90-day pause on tariffs by Donald Trump. However by mid-June, the Concern and Greed Index shifted again to impartial territory, exhibiting that buyers have been turning into extra cautious as a consequence of world and financial uncertainty. But, they have been making bullish bets.

- Bullish bets backed by hiring surge – This rising optimism was additional mirrored in an enormous surge in crypto hiring, which rose by 753%. Most of those roles have been for builders and advertising professionals. Effectively, hiring surges like this are typical throughout bull markets and replicate sturdy perception within the trade’s progress potential.

- Stablecoins led sector-wide demand – Amongst all crypto sectors, Stablecoins noticed the very best demand. A current Coinbase survey confirmed that 81% of small and medium companies (SMBs) accustomed to crypto are interested by utilizing Stablecoins of their day-to-day operations. It additionally discovered that the variety of Fortune 500 corporations planning to make use of Stablecoins has tripled since 2024. We will clearly say that the Stablecoin adoption is about to rise sharply in Q3.

- Circle’s profitable IPO – Backing this pattern is Circle’s profitable IPO, which confirmed that buyers are desirous to get crypto publicity, even when they aren’t straight holding these belongings. On its first buying and selling day, Circle’s inventory value jumped 168%, marking a record-breaking debut for an organization that raised at the very least $1 billion in its IPO. It’s additionally value noting that Circle made historical past as the primary Stablecoin firm to go public, highlighting how far the trade has come.

- Regulatory readability – The U.S. govt. made some main strikes that broadly supported the crypto market. Key legal guidelines and government orders have been handed, and IRS reporting guidelines for DeFi platforms have been eliminated. U.S. financial institution regulators, too, relaxed guidelines round crypto, so banks not want to tell the Federal Reserve earlier than partaking in crypto-related actions. These constructive adjustments within the broader crypto market helped enhance buyers’ confidence in Bitcoin, pushing its dominance to a four-year excessive of 63%.

A Take a look at the Crypto Leverage Market

Between 1 January 2025 to 27 Could, publicly traded corporations that maintain Bitcoin of their treasuries borrowed $2.1 billion to purchase extra BTC. Semler Scientific borrowed $100 million on 24 January with plans to repay it no sooner than August 2030. Likewise, Technique borrowed an extra $2 billion on 20 February, with reimbursement set for March 2030.

Crypto-collateralized lending continued to be one of many most important methods buyers accessed leverage within the crypto market. The typical rate of interest to borrow Stablecoins dropped considerably, from 11.59% in January to simply 5% by 26 Could, marking a 56.86% decline in borrowing prices. On the identical time, Collateralized Debt Place (CDP) Stablecoins like DAI, that are backed by crypto belongings, noticed a $1.6 billion improve in issuance, up 25.56%.

Bitcoin futures open curiosity throughout all main platforms rose from $101.82 billion on 1 April to $137.70 billion by 26 June. This meant that extra money was invested in leveraged trades. In distinction, the futures marketplace for altcoins stayed comparatively quiet, exhibiting that almost all merchants have been centered on Bitcoin as an alternative. And suggesting that the broader market was distant from the altcoin season.

In the meantime, crypto enterprise capital funding held regular in Q2, however Q1 2025 noticed a powerful surge, with blockchain and crypto startups elevating $4.8 billion, the very best quarterly quantity since late 2022. In truth, the funding in Q1 alone made up 60% of all VC funding seen in 2024.

Bitcoin’s Quantitative Evaluation – Tendencies & Insights

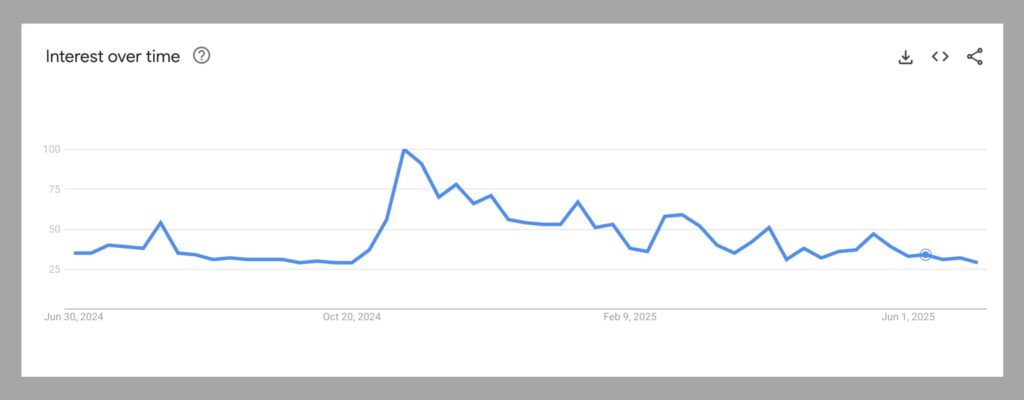

Within the present bull run, Bitcoin hasn’t attracted as a lot consideration from retail buyers because it did in previous rallies. In keeping with Google Tendencies, searches for “Bitcoin” have been fairly low in comparison with the previous yr, which is stunning, since Bitcoin hit a brand new all-time excessive in Q2.

As per the technical evaluation of Bitcoin’s 1-Day chart, the king coin was caught in a downtrend from February to March. In early April, it broke out of this sample with a powerful transfer up, which marked the beginning of a brand new uptrend.

- In the direction of the tip of Q1, a descending triangle fashioned with decrease highs and flat help. That is usually a bearish sample. However on this case, the breakout was to the upside, as sellers have been shedding management, and consumers stepped in with nice power. This upside motion was backed by excessive quantity, which initiated the Q2 uptrend.

- Submit-breakout, a transparent formation of HH (Greater Highs) and HL (Greater Lows) was seen on the chart. This was an indication that buyers have been accumulating within the hope of profit-taking.

- $92K-$96K degree acted as a powerful help zone. The worth consolidated right here and bounced, highlighting the consumers’ conviction. Nonetheless, $109K-$112K continued to behave as a good provide zone the place liquidity was much less.

- For all of Q2, Bitcoin handled the 200-day Shifting Common (MA) as its help. On 22 Could, the 50-day MA sloped and crossed above the 200-day MA. Thus, forming a golden cross. This indicated that the bullish momentum would proceed within the subsequent few days.

- The Quantity Oscillator confirmed excessive exercise through the breakout in April. However in late June, it confirmed a divergence with the BTC value. In essence, it dipped beneath zero, suggesting that purchasing momentum was cooling down as BTC approached the psychological degree of $110k.

What Influenced Bitcoin’s Value Trajectory?

A number of elements have influenced Bitcoin’s value, from macroeconomic developments and basic information to on-chain metrics and general market sentiment.

Macroeconomic Components

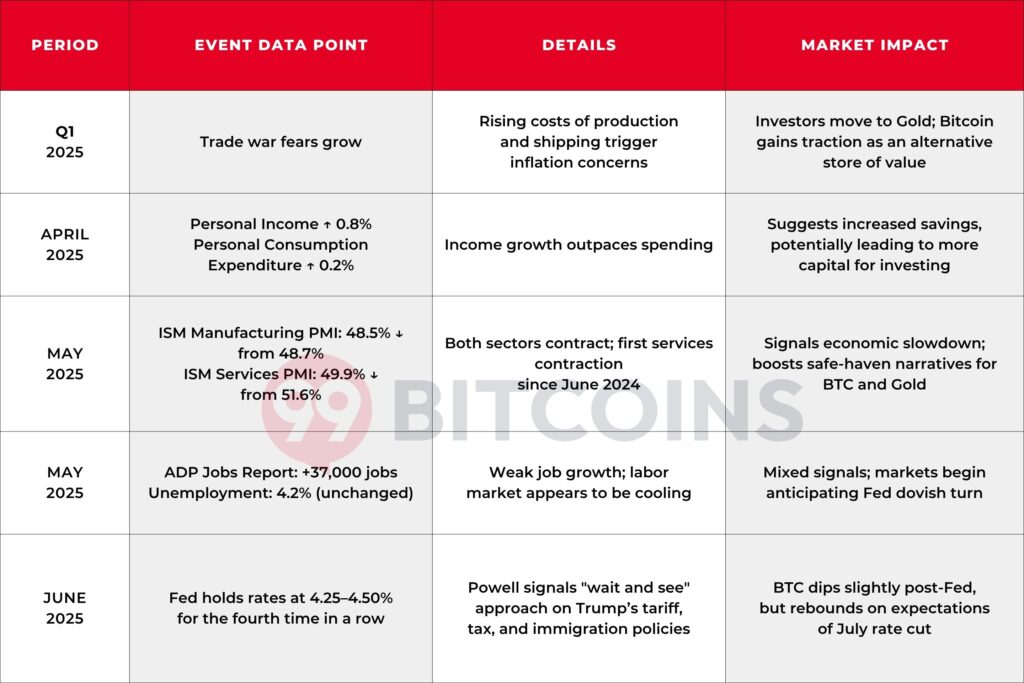

In Q1 2025, rising fears of a world commerce battle led to issues about rising costs as a consequence of larger manufacturing and transport prices. Due to this, many buyers turned to safe-haven belongings like Gold. Nonetheless, Bitcoin additionally gained consideration as a substitute retailer of worth.

This shift in buyers’ sentiment coincided with blended financial alerts within the United States. Private Revenue elevated by 0.8% month-to-month in April whereas Private Consumption Expenditure (PCE) went up by solely 0.2%. The ISM Manufacturing PMI dropped to 48.5% in Could, from 48.7% in April. This marked the third straight month of contraction within the manufacturing sector. The ISM Providers PMI additionally fell to 49.9% in Could, from 51.6% in April. This was the primary time the providers sector contracted since June final yr.

Each manufacturing and providers knowledge instructed the economic system was slowing. Additional, the ADP Nationwide Employment Report confirmed simply 37,000 non-public sector jobs have been added in Could 2025, and the U.S. unemployment price stayed at 4.2%. In response to those blended knowledge, in June, the Fed stored rates of interest unchanged at 4.25%–4.50% for the fourth time in a row.

Fed Chair Jerome Powell stated the policymakers wished to see the complete influence of President Trump’s insurance policies on tariffs, taxes, and immigration earlier than making any price cuts. Behind this announcement, Bitcoin pulled again barely, however shortly recovered as hopes for a July price minimize grew.

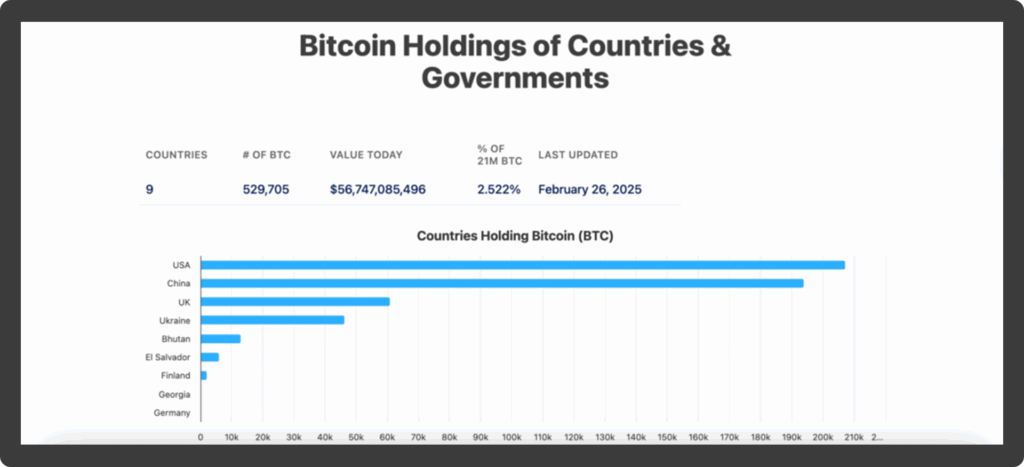

We discovered that Bitcoin is gaining popularity as a strategic asset for each corporations and governments. Right this moment, corporates maintain over 5% of all Bitcoin in circulation, which they use as a part of their treasury technique. Governments are additionally beginning to take discover.

Round 2.5% of Bitcoin’s complete provide is now held by governments worldwide, with the U.S. alone holding 0.987%. In a 13F submitting launched on 15 Could, it was discovered that Abu Dhabi’s sovereign wealth fund invested $408.5 million within the iShares Bitcoin Belief (IBIT).

Crypto ETFs and ETPs have made it a lot simpler for buyers to get publicity to digital belongings with out straight shopping for or storing them. Within the U.S., Bitcoin ETFs now have a full yr of efficiency historical past, which has helped construct belief amongst buyers.

As of June’s finish, Bitcoin ETF Belongings Below Administration (AUM) made up 6.35% of Bitcoin’s complete market cap, whereas the full AUM for crypto ETFs stood at $135.08 billion. ETFs have contributed massively to Bitcoin’s rise. Take into account this: Internet flows into BTC spot ETFs reached $226.70 million, with inflows outpacing outflows during the last three months.

Expressing confidence within the rising ETF market, Chris Wright, World Head of Marketing at 21Shares informed 99Bitcoins,

We imagine that Bitcoin ETFs will entice 50% extra inflows this yr in comparison with final yr. This is able to lead to internet inflows of roughly $55 billion in 2025, representing a rise of round $20 billion year-over-year. If this pattern continues, the full belongings underneath administration may almost double from simply over $110 billion at present, to over $200 billion by the tip of the yr.

In truth, the most recent 13F filings submitted to the SEC by main institutional buyers reveal {that a} rising variety of fiduciaries, insurance coverage corporations, and different companies are including Bitcoin ETPs to their portfolios. In an unique dialog, Chris Wright stated,

This surge alerts not simply heightened curiosity, however a deepening conviction in Bitcoin as a long-term, strategic asset, with ETPs turning into the popular entry level for establishments. Filings confirmed a 5% improve in institutional holders and a 7% improve from funding advisors. College endowments additionally continued to enter the crypto house, with Brown College turning into the primary Ivy League establishment to allocate funds to Bitcoin ETPs.

In addition to ETFs, regulatory readability has additionally acted as a tailwind for Bitcoin’s upward transfer. In 2025, the SEC rolled again a number of enforcement actions and lawsuits in opposition to the digital asset trade. The crypto market additionally noticed progress on the Market Construction Invoice, which goals to create clear guidelines for digital belongings within the U.S. Additional, FDIC and SEC eliminated limitations for banks to custody digital belongings. The Monetary Accounting Requirements Board additionally modified accounting guidelines, simplifying company reporting for Bitcoin.

This extra relaxed regulatory stance led to a surge in investor confidence, with many making massive bets on the crypto market. As we advance, the market will watch developments round U.S. commerce coverage, which may have a larger influence on crypto costs.

On-Chain Components

Institutional buyers additionally dominated on-chain exercise. As per Glassnode, over 30% of Bitcoin’s provide was held by centralized entities, with a small group of big-pocketed buyers proudly owning a lot of the cash. As extra institutional gamers have entered the market, Bitcoin exercise has shifted from on-chain settlements to off-chain infrastructures.

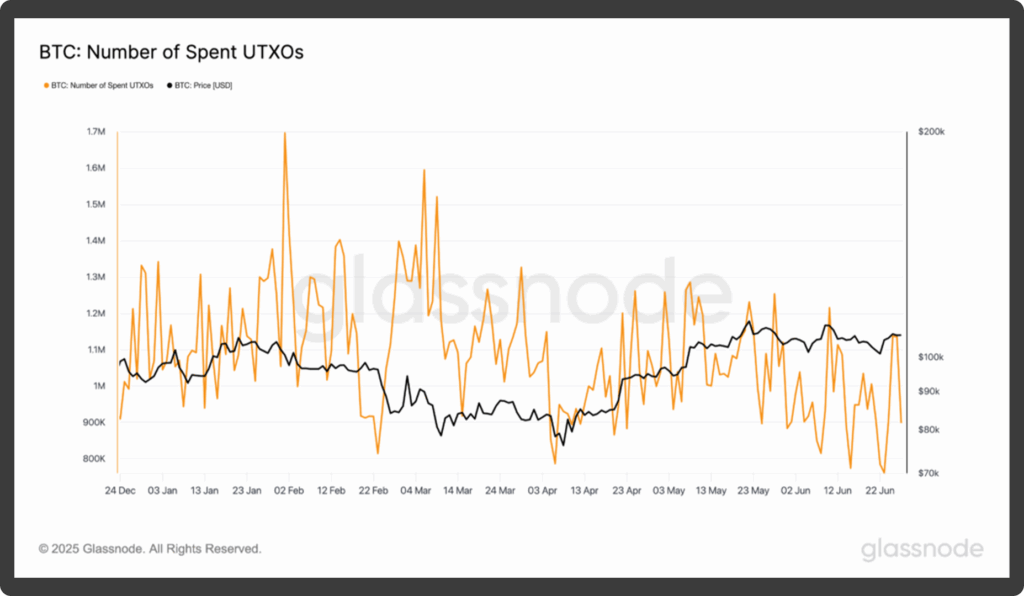

On-chain knowledge confirmed elevated confidence and long-term HODLing habits amongst market members. The yellow line (within the chart beneath), representing the variety of spent UTXOs exhibits excessive volatility in Q1 with frequent sharp spikes. Nonetheless, after mid-March, there’s a visual decline within the depth of those spikes, highlighting buyers’ decreased speculative exercise and extra confidence in holding.

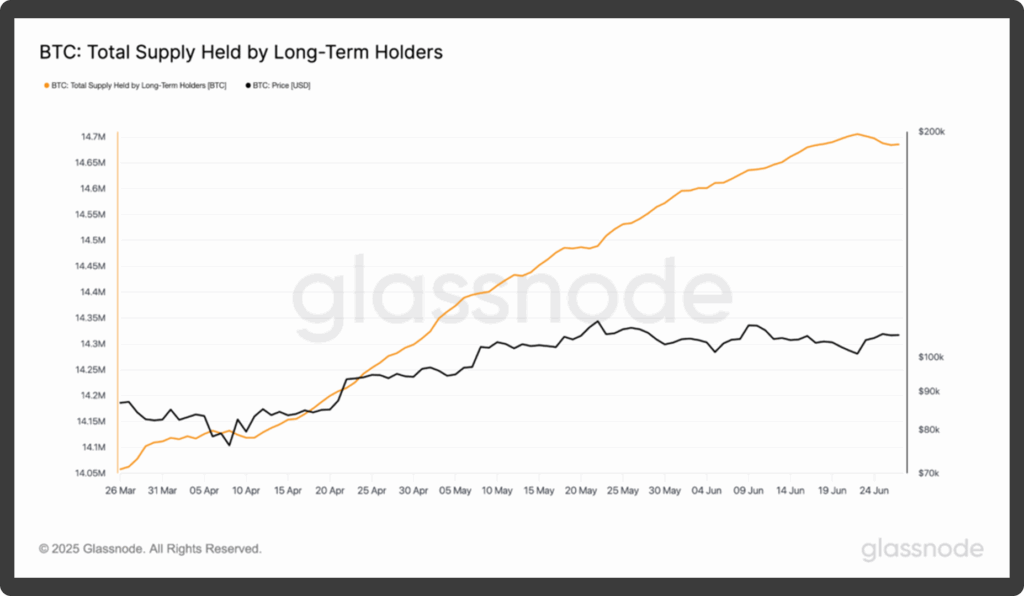

In truth, the change influx quantity additionally decreased in Q2, thus highlighting that buyers have been transferring their Bitcoin away from centralized exchanges to their chilly wallets. This statement was additionally validated by the ‘Complete Provide Held By Lengthy-Time period Holders’ metric, which noticed a pointy and constant rise all through the final three months.

It climbed from round 14.05 million BTC to over 14.65 million BTC, indicating sturdy accumulation. Throughout this time, Bitcoin’s value additionally noticed some sideways motion and slight pullbacks. Regardless of this, the long-term provide continued to extend, signaling that long-term holders weren’t deterred by short-term value weak point.

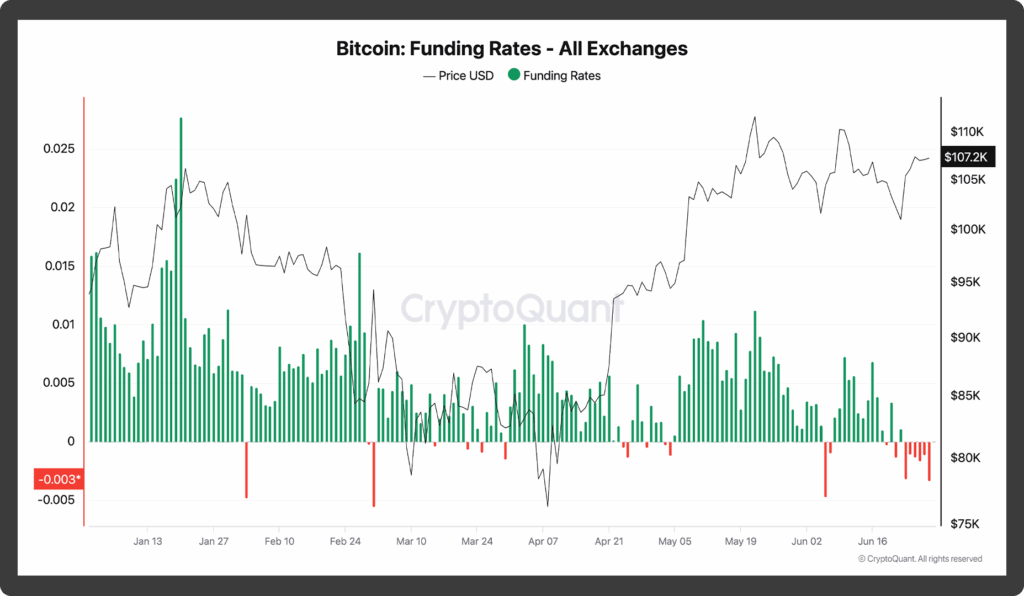

Within the derivatives market, lengthy positions outweighed the brief positions for almost all of the buying and selling classes within the second quarter. Each Bitcoin’s value and Open Curiosity (OI) rose in tandem, revealing extra merchants opened lengthy positions anticipating additional upside. You’ll be able to contemplate it a basic signal of a bullish derivatives-driven rally.

Within the perpetual futures market, funding charges have been predominantly constructive all through Q1 and early Q2, reflecting bullish bias. Nonetheless, this pattern shifted with a number of dips into unfavourable territory, most notably in late February, March, and once more in June. These have been the instances when aggressive brief bets have been excessive. The on-chain actions within the latter a part of Q2 revealed there may very well be heightened volatility within the months forward.

By the tip of June, near 93% of BTC holders have been sitting on earnings. Whereas 75% of holders selected to maintain their earnings for over a yr, round 20% held for 1-12 months, and a small group of 4% held for lower than a month, pointing to short-term buying and selling exercise. In the meantime, market volatility dropped sharply in Q2, falling from 52.68% in late March to 25.71% by mid-June.

The variety of addresses with some form of steadiness rose steadily, hitting 53.72 million in mid-June, reflecting rising consumer participation. Addresses holding greater than $1 million in BTC jumped from 124,663 on 14 March to 160,822 by mid-June, once more highlighting rising institutional curiosity.

On the flip aspect, the variety of addresses holding at the very least one Bitcoin dropped sharply, suggesting some retail holders could have taken earnings through the rally. These knowledge units collectively implied that by the tip of Q2, the Bitcoin market was in a powerful but maturing section.

What’s Forward For Bitcoin in Q3 2025?

With rising cash provide, rising curiosity from sovereign wealth funds and establishments, clearer laws, supportive laws, and a historic provide crunch, Bitcoin seems well-positioned for additional upside within the subsequent quarter.

Including to this momentum are growing ETF netflows and the chance of upcoming price cuts, all of which may gasoline continued value progress. If we have a look at the technical readings, we are able to discover that the market is in a decisive state.

Bitcoin broke above the 0.236 Fibonacci degree ($103,473) on 23 June and began treating it as a near-term help. The bulls have been trying to interrupt above the all-time-high zone of $111,000-$112,000, which has many sellers. On the again of constructive macroeconomic developments, if BTC manages to interrupt above this degree, we may see the subsequent transfer towards $120,000, a probable psychological and Fibonacci extension goal.

Be aware that within the chart above, the Fibonacci retracement is drawn from $76,000 to $112,000. If Bitcoin breaks again beneath $103,000, you may anticipate a liquidity sweep all the way down to $98,000-$93,000 degree, the place the consumers will seemingly step in.

In keeping with the studying of Quantity Vary Seen Profile (VRVP), there’s a visual demand on the $104,000-$107,000 zone. The Level of Management (PoC) occurs to be at $96,000. So, if this fails, the best way to $89,000 opens shortly. And as soon as $112,000 is cleared with sufficient quantity, Bitcoin can simply rally to $120,000 degree in a matter of some days.

A clear MACD crossover may sign the continuation of the uptrend. RSI hasn’t reached an overbought degree after 22 Could, so there are excessive probabilities of a value improve.

Bullish State of affairs (70% Likelihood)

For bullish momentum to proceed, these elements must be checked –

- Bitcoin holds $103,000 degree and breaks by $111,900.

- MACD continues rising, and RSI pushes above the 60 mark.

Goal zone

- $120,000 may be stored in focus since it can act as psychological resistance.

- $135,000 can solely be reached with excessive ETF inflows and macro tailwinds.

Impartial-to-Bearish State of affairs (30% Likelihood)

In a impartial or bearish state of affairs, you may see the next occasions –

- Bitcoin rejects $111,000 and falls beneath $103,000.

- Quantity drops and MACD flattens or turns pink.

- RSI dips beneath 50 and continues to remain sideways.

Goal zone

$98,000, $93000, $89,000 – Every degree has historic help and fibonacci confluence.

Acknowledging the likelihood that Bitcoin may wrestle to interrupt previous $100,000, Daniel Polotsky, Co-Founding father of CoinFlip, informed 99Bitcoins,

I imagine Bitcoin will finish the yr effectively north of $100,000. Nonetheless, if tariffs result in vital inflation and immediate central banks to boost rates of interest, it may pose a critical problem. The identical issues apply if the battle within the Center East escalates or a brand new battle breaks out.

It’s additionally vital to notice that Bitcoin faces an unprecedented provide shock. Spot Bitcoin ETFs have develop into constant each day consumers, with their inflows often exceeding the 450 BTC mined every day. This widening hole between demand and new provide is quickly lowering the quantity of Bitcoin obtainable out there.

On the identical time, the change reserve continues to say no. This merely means fewer cash can be found for buying and selling. This shortage is sure to ignite sharp strikes upward.

Traditionally, Bitcoin’s largest value surges have occurred six to 12 months after a halving occasion. In each 2017 and 2020, these rallies have been fueled by elements like retail enthusiasm and favorable financial insurance policies. Effectively, a 10x acquire this time won’t be potential. Primarily based on previous developments, a transfer that doubles or triples Bitcoin’s earlier all-time-high of $69,000 is effectively inside attain.

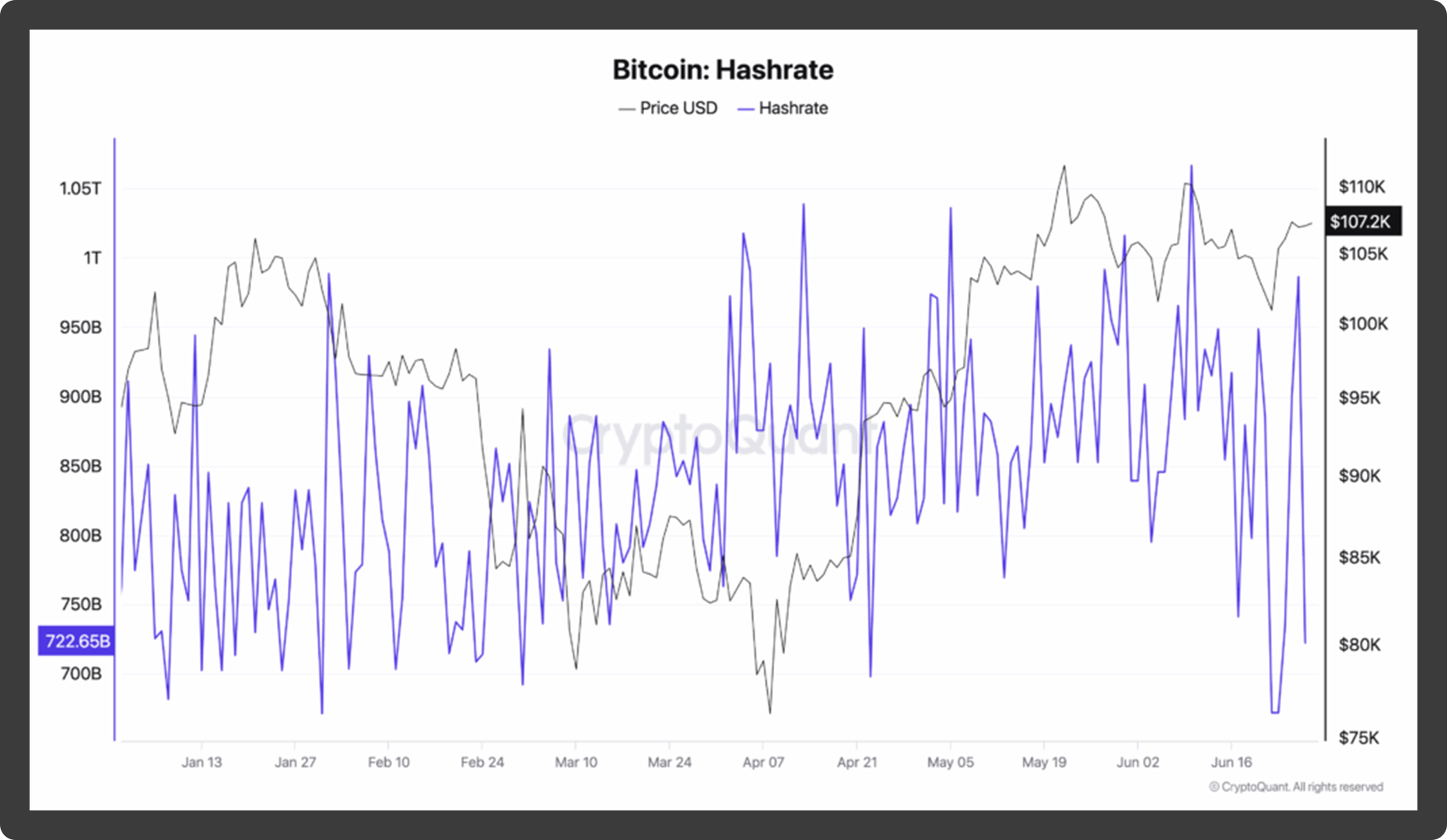

Most significantly, Bitcoin’s illiquid provide stored rising all through Q2, now surpassing 14 million Bitcoin as extra holders transfer their cash off exchanges and into long-term storage. On the identical time, the community’s hashrate has dipped barely, however miners aren’t speeding to promote.

In truth, miner wallets holding between 100 and 1,000 Bitcoin have elevated their balances from 61,000 Bitcoin on the finish of March to 65,000 BTC on 27 June, the very best since November 2024. It merely means that miners are assured and never feeling the strain to promote on the present costs.

99Bitcoins’ BTC Value Prediction For Q3 2025

Bitcoin typically follows seasonal patterns, often performing effectively in Q2 and early This autumn, whereas Q3 tends to be slower as a consequence of decreased summer time buying and selling exercise. In Q3 2025, Bitcoin’s momentum may decelerate if ETF inflows drop or world financial uncertainty grows.

Nonetheless, shock price cuts and rising institutional curiosity may push costs larger regardless of the seasonal lull. Primarily based on present fundamentals, technical charts, and the broader financial circumstances, we imagine BTC may hit $120,000 by Q3. If the worldwide cash provide retains rising, Bitcoin may even climb to $135,000 throughout the subsequent six months.

Ethereum Q2 2025 Outlook

All through the quarter, Ethereum’s correlation with Bitcoin moved between 0.49 and 0.98. There was a short divergence in late June, as ETH pushed above $2,459, its correlation with Bitcoin declined earlier than stabilizing once more. The Complete Worth Locked (TVL) on this layer-1 chain steadily grew all through Q2, with solely minor pullbacks. This indicated that builders continued to favor Ethereum regardless of ongoing issues about excessive gasoline charges.

Out of the 1,263 protocols on Ethereum, the liquid staking platform Lido held the biggest share with $22 billion in TVL, adopted carefully by AAVE with $21.7 billion. Solely 30.94% of addresses holding ETH have been making a revenue on the $2,439 value degree, whereas 18.47% have been in loss, and 50.59% have been impartial.

In early January, the MVRV ratio was above 1.5, indicating ETH was buying and selling effectively above its common on-chain value foundation. From February to April, each the ETH value and MVRV ratio declined. MVRV dropped beneath 1.0 in March, signaling undervaluation, usually a bullish sign suggesting ETH was buying and selling beneath what most holders paid.

Curiously, ETH started climbing once more in late April, MVRV additionally recovered to simply above 1.2, highlighting reasonable revenue ranges, however not excessive overvaluation. Round mid to late June, ETH costs elevated, however MVRV dipped barely. This divergence instructed that new consumers entered at larger costs, making ETH extra expensive, whereas additionally inflicting the realized cap to go up. Principally, the worth of ETH was rising, however the general revenue margin out there was shrinking.

With favorable laws anticipated from the U.S., Ethereum ETF initially skilled internet outflows in early April, however the pattern quickly shifted because the inflows started to rise. The inflows have been comparatively decrease than what Bitcoin registered. Nonetheless, ETH ETFs collected $11 billion in Belongings Below Administration (AUM) by the tip of June. On the identical time, the variety of addresses holding at the very least 10,000 ETH elevated throughout Q2, highlighting whales’ energetic acquisition.

What to Anticipate From Ethereum in Q3 2025?

Ethereum’s each day chart confirmed a transparent breakdown from a rising wedge sample, which usually alerts short-term bearish momentum. After peaking beneath the $3,000 degree, ETH failed to interrupt above the near-term resistance zone of $2,950-$3,250.

Following the breakdown in mid-June, the worth fell towards the $2,200 degree, however managed to get better barely. In late June, ETH began treating the center Bollinger Band (BB) as its resistance, and the bands contracted, revealing that the market was indecisive. Chaikin Cash Movement (CMF) has been beneath 0.29 degree for many of Could and June, indicating delicate shopping for strain and never a powerful accumulation section. Quantity has additionally been common and not using a clear sign of pattern reversal.

If Ethereum is unable to reclaim the $2,879 degree convincingly, it might proceed to commerce sideways, or it’d even revisit the $2,000 help degree that has consumers’ dominance. Nonetheless, if bulls regain management and ETH breaks above $2,879 with growing quantity and CMF affirmation, the worth may problem $3,000 to $3,197 provide zone in Q3. For now, the technical setup favors a cautious outlook.

Overview of Key Crypto Sectors

Amongst all of the sectors, memecoins and AI tokens skilled the very best volatility, marked by sharp value swings and speculative buying and selling. Bitunix‘s analyst knowledgeable 99Bitcoins,

Sectors underpinned by actual belongings or breakthrough know-how functions attracted essentially the most capital and investor consideration.

In distinction, the NFT market remained largely subdued, persevering with the pattern of stagnation seen over the earlier years.

DeFi Sector

- The Complete Worth Locked (TVL) in DeFi climbed steadily in early Q2, however declined once more towards the tip of June. Regardless of the pullback, it remained above the 15 April low of $86 billion. Ethereum continued to dominate the DeFi house, accounting for 55.78% of the full TVL, whereas Solana held a 7.62% share.

- Q2 additionally noticed encouraging alerts from the Securities and Alternate Fee (SEC). In a roundtable hosted on the SEC’s headquarters, Chair Paul Atkins hinted at the potential of regulatory exemptions that would permit U.S.-based DeFi companies to function with fewer constraints.

- Curiously, Chainlink reached a serious milestone in its improvement work, strengthening its place within the DeFi house. In June, it recorded 363 vital GitHub actions, greater than any of its rivals. DeepBook Protocol got here in second with 193 GitHub actions, adopted by DeFiChain with 152 developmental updates.

- Ripple formally concluded its five-year authorized battle with the SEC by withdrawing its cross-appeal. The top of this battle is predicted to behave as a tailwind, with some specialists predicting XRP will cross above $3.4 by the tip of 2025. XRPL utilization has been rising throughout the TradFi sector, notably for cross-border funds and tokenization. 99Bitcoins additionally discovered that XRPL funds made out of one account to a different elevated significantly in June.

- The Decentralized Alternate (DEX) Hyperliquid’s token HYPE elevated by 396% between 7 April and 16 June, pushed by rising investor curiosity. In truth, this DEX now leads the decentralized perpetuals market, processing over 70% of DEX perp quantity. It has, thus, develop into one of many largest gamers within the DeFi house.

- Not too long ago, Nasdaq-listed Lion Group introduced that it’ll maintain $600 million in reserves with HYPE as its most important treasury asset. The DEX additionally delivers a easy buying and selling expertise with options like one-click buying and selling, direct deposits from over 30 chains, and quick access to identify, margin, and perpetual markets. Its Distinctive Energetic Wallets (UAW) depend has additionally seen appreciable progress. Thus, prompting many analysts to foretell HYPE token’s surge to at the very least $50 by the tip of 2025.

Stablecoin Market

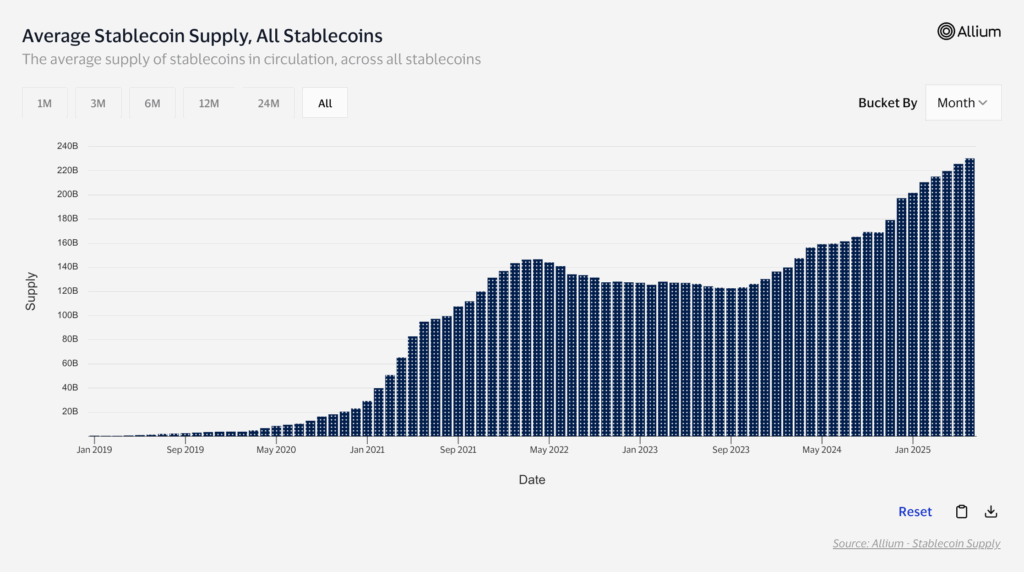

Q3 has been one of many strongest quarters for the Stablecoin sector. In 2025, Stablecoin utilization has steadily grown, with the common circulation provide growing month-to-month. Over the previous yr, complete Stablecoin transaction quantity surpassed $35 trillion, whereas the variety of distinctive energetic addresses reached 265 million.

USDT continues to dominate Stablecoin transaction quantity. Nonetheless, USDC is steadily gaining floor, particularly following Circle’s profitable itemizing on the New York Inventory Alternate. In June, USDT accounted for 68.77% of all Stablecoin transactions, with USDC capturing 30.83%. On the blockchain aspect, Tron led in Stablecoin quantity for many months whereas Ethereum held the second spot.

The U.S. continues to advance federal Stablecoin laws with the STABLE Act and the GENIUS Act. With extra regulatory readability, this sector is predicted to develop quickly within the subsequent few quarters.

Market Tendencies in Memecoins

Memecoins creation has surged to new heights in 2025, with over 5.9 million tokens created to date in 2025, with most of them originating from pump.enjoyable. After a pointy decline in Q1, the memecoin market cap noticed a modest restoration in Q2, although it remained extremely unstable.

Among the many top-gainers of all time, PEPE led the best way with a surprising 89.93M% acquire, whereas FARTCOIN holds the eighth spot with 2.28M% acquire. Curiously, blue-chip memecoins like DOGE or SHIB have been absent from the “Top Gainers” record. This highlights the shift in momentum towards newer and extra speculative tokens.

As risk-loving buyers proceed to flock to memecoins, the crypto market can be witnessing a shift within the nature of crypto-related crimes. Slightly than exploiting sensible contract bugs, hackers are more and more specializing in phishing assaults and wallet-related breaches. A major variety of these pockets hacks have focused addresses holding memecoins as effectively.

DePIN, RWAs, and AI Token Sectors

- In contrast to all different sectors, the DePIN market cap noticed a major fall post-Could. Out of 417 initiatives, Bittensor carried out higher by way of value motion. This sector continues to be in its early stage, with many initiatives being too technical for an investor to grasp.

- The RWA sector noticed notable progress, with LINK securing the fifth spot on the all-time prime gainers record, boasting a formidable 8.39k% progress.

- AI tokens confirmed higher efficiency in April and Could, however struggled in June, with most recording losses. In comparison with different sectors, they’ve but to generate vital pleasure or sustained curiosity from buyers.

Non-Fungible Tokens (NFT) Market

- Regardless of the continuing winter, buying and selling quantity within the NFT market noticed an uptick within the second quarter. The entire variety of NFT collections continued to develop, and the variety of addresses interacting with NFTs additionally noticed a slight improve by mid-April.

- NFT gross sales reached 51 million by the tip of June. Nonetheless, over the previous month, the market skilled a pullback with NFT gross sales quantity dropping by 27% and transactions declining by 52%. Curiously, the variety of consumers rose by 27.85% whereas sellers decreased by 13%. Thereby, hinting at a gradual shift in market dynamics.

- OpenSea dominated the NFT market with $2.3 million in quantity. In the meantime, NFT quantity on the Ethereum blockchain accounted for $22.44 million.

Help Our Analysis

To proceed supporting our analysis efforts, we kindly ask that you just embrace a hyperlink to our ‘Q2 2025 Crypto Market Report‘ should you use any of the info or insights.

References

- SEC Official Website

- Federal Funds Efficient Fee

- Glassnode

- Santiment

- IntoTheBlock

- CryptoQuant

- CoinMarketCap

- CoinGecko

- DappRadar

- NFTGo

Disclaimer: This ‘Q2 2025 Crypto Market Report’ presents an in depth overview of the crypto market. The information and evaluation are meant just for informational and academic functions and shouldn’t be thought-about monetary recommendation.

About Our Proud Associate: KCEX

KCEX is registered as a Cash Service Enterprise (MSB) with the U.S. Monetary Crimes Enforcement Community (FinCEN). The change places a powerful deal with following laws and complies with native regulatory authorities.

Customers security is a prime precedence for which the platform employs excessive degree safety know-how. It additionally protects customers by safety features like two-factor authentication (2FA) and chilly storage for digital belongings.

KCEX is sort of standard for providing among the lowest charges within the trade. It expenses 0% for each spot and futures maker charges, with simply 0.01% for futures taker charges. The perfect half is that there aren’t any withdrawal charges not like many crypto exchanges.

The platform helps over 500 cryptocurrencies, together with prime cash and newer tokens. KCEX is all the time fast to record standard, new and legit tokens. It presents over 1000 spot pairs and 500 futures pairs for buying and selling. We discovered that KCEX serves greater than 1 million customers throughout the globe, providing straightforward to make use of interface and 24/7 multilingual buyer help. 99Bitcoins’ expertise of utilizing this change was completely easy and unbelievable, with ample liquidity and beginner-friendly options. Go forward and take a look at the platform your self.

Go to KCEX

The submit 99Bitcoins’ Q2 State of Crypto Market Report appeared first on 99Bitcoins.