Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

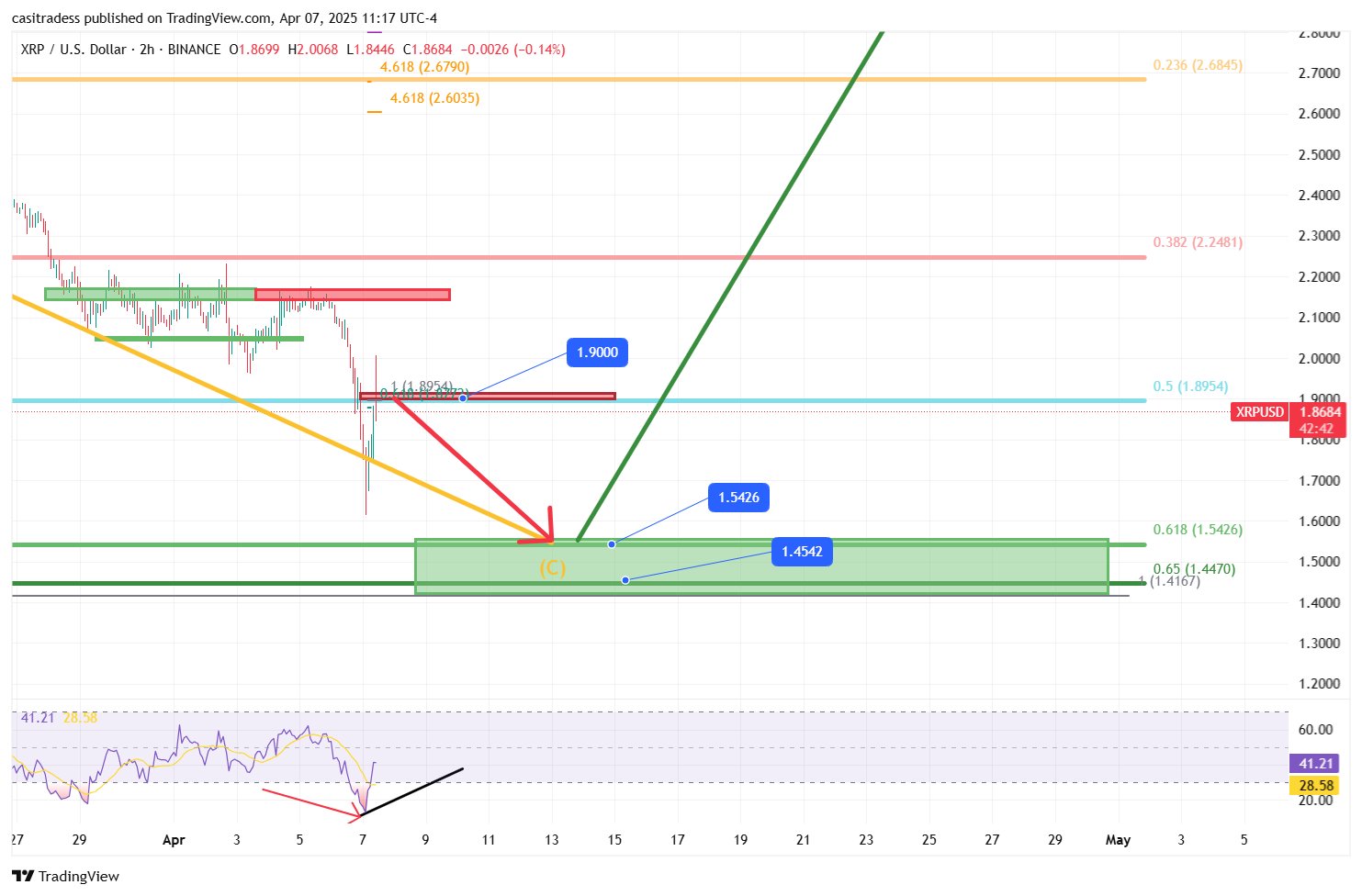

Crypto analyst CasiTrades (@CasiTrades) revealed a brand new XRP evaluation, highlighting yesterday’s intraday plunge to about $1.61 after the extensively watched $1.90 stage gave means. “Overnight we saw $1.90 break down, and price flushed to around $1.61,” the analyst commented through X, stating that this sudden drop produced “new extremes on the RSI across the market” and got here inside placing distance of a beforehand recognized assist zone.

XRP To Hit $13 In April?

Because the crash on Monday, XRP has rebounded considerably, however the analyst now views $1.90 as “major resistance at this point” and underscores that the breakdown of the 0.5 Fibonacci retracement close to $1.90, whereas disappointing for bulls, should be according to a bigger corrective state of affairs.

Associated Studying

The chart itself reveals an ongoing corrective Wave 2, as CasiTrades maintains: “I’ve believed for a while we were in a macro Wave 2.” He emphasizes that the breach of the $1.90 assist stage confirms that corrective sample “more than it invalidates anything.” Beneath $1.90, the following essential pivot, in line with the chart, is the “golden .618 retracement,” flagged at about $1.55.

This space is a part of a broader inexperienced assist band that stretches from roughly $1.45 (the .65 retracement) up towards $1.55 (the .618 retracement). CasiTrades means that the worth motion arriving on this zone may nicely be the turning level that units XRP on a path to greater floor. “It’s exactly what sets up the kind of Wave 3 that breaks through ATHs,” she mentioned, whereas additionally noting, “The next wave should easily break those resistances. Be prepared for this to happen very fast.”

The relative energy index on CasiTrades’ chart reveals XRP reaching excessive oversold territory amid yesterday’s crash, having dropped beneath 20 earlier than recovering to the low 40s. That bounce, which aligned with value getting back from $1.61 towards the $1.90 area, underscores the importance of the short-term retracement.

Associated Studying

But the analyst maintains that any definitive bullish affirmation now hinges on whether or not XRP can stabilize round $1.55 if it continues to slip. “If we do bottom near $1.55, it actually strengthens the bullish case for those big April targets—$8 to $13 still stands,” CasiTrades wrote, reiterating her perception {that a} profitable Wave 3 extension above prior highs may generate a fast climb into the multi-dollar vary.

Resistance at $1.90 stays entrance and heart for merchants within the rapid time period, with CasiTrades remarking that “$1.90 – resistance test – happening now.” She believes that if value fails to carry above that threshold on any retest, XRP will possible proceed its descent towards the $1.55 mark.

From there, the chart suggests a possible wave reversal that, if confirmed, may ship one of many extra essential breakouts of this cycle. “I still believe this could be one of the most important months XRP prints this cycle,” CasiTrades added, underscoring the excessive stakes surrounding the 0.618 Fib stage bear $1.55 and the potential for a brand new bullish impulse forming within the close to future.

Whether or not XRP can regroup and energy by means of the $1.90 ceiling after dipping to the golden pocket stays the central query. At press time, XRP traded at $1.86.

Featured picture created with DALL.E, chart from TradingView.com