Decentralized finance hinges on Chainlink (LINK). This oracle community shatters limitations between blockchain and real-world information, making sensible contracts purposeful and dependable. However the LINK value appears undervalued; how can that be?

Blockchains want this service as a result of they act as remoted networks; they can’t retrieve or ship information to an off-chain resolution.

Right here’s why LINK is crucial DeFi protocol.

The Nitty Gritty of How Chainlink Works

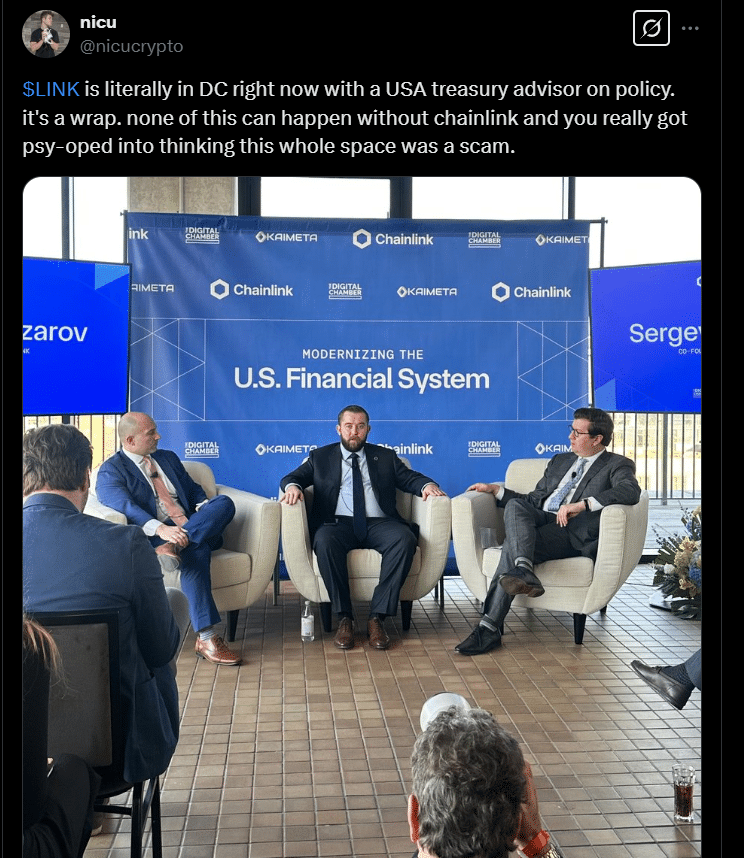

Sergey Nazarov created Chainlink in 2014 and launched it in 2017. As a widely known cryptocurrency, it’s listed on the entire in style crypto-trading platforms, together with Kraken, Binance, Gemini, and Coinbase.

With out Chainlink, blockchains couldn’t obtain needed information from exterior sources, making Chainlink a extremely precious undertaking on this house.

Chainlink sensible contracts primarily perform three predominant features.

- Fame evaluation: Consider Oracles as nodes that feed data to a blockchain undertaking. Oracles that act outdoors of those boundaries are penalized and downgraded.

- Working with exterior information: On this step, correct oracles with the very best repute are chosen, and a scientific consensus is reached concerning transferring the demanded information.

- Lastly, we have now aggregation: Right here, the aggregation contract gathers all the info conveyed by the off-chain oracles after which finds the median to kind a weighted mixture response.

The Bull and Bear Case for LINK Value Motion

Chainlink is the spine of crypto interoperability. It ensures that Bitcoin (BTC) and Ethereum (ETH) play properly, brings banks into the fold, and allows Wrapped Bitcoin.

With help from titans like Google and Oracle, plus a plan to safe future presidential elections with cryptographic verification, Chainlink is in every single place. Its decentralized sensible contracts additionally add an important layer of DeFi safety.

LINK could be essential for decentralized finance, however its critics are loud. They declare the LINK token is pointless—one other cryptocurrency, like Ethereum may simply exchange its function in powering Chainlink’s companies. LINK’s dependence on community exercise underscores its vulnerability, although its deflationary design may nonetheless make it a bullish asset.

Even Ethereum’s Vitalik Buterin has questioned the undertaking, suggesting Uniswap may exchange LINK as a number one oracle. For now, LINK dominates the house, however vital challenges stay.

EXPLORE: XRP Value Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- With out Chainlink ($LINK), decentralized finance wouldn’t exist.

- For now, Chainlink dominates the house, however vital challenges stay.

The publish Why Chainlink is More Important than Most DeFi Protocols appeared first on 99Bitcoins.