Today’s CPI report is in, and for the primary time since July 2024, inflation bought rekt.

With December’s CPI displaying indicators of slowdown, inflation hawks are catching a uncommon glimpse of reduction. All eyes now flip to the Federal Reserve as this deceleration reshapes the financial chessboard.

The Client Price Index (CPI), which maps out value modifications in city shopper items and companies, stays the go-to barometer for financial inflation.

Everybody can really feel that the Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

(BTC) value motion is at present manipulated AF.

But, like clockwork, Bitcoin pumped 2% on the information, reclaiming $98,000. So the place does the Bitcoin value head subsequent?

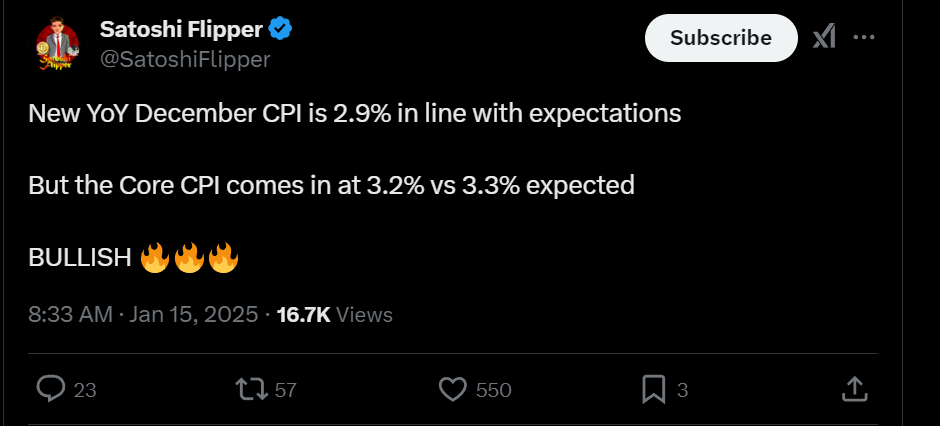

Core CPI Falls for the First Time in Months

This man want to increase charges. And seeing as how job progress was stronger than beforehand anticipated, markets have been betting that Fed Chair Jerome Powell wouldn’t entertain the thought of slicing rates of interest.

Now that possibility is again on the desk, markets responded with a sigh of reduction.

Inventory futures ticked up, and the 10-year Treasury yield fell to below 4.7%, pushed by a slight enhance in investor confidence. However the Fed’s battle isn’t over—prices for used vehicles and transportation stay stubbornly excessive, leaving inflation elevated and unpredictable.

Headline inflation ticked up 2.9% year-over-year in December, edging above November’s 2.7%. It climbed 0.4% month-to-month, with gasoline costs and stubbornly excessive meals prices doing many of the injury.

Vitality shot up 2.6%, fueled by a 4.4% spike in gasoline costs, which made up 40% of the month’s CPI positive aspects.

UK inflation additionally caught everybody off-guard in December, slipping to 2.5% from November’s 2.6%. That tiny drop—the primary in three months—has fueled speak of an rate of interest reduce on the horizon.

How Will CPI Impression on Federal Reserve Coverage?

The inflation report is a blended bag for the Fed, pointing to sluggish progress whereas exposing the grind of hitting its 2% purpose.

Morgan Stanley’s Ellen Zentner dubbed the CPI knowledge “dovish,” sufficient to maintain expectations agency for a pause in charge strikes this month, placing hawkish chatter on ice.

On the horizon, Donald Trump’s proposed tariffs and tax breaks might additional stoke inflation when his insurance policies take impact in 2025.

Optimism for 2025

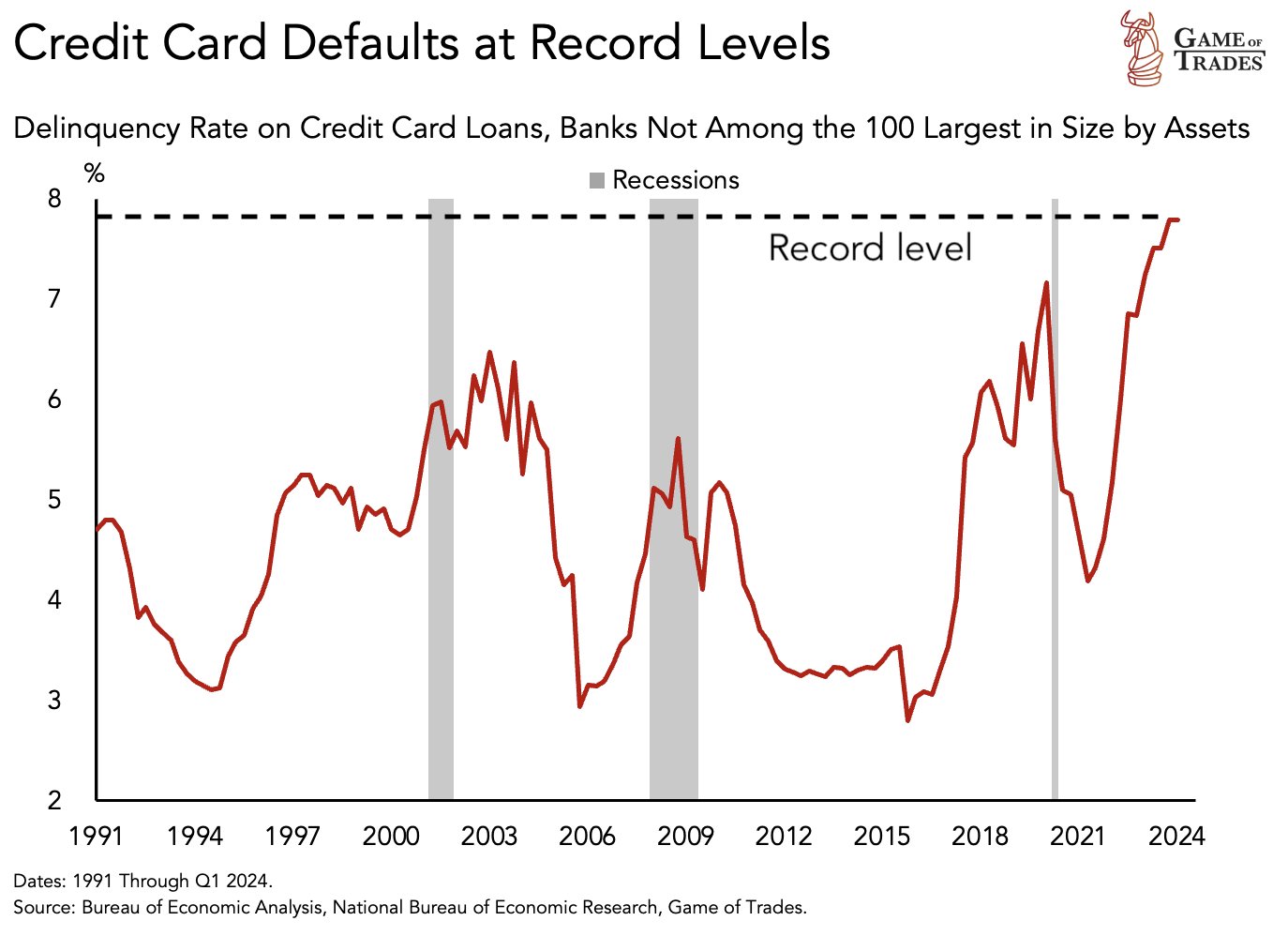

Oh wait, we mentioned “optimism in 2025!” Bank card debt ain’t that.

Nevertheless, the credit score debt drawback exhibits President Joe Biden left Trump an financial mess.

We’re in a state of affairs the place each end result might be interpreted badly. If CPI is excessive, the market panics as a result of it assumes rates of interest will keep excessive and even get hiked. If CPI is low, it should scare everybody into considering financial exercise is sluggish, and the Fed must decrease charges, however getting the Fed to decrease charges is like pulling enamel.

Proper now, we’re within the “all news is bad news” section, however there have been loads of occasions we’ve been within the “all news is good news” section, too.

Trump is the X issue. His first few months in workplace will decide the Bitcoin value and the course of the financial system.

EXPLORE: Crypto Traits For Bullrun – January 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Today’s CPI Report: Is a Major Bitcoin Price Correction Incoming? appeared first on 99Bitcoins.