Este artículo también está disponible en español.

Solana (SOL) has made a outstanding restoration following Monday’s surprising flash crash, surging by greater than 28% in lower than 5 days. This spectacular rebound has sparked renewed optimism amongst buyers, who at the moment are eyeing the potential for a bullish continuation within the weeks forward. The fast value enhance has positioned Solana as one of many top-performing belongings within the crypto market, signaling a possible shift in momentum.

Associated Studying

Famend analyst Jelle lately shared an in depth technical evaluation, highlighting that Solana has damaged out of its extended downtrend. In accordance with Jelle, SOL has efficiently reclaimed essential month-to-month and weekly assist ranges, indicating a major transfer could possibly be on the horizon. These ranges, usually thought of key benchmarks for long-term stability, counsel that Solana’s latest beneficial properties could also be greater than only a momentary bounce.

If Solana can maintain this momentum, it could not solely recuperate from latest losses but additionally pave the way in which for additional beneficial properties, probably outperforming different main altcoins. As technical indicators align with market enthusiasm, Solana could possibly be gearing up for a breakout rally that captures the highlight.

Solana Set To Enter Worth Discovery Part

Solana (SOL) emerged as one of many high market performers in 2024, posting a powerful surge of over 170%. This stellar efficiency cemented its place as a market chief and highlighted its resilience and progress potential inside the crypto house. As 2025 unfolds, optimism surrounding Solana stays excessive, with many buyers anticipating important beneficial properties within the coming months.

The momentum seems to be constructing already, as Solana begins the yr with a possible breakout. Famend analyst Jelle lately shared insights on X, mentioning that SOL has efficiently damaged out of the downtrend that had restrained it since late November.

Furthermore, Solana has reclaimed each month-to-month and weekly assist ranges—essential milestones indicating that the asset has regained its bullish footing. In accordance with Jelle, the worth motion for Solana is “super clean,” suggesting that the cryptocurrency is well-positioned for greater valuations.

Jelle’s preliminary goal for SOL is about at $330, a degree that might not solely mark a major restoration however might additionally push Solana right into a value discovery part. This part sometimes sees heightened market curiosity and volatility as merchants and buyers recalibrate expectations for the asset’s long-term worth. With technical indicators and market sentiment aligning, Solana seems poised to capitalize on its upward trajectory.

Associated Studying

If Solana sustains this bullish momentum, it might proceed to dominate headlines as a top-performing asset in 2025. As anticipation builds for additional upside, merchants and buyers are intently monitoring key ranges, realizing that the cryptocurrency’s subsequent massive transfer might redefine its position within the broader crypto ecosystem.

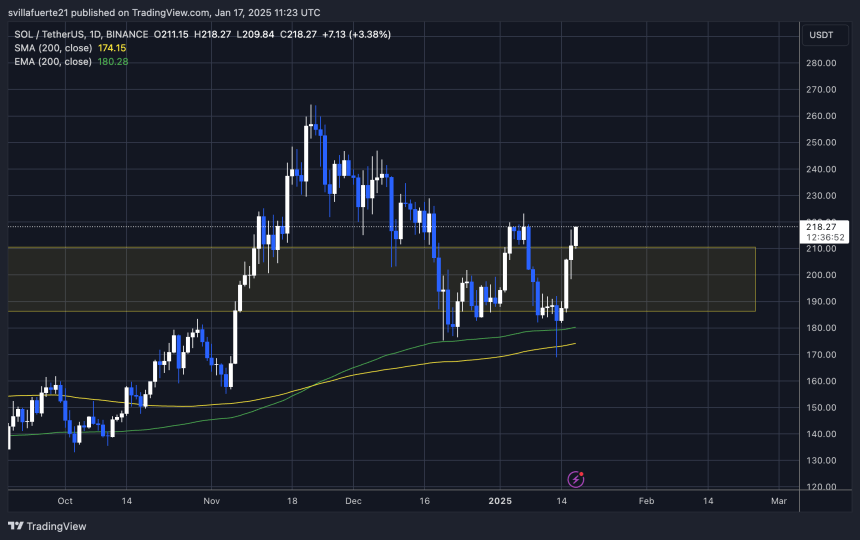

SOL Testing Essential Provide Round $220

Solana (SOL) is presently buying and selling at $218, approaching a essential degree that would decide its subsequent main transfer. The value is on the verge of setting a brand new native excessive above $222, a major resistance level. Breaking by way of this degree would sign a powerful bullish continuation, setting the stage for large value appreciation and the potential to reclaim its all-time excessive (ATH).

Analysts consider that if SOL clears the $222 mark and maintains its momentum, the following key degree to look at is $250. Reclaiming and holding $250 as assist would pave the way in which for Solana to enter uncharted territory, pushing its value into a brand new all-time excessive and probably starting a value discovery part. This growth would additional solidify Solana’s place as a market chief and appeal to elevated investor consideration.

Associated Studying

Nonetheless, failing to surpass the $222 resistance or reclaim the $250 degree might result in a consolidation part. Such a pause in value motion would possibly delay Solana’s rally however might additionally present a basis for renewed momentum sooner or later. With market individuals intently monitoring these ranges, Solana’s value actions within the coming days shall be pivotal in figuring out whether or not the cryptocurrency embarks on its subsequent main leg up or enters a short lived holding sample.

Featured picture from Dall-E, chart from TradingView