Este artículo también está disponible en español.

A current report by market intelligence agency Messari has highlighted a rare efficiency by Solana (SOL) throughout the fourth quarter of 2024, characterizing it as probably the most effective quarter for any blockchain in historical past.

Solana Turns into Second-Largest DeFi Community

The report reveals a staggering 213% quarter-over-quarter (QoQ) development in Chain GDP—basically the overall app income generated on the Solana community—rising from $268 million in Q3 to a formidable $840 million in This autumn. November stood out as essentially the most profitable month, contributing $367 million to the ecosystem.

Associated Studying

Among the many main purposes driving this income surge have been Pump.enjoyable, which generated $235 million, marking a 242% QoQ improve, and Photon, which noticed much more explosive development with a 278% improve, bringing in $140 million.

The general uptick in income might be attributed largely to renewed hypothesis in memecoins and a surge in AI-related cryptocurrencies launched throughout this era.

Solana’s decentralized finance (DeFi) complete worth locked (TVL) grew by 64% QoQ, reaching $8.6 billion and positioning it because the second-largest DeFi community, surpassing Tron in November.

The DeFi TVL, when expressed in SOL, noticed a 28% QoQ improve, totaling 46 million SOL. The common day by day spot decentralized change (DEX) quantity additionally skyrocketed by 150% QoQ to $3.3 billion, pushed by a resurgence in memecoin buying and selling and the rise of AI-themed tokens.

In phrases of stablecoins, Solana’s market cap grew by 36% QoQ to succeed in $5.1 billion, making it the fifth-largest stablecoin market amongst competing networks. The dominance of USDC continued, with its market cap rising by 53% to $3.9 billion, capturing a 75% market share.

Increased Exercise And Hypothesis

The liquid staking charge, which measures the share of liquid-staked SOL, rose by 33% to 11.2%, indicating that a good portion of the eligible SOL provide—66%—is now staked. This development is essential for a thriving ecosystem constructed on yield-bearing SOL.

The NFT market additionally noticed a modest improve, with common day by day quantity rising by 7% QoQ to $2.7 million. Tensor dominated this house, attaining $103 million in quantity—a 14% QoQ improve—whereas Magic Eden skilled a lower of 28% to $68 million.

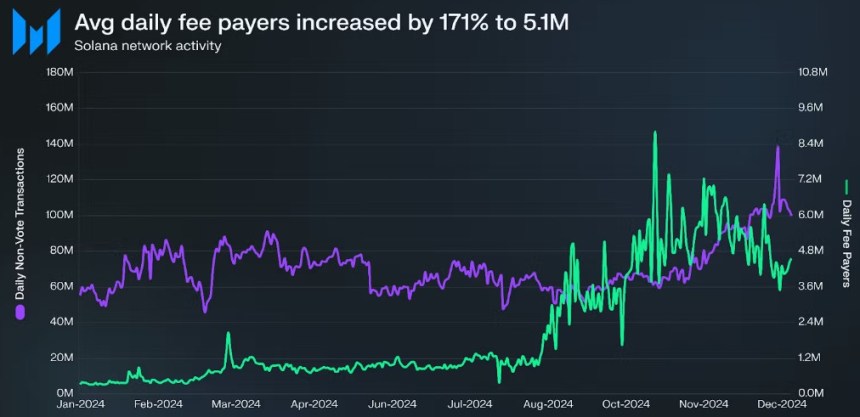

Community exercise metrics mirrored sturdy engagement, with common day by day payment payers rising by 171% QoQ to five.1 million. The variety of new payment payers surged much more dramatically, rising by 189% to three.8 million. Common day by day non-vote transactions rose by 32%, reaching 81.5 million.

Interestingly, the common transaction payment noticed a notable uptick, rising by 122% QoQ to $0.05, pushed by heightened community exercise fueled by hypothesis relating to a extra favorable regulatory atmosphere for cryptocurrencies within the US.

Associated Studying

Regardless of these beneficial properties, staked SOL skilled a lower of 5% in This autumn, attributed partially to the FTX property unlocking its tokens. Nevertheless, SOL’s market cap itself grew by 27% QoQ to $91 billion, peaking at $120 billion in November.

By the top of the quarter, SOL ranked sixth amongst all cryptocurrencies in market cap, trailing behind Bitcoin (BTC), Ethereum (ETH), Tether’s USDT, XRP, and Binance Coin (BNB).

Presently, SOL is buying and selling at $199, down 22% over the past two weeks, amid rising macroeconomic challenges which can be having a big influence on danger property.

Featured picture from DALL-E, chart from TradingView.com