Este artículo también está disponible en español.

Solana (SOL) is navigating a turbulent interval after going through a big 33% correction from its all-time excessive at $264, reached in late November. Regardless of the sharp pullback, Solana demonstrates resilience, providing traders a promising long-term outlook.

Associated Studying

Famend crypto analyst Carl Runefelt not too long ago shared his insights on X, highlighting a compelling technical setup for SOL. Based on Runefelt, Solana has efficiently retested an enormous triangle sample on the weekly timeframe. This important retest means that Solana’s value motion stays intact and will function a launching pad for a big rally shortly.

Whereas broader market corrections have weighed down short-term sentiment, Solana’s means to take care of its structural integrity amidst the downturn offers a glimmer of hope for bulls. If SOL can maintain its present ranges and construct momentum, it could quickly get better misplaced floor and chart a path towards new highs. Analysts intently watch how Solana responds to this important technical sign, because it may outline the altcoin’s trajectory within the coming weeks.

Solana Holding A Bullish Construction

Regardless of a 30% retrace from its all-time excessive, Solana (SOL) maintains a bullish construction on increased timeframes, signaling long-term power. This resilience has analysts and traders optimistic about Solana’s potential to outperform as soon as the market regains momentum. Recognized for its robust fundamentals and speedy adoption, SOL stays a favourite amongst merchants who’re anticipating the subsequent altcoin rally.

Prime crypto analyst Carl Runefelt not too long ago shared an in depth technical evaluation on X, highlighting an encouraging sample for Solana. Runefelt revealed that SOL has efficiently retested an enormous triangle formation on the weekly timeframe, a important milestone for its bullish trajectory.

Based on his evaluation, if Solana can maintain firmly above the $180 mark, the cryptocurrency may surge to $330 within the coming weeks. This projection aligns with expectations that Solana will likely be a frontrunner within the subsequent market-wide rally.

Associated Studying

Nevertheless, the broader market stays in a state of uncertainty. Bitcoin, the market chief, has struggled to reclaim the $100K degree, and adverse sentiment continues to weigh on merchants’ confidence. This lingering doubt poses challenges for altcoins like Solana, which regularly rely on a robust Bitcoin efficiency to maintain rallies.

Testing Essential Demand

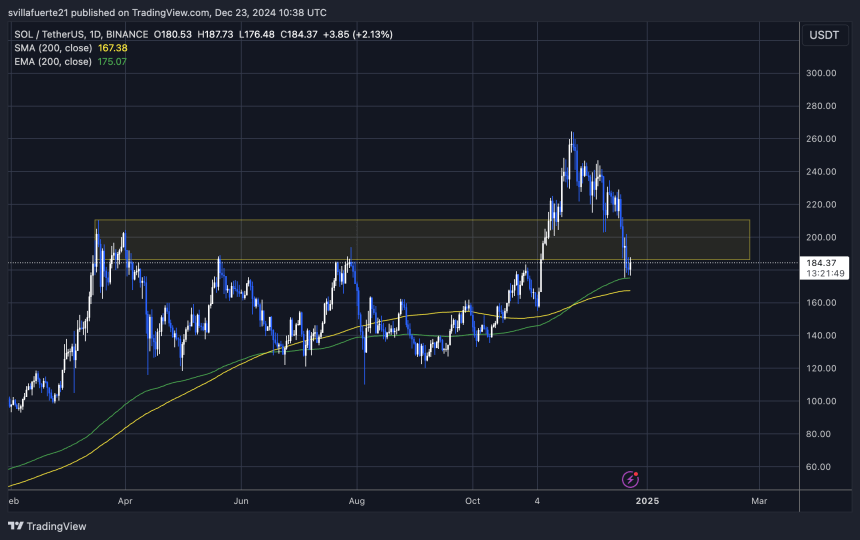

Solana is at present buying and selling at $185, exhibiting resilience after efficiently holding the 200-day exponential transferring common (EMA) at $175. This key degree is usually considered a robust indicator of long-term market power, and SOL’s means to defend it underscores the asset’s bullish potential.

On a weekly timeframe, Solana continues to make increased lows, signaling a optimistic development regardless of current market volatility. This value motion means that patrons stay assured in SOL’s long-term prospects, stepping in to defend important assist ranges. If the $175 mark continues to behave as a robust basis, Solana is well-positioned for a fast restoration within the days forward.

Associated Studying

Holding above the 200-day EMA is a vital step in constructing momentum for a broader rally. Analysts and traders are intently watching this degree, because it may pave the best way for Solana to retest key resistance factors and probably goal new highs. Nevertheless, if SOL loses this important assist, it could face elevated promoting stress.

Featured picture from Dall-E, chart from TradingView