Este artículo también está disponible en español.

Raydium (RAY) has had an exceptionally bullish week, surging over 62% in lower than six days and capturing the highlight within the decentralized alternate (DEX) market. This spectacular rally has positioned Raydium as a market chief, with sturdy momentum that reveals no indicators of slowing down. The cryptocurrency just lately cleared final 12 months’s excessive, a big milestone that additional bolsters its bullish outlook.

Associated Studying

High analyst BigCheds shared insights into Raydium’s efficiency, highlighting its relative power out there. Based on BigCheds, the token’s capability to outperform in a risky atmosphere indicators sturdy demand and solidifies its place as one of many top-performing DEX tokens. This bullish momentum is drawing elevated consideration from merchants and traders who see the potential for even larger features within the close to time period.

Raydium’s breakout above final 12 months’s excessive is a big technical achievement, paving the best way for additional upward motion. With market sentiment turning more and more constructive and Raydium showcasing resilience and power, the DEX is well-positioned to capitalize on its latest momentum. Because it continues to outperform, many are watching carefully to see simply how excessive Raydium can go on this bullish section. The approaching days can be essential for figuring out its subsequent huge transfer.

Raydium Reaches Multi-12 months Highs

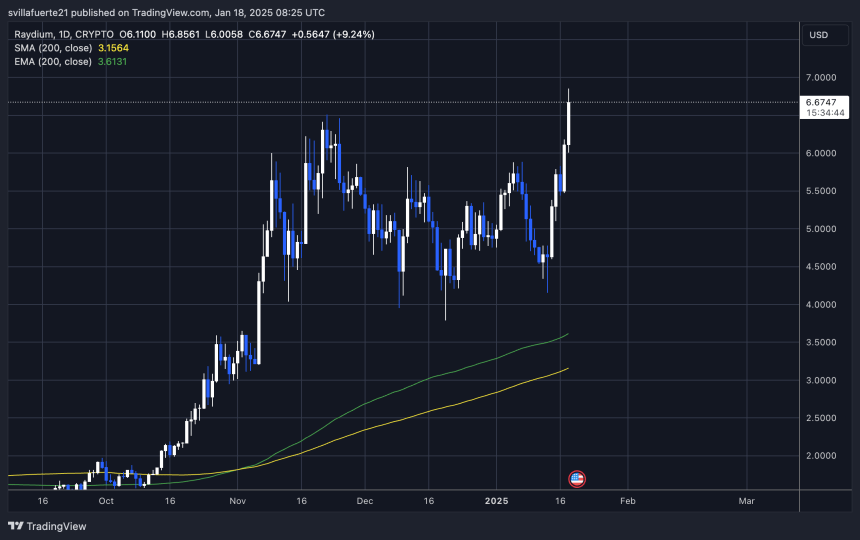

Raydium has made a big transfer, breaking above the $6.5 mark just some hours in the past and persevering with to push greater because the cryptocurrency market features momentum. This breakout indicators sturdy bullish sentiment for the token, as each technical and basic components align to assist additional worth appreciation. Because the main decentralized alternate (DEX) on Solana, Raydium’s progress and dominance inside the ecosystem additional bolster its long-term potential.

High analyst Cheds just lately shared a technical evaluation on X, emphasizing Raydium’s relative power in comparison with different altcoins. Based on Cheds, RAY’s capability to outperform in a risky market atmosphere highlights the sturdy demand driving its rally. The token’s decisive transfer above key provide ranges is a bullish indicator that might pave the best way for vital features within the coming days.

Past technicals, Raydium’s fundamentals stay strong, contributing to its sturdy efficiency. The DEX has cemented itself as a vital element of the Solana ecosystem, offering liquidity and facilitating seamless buying and selling for a variety of belongings. Its increasing person base and constant innovation reinforce investor confidence, making it a best choice for merchants and liquidity suppliers alike.

Associated Studying

As Raydium builds on its momentum, clearing vital worth ranges and pushing greater, many traders at the moment are focusing on even loftier worth factors. If the market continues to warmth up and RAY maintains its relative power, the potential for an enormous rally turns into more and more doubtless. With its sturdy fundamentals and bullish technical outlook, Raydium is well-positioned to seize additional features, making it probably the most thrilling altcoins to observe on this present market cycle. The approaching days can be pivotal in figuring out how far RAY can go on this bullish section.

RAY Breaking Above Key Levels

Raydium is at the moment testing ranges not seen since 2022, signaling a exceptional resurgence in its worth motion. The token’s sturdy momentum suggests it’s primed for additional features, with bullish sentiment dominating the market. Nonetheless, a possible retest of the $6.5 stage might be on the horizon, offering a chance for consolidation earlier than the following leg up.

As of now, RAY is holding above the vital $6.70 mark, a stage that solidifies bullish management. Sustaining this assist is essential, because it underscores market confidence and units the muse for continued upward motion. If bulls can defend this stage, the following logical goal for RAY can be the $7 mark—a key psychological and technical resistance that, as soon as cleared, might pave the best way for even larger features.

Associated Studying

Market sentiment round Raydium stays optimistic, with each technical indicators and fundamentals aligning to assist its bullish trajectory. Because the main decentralized alternate (DEX) on Solana, RAY continues to profit from sturdy utility and rising adoption, additional reinforcing its attraction to traders.

Featured picture from Dall-E, chart from TradingView