Public firms like Tether and Technique are stacking Bitcoin, however why are crypto and Bitcoin costs crashing? BTC USD is monitoring in the direction of $80,000 and should affect even a number of the best-performing meme cash and prime altcoins.

The most recent on-chain information reveals that public firms, particularly these in the US, aggressively purchased Bitcoin in Q1 2025. Analysts word that these company giants collectively purchased 91,781 BTC within the first three months of the yr.

Regardless of their dedication to doubling down on the world’s most respected coin, Bitcoin slid double digits from its all-time excessive of almost $110,000, dropping under $78,000 in March 2025.

At this tempo, there’s a actual threat of the coin retesting the 2021 excessive of $74,000. If bears press on, forcing the world’s most respected coin to $50,000, a number of the finest meme cash may even come underneath stress.

(BTCUSDT)

Contemplating all this, traders ought to ask the best questions: Who’re the large gamers shopping for Bitcoin, and why is Bitcoin nonetheless down?

Public Companies Shopping for Bitcoin Is The Huge Pattern for 2025

In Q1 2025, analysts, citing CryptoQuant information, noticed that Tether, the issuer of the world’s most liquid stablecoin, USDT, added 8,888 BTC to its reserves, pushing their holdings to over 100,000 BTC, in line with Arkham information.

Whereas Tether is likely to be shopping for Bitcoin as a technique, utilizing it as the primary line of protection ought to USDT depeg, say, over the weekend, the choice to build up BTC and never some other altcoin is a big endorsement of digital gold.

Over time, Tether has performed an important function in driving adoption and permitting TradFi gamers to simply bridge to crypto by a steady token that now serves as a medium of change for hundreds of thousands, particularly in rising nations. By way of USDT, anybody on the earth can have interaction, even shopping for a number of the hottest presale tokens in 2025.

Along with Bitcoin, Tether holds U.S. Treasuries and different money equivalents, that are used to again USDT.

Whereas Tether is an enormous BTC whale price watching, Technique, previously MicroStrategy, is the most important company Bitcoin holder. In Q1 2025, Technique used a part of its debt to purchase much more Bitcoin, including a whopping 81,785 BTC in Q1 2025 alone.

Notably, Technique spent over $8 billion on BTC purchases, cementing its place as a Bitcoin bull, a view held by its founder, Michael Saylor.

MicroStrategy is the general public fairness play on #Bitcoin Maximalism. pic.twitter.com/96lpcdN5Zi

— Michael Saylor

(@saylor) October 31, 2024

Different notable firms that purchased the coin embody the Blockchain Firm, which added 605 BTC to its steadiness sheet; Semler Scientific, which purchased 1,108 BTC; and Metaplanet, which added 2,285 BTC.

(Supply)

Furthermore, Marathon Digital is making ready to lift $2 billion by a inventory sale to bolster its Bitcoin holdings. As a Bitcoin mining agency, Marathon Digital already holds many BTC.

Its determination to purchase much more BTC confirms that it believes the coin will spike within the coming years.

Moreover, GameStop plans to lift $1.3 billion through a 0.00% convertible word maturing in 2030. Their entry into the crypto house is a big endorsement of the coin.

Why is Crypto Crashing? Why Is Bitcoin Down?

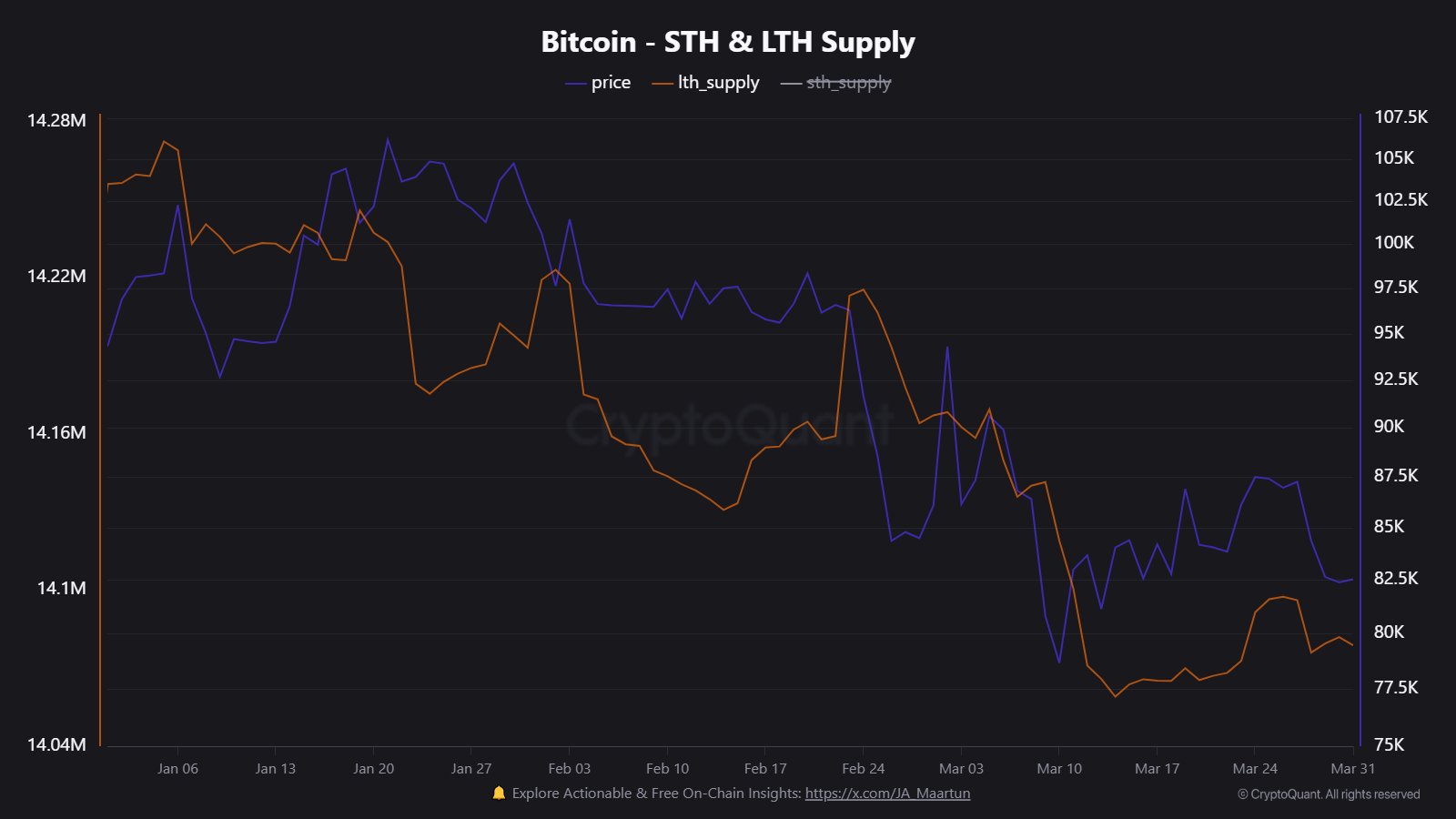

Analysts word that Bitcoin is down regardless of corporates shopping for over 90,000 BTC in Q1 2025. This drawdown is as a result of long-term holders, or diamond fingers, are promoting.

CryptoQuant information exhibits that in Q1 2025, these entities offloaded over 178,000 BTC, considerably outweighing company buys and heaping extra stress on BTCUSD. Throughout this time, the coin slipped from $109,000 to $77,000, a 25% drop.

(Supply)

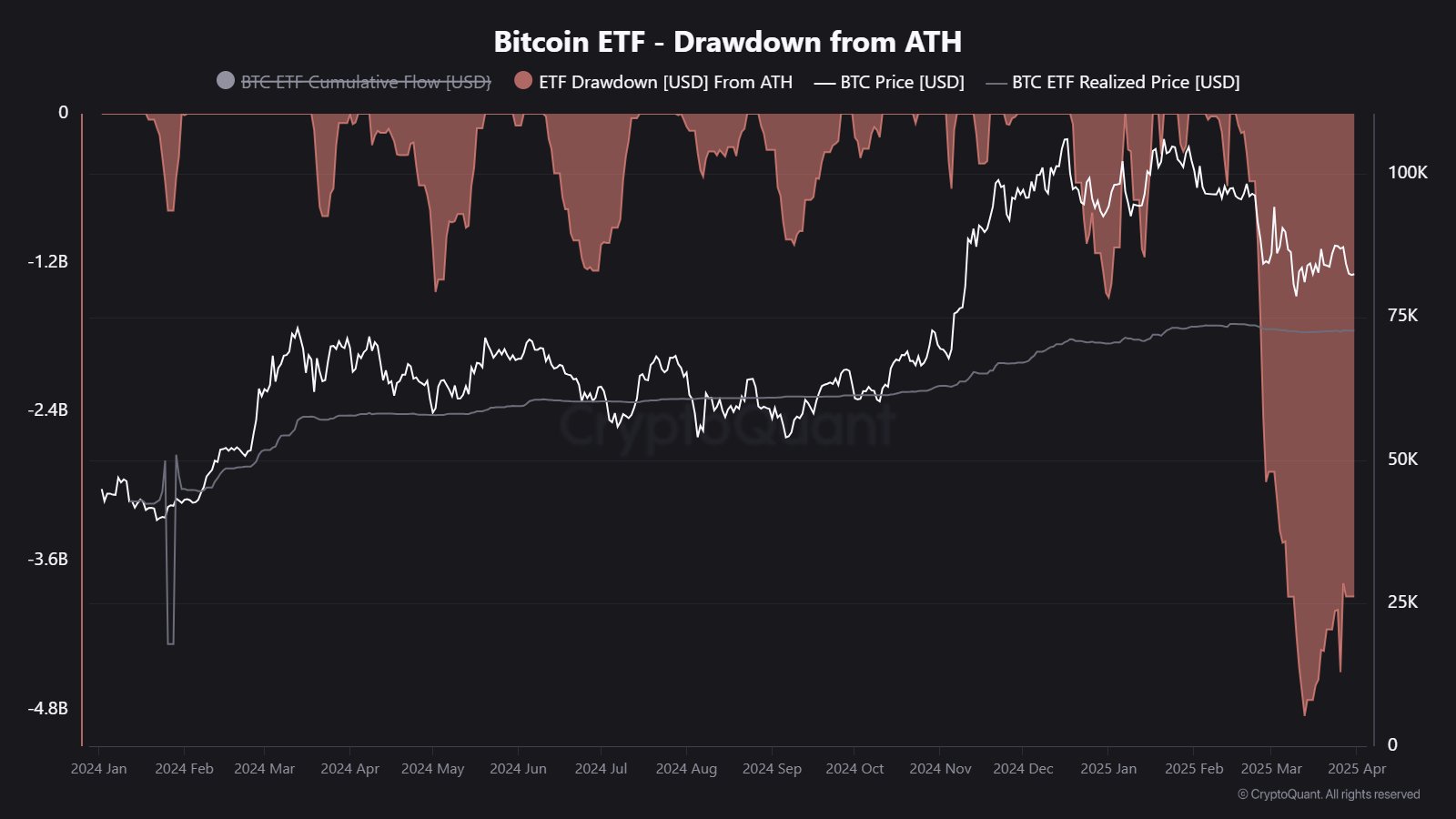

On the identical time, establishments redeemed their spot Bitcoin ETF shares, reserving income. Analysts stated almost $4.8 billion of Bitcoin-backed shares had been redeemed, fanning sellers and dragging BTC/USD costs because of this.

(Supply)

Bitcoin costs may face much more promoting.

Yesterday, the Donald Trump administration introduced a brand new spherical of tariffs on international commerce companions, which is inflicting jitters.

Anticipated financial pressures will set off extra volatility, and crypto property will bear the brunt.

Barely 24 hours after Liberation Day on April 2, crypto costs are within the pink. Notably, the highest 10 cash have posted double-digit losses over the previous week.

DISCOVER: 17 Subsequent Crypto to Explode in 2025: Skilled Cryptoforeign money Predictions & Evaluation

Public Companies Stack BTC, Why Is Bitcoin Down in 2025?

- Public firms like Tether, Metaplanet, Technique, and Semler Scientific are shopping for Bitcoin

- Tether is aggressively shopping for BTC. Is it strategic?

- Technique is the most important BTC whale

- Trump tariffs impacting crypto and monetary markets

The submit Public Companies Are Stacking Up, But Why Are Bitcoin and Crypto Down Today? appeared first on 99Bitcoins.