The crypto market is paying consideration to an enormous Dogecoin (DOGE) transaction. A whale transferred 100 million DOGE, or about $25.42 million, to Binance. The transfer has raised questions on whether or not a sell-off is about to occur or if that is simply one other typical shift in holdings.

Whale Exercise Sparks Issues

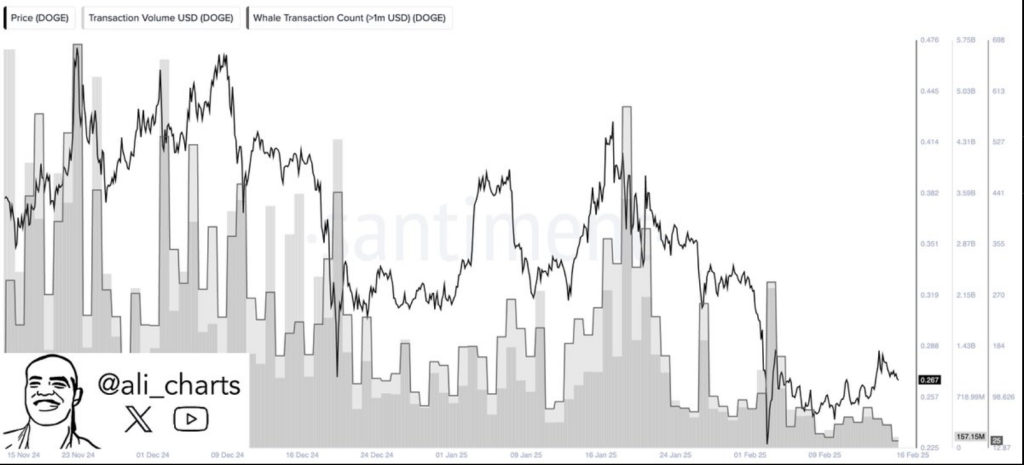

When a significant cryptocurrency holder strikes a large quantity of their holdings to an trade, it normally means they need to promote. The value of DOGE could drop because of this, which might trigger smaller traders to react. Nonetheless, cryptocurrency professional Ali Martinez famous a decline in whale exercise total, suggesting that main traders should not appearing aggressively in the meanwhile.

Whale exercise on the #Dogecoin $DOGE community has declined by almost 88% since mid-November! pic.twitter.com/6X4CIH3mf8

— Ali (@ali_charts) February 17, 2025

DOGE’s current market efficiency factors to vagueness. As of the time of writing, the value is $0.255622; an intraday excessive is $0.257605 and a low is $0.250725. These swings indicate a reasonably restricted buying and selling vary; however, if extra important holders determine to promote their shares, volatility would possibly improve.

Market Sentiment Stays Divided

In keeping with sure merchants, the whale switch is a bearish sign, whereas others consider that its affect could also be negligible except an inflow of extra cash happens. Dogecoin has a historical past of reacting sharply to whale actions; nevertheless, the combination promoting stress seems to be subdued this time.

The continuing dialogue concerning a possible DOGE exchange-traded fund (ETF) is one other important issue that impacts sentiment. If an ETF acquires momentum, it might appeal to institutional traders, probably counteracting any promoting stress from whales. However, the market is presently in a state of supposition, as no official approvals or timelines have been introduced.

The Highway Forward For Dogecoin

Regardless of the whale transfer, the value of DOGE continues to stay regular, but when market sentiment shifts, there might be an additional drop. Additional dumping could happen if the value of DOGE drops beneath $0.25, which could additional decrease the value. Then again, robust buying exercise could act as a barrier to additional lower.

Traders’ Choices

The whale motion reminds us of the velocity with which retail commerce’s market dynamics may shift. Some individuals would possibly determine to maintain their positions since they hope that attainable catalysts just like the ETF will increase costs, whereas others take a extra cautious strategy, on the lookout for indicators of elevated whale exercise earlier than deciding on what to do subsequent.

Featured picture from Medium, chart from TradingView