KTON, Launching February 2025, Poised to Unleash 18X Progress in TON’s Liquid Staking Market

KTON, an institutional-grade liquid staking protocol incubated by TONX, the main TON-focused enterprise studio backed by high VC companies from the Asia-Pacific area, is gearing up for its V1 launch in February 2025. TONX, which not too long ago unveiled a $5M accelerator program to foster innovation inside the TON and Telegram ecosystem, is behind TONX API, the main developer platform trusted by Blum, Catizen, Google Cloud, and over 20 main tasks. TONX can be the pressure behind Tonkey, a multisig resolution managing $400M in property and adopted by the TON Basis. KTON is ready to enter the USA and international markets, bringing its enterprise-grade liquid staking resolution to institutional and retail customers.

Telegram not too long ago introduced it is going to completely assist The Open Community (TON) for its blockchain ecosystem. KTON is uniquely positioned to capitalize on this development as it’s being constructed particularly for TON customers. Constructing on TONX’s success within the API and safety house, KTON is positioned to seize the $6.12 billion TON liquid staking market alternative.

KTON permits customers to stake TON whereas receiving $KTON, unlocking liquidity with out sacrificing staking rewards. In contrast to current options that always focus danger or lack strong standardization, KTON offers institutional-grade safety tailor-made for household places of work, trusts, and exchanges. Users can begin staking with as little as 1 TON, and there’s no lock-up interval.

Unlocking TON’s $6.12B Liquid Staking Market Potential

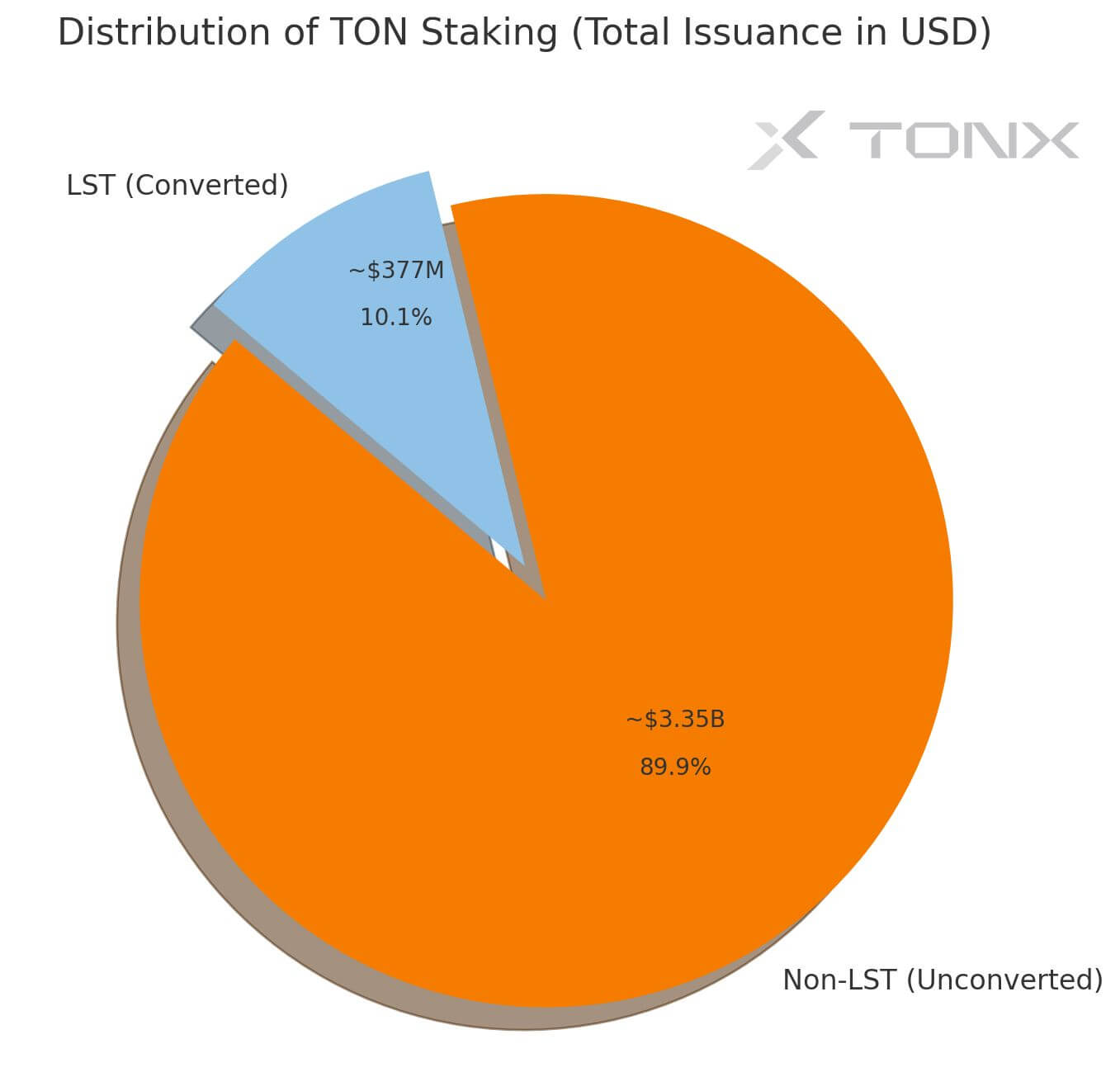

Liquid staking has reworked blockchain ecosystems with Lido Finance dominating Ethereum’s LST market at $30B TVL. KTON goals to seize comparable potential in TON’s nascent LST market, at the moment valued at $0.36B.

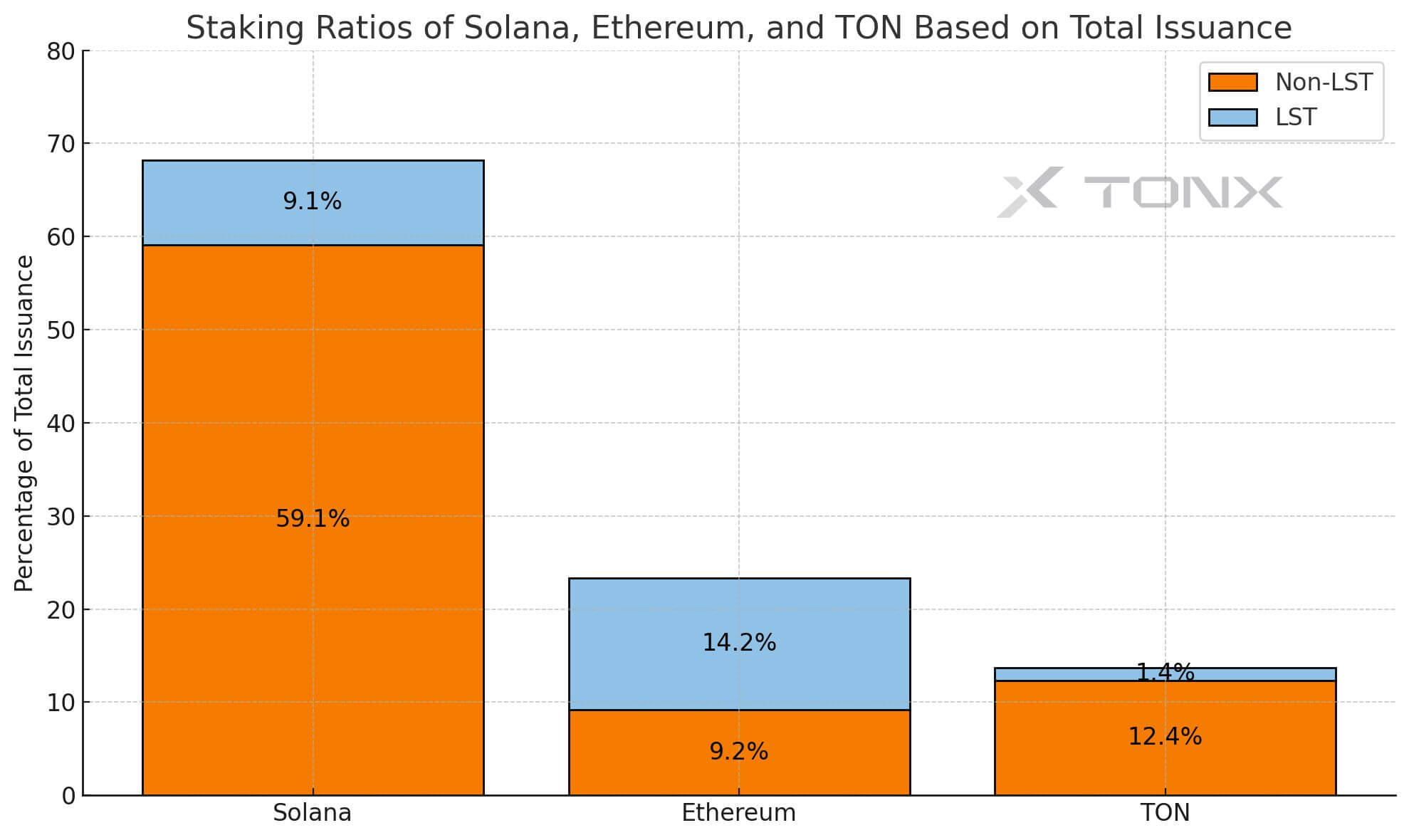

“Our research reveals TON’s LST ratio matches Solana at 10% of staked tokens, yet TON’s total staking rate is merely 13.7% versus Solana’s 69%, indicating a 5x growth potential. Furthermore, if TON’s LST ratio reaches Ethereum’s 36%, the market could surge 18X, unlocking an additional $6.12B in value,” stated Dr. Superior Doge, founding father of TONX and KTON. “KTON aims to bridge this gap by providing the infrastructure needed to unlock this liquidity and drive TON’s DeFi expansion.”

KTON’s staking service will unlock liquidity, enabling seamless integration with main TON native DEXs and protocols, and extra DeFi giants that are coming into TON like Ethena and Curve Finance. This affords TON customers versatile and steady yield methods via varied DeFi alternatives whereas sustaining staking rewards.

“TONX’s triumph is a powerful testament to why KTON has solidified its place as a trusted pillar in the ecosystem,” stated Howard Peng of TON Ventures.

KTON Units New Requirements for TON Liquid Staking Infrastructure

KTON is addressing the essential challenges of current liquid staking options, akin to focus dangers and lack of standardization, by introducing a decentralized protocol with institutional-grade safety.

To additional improve accessibility, KTON is launching a Telegram Mini App designed for the platform’s 950M customers in a transfer to bridge DeFi adoption and mainstream accessibility. By integrating liquid staking straight inside Telegram, KTON simplifies the method, guaranteeing that anybody can take part with ease. This revolutionary method positions KTON to drive the widespread adoption of TON blockchain expertise, increasing its attain within the US market and globally.

The platform’s roadmap goes past staking rewards. Following the launch of KTON V1, the deliberate improve will introduce a dual-token mannequin that includes $KTON and a brand new governance token. This technique permits $KTON holders to earn rewards whereas actively taking part in KTON DAO governance.

Unlock Your Yield with KTON, Launching February 2025

KTON is poised to grab the $6.12 billion market potential in TON’s liquid staking ecosystem with its enterprise-grade staking companies. Launching this February, KTON offers essentially the most safe and user-friendly options for each retail and institutional purchasers, enabling them to unlock liquidity, maximize staking rewards, and confidently take part in TON’s thriving DeFi ecosystem. KTON’s dedication to safety, mixed with a decentralized governance construction, makes KTON a trusted selection for staking at scale.

For partnerships and customised options, contact: [email protected]

About KTON

KTON is a next-generation liquid staking protocol constructed for the TON ecosystem, designed to unlock liquidity for each retail and institutional customers. By its liquid staking token $KTON, customers can take part in TON’s rising DeFi ecosystem whereas incomes staking rewards. Combining institutional-grade safety with decentralized governance and seamless Telegram integration, KTON goals to drive TON’s ecosystem development and mass adoption.

X | Telegram

About TONX

Based in 2021, TONX is a SuperApp platform layer driving the brand new Web3 economic system. As a cornerstone of the TON ecosystem, it delivers highly effective instruments like TONX API, a trusted RPC resolution built-in with over 20 main tasks, and Tonkey, a safe multi-signature pockets managing over $400 million in property.

TONX | X | Telegram | Weblog | Docs | TONX API | Tonkey