With inflation cooling and jobless claims shrinking, crypto merchants are betting large on the FOMC odds and Federal Reserve price cuts by 2025. Add in sluggish financial indicators and a leap in Treasury demand, and the narrative of a coverage shift from Fed Chair Jerome Powell is gaining severe momentum.

However will it occur? Because the previous fable goes, no cuts till Punxsutawney Powell sees his shadow. Right here’s when price cuts are almost definitely to occur.

FOMC Odds: Flat Producer Costs and Falling Jobless Claims in Focus

February’s U.S. producer costs had been lifeless flat, defying market forecasts. Pair that with a dip in weekly jobless claims, and also you’ve obtained a labor market standing agency regardless of the backdrop of commerce nervousness.

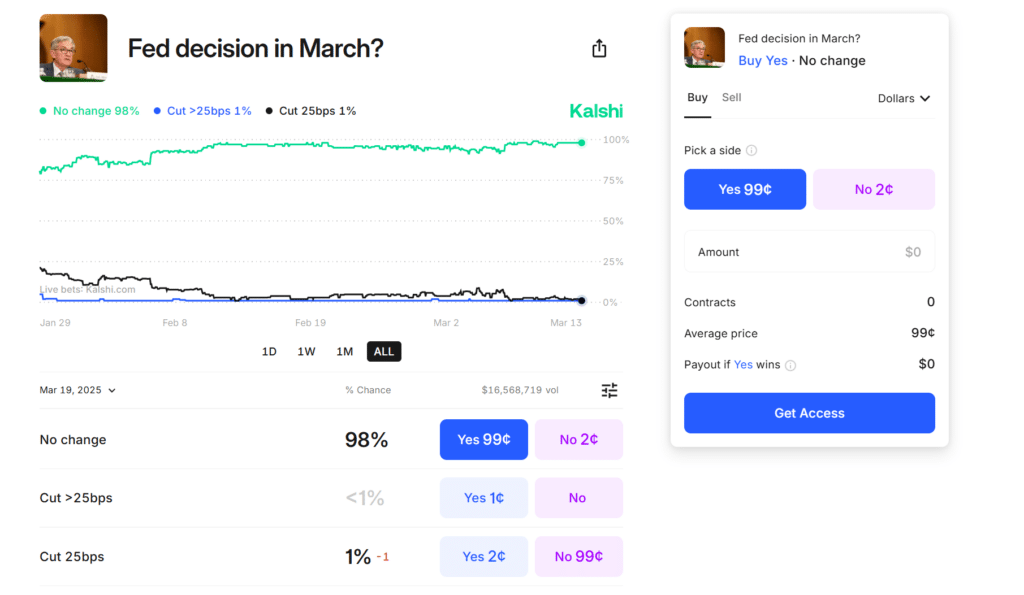

The shift was fast. Odds of a June Federal Reserve price minimize shot as much as 75%, with merchants now anticipating as many as three by yr’s finish.

its going to be hilarious seeing the bipolar shift on the tl when the information comes out that:

inflation is at a historic report low

unlawful crossing is at a historic report low

new jobs being created in any respect time highs+ add FOMC cash printer go brrr march nineteenth

endurance anon $btc pic.twitter.com/RpB0fyU9qj

— TheMemeLord

(@TheMEMELordx69) March 11, 2025

Quick-term rate of interest futures and choices exercise mirror this constructing narrative. Name choices tied to two-year Treasury notes have surged, with the premium on these bets hitting their highest ranges since September. These positions would repay if the Fed takes a extra aggressive stance to rev up financial exercise amidst the uncertainties attributable to President Donald Trump’s commerce agenda.

The Trump Administration’s Tariff Influence

The continuing tariff will increase from the Trump administration have added gas to the hypothesis of price cuts. Tough commerce insurance policies associated to tariffs are squeezing shopper spending and creating “a ridiculous amount of angst,” in accordance with CNBC’s Jim Cramer.

Retail is beginning to crack, with corporations falling wanting their gross sales targets. As Cramer stated, “We’re not out of the tariff woods.” The squeeze on shopper spending and the pressure on companies paint a bleak image.

Cramer may not be proper about lots, however this is likely to be one of many few occasions he’s on to one thing.

One other key determine including weight to the potential of price cuts is February’s Client Value Index, which crept up simply 0.2%, sliding beneath expectations. It’s a inexperienced mild for the Federal Reserve to maintain price cuts within the toolbox, prepared if the financial system takes a flip for the more severe.

The Nasdaq shot up 1.22% on the information, fueled by positive aspects in tech, whereas the S&P 500 edged larger by 0.49%. Bitcoin is trapped between $79,000 and $82,000.

FOMC Odds: Treasury Markets Put together for Cuts

This week’s cooler inflation numbers will set the tone for subsequent week’s FOMC assembly. As well as, slowing progress beneath the load of tariffs paints a dovish image total, with rumors of price cuts rising extra believable by the day.

Jim Cramer argues {that a} well timed Fed intervention might keep away from a extreme downturn. “There will be no serious recession,” he assures, however markets will stay on tenterhooks, watching each transfer from the central financial institution and the administration.

EXPLORE: XRP Value Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- With inflation cooling and jobless claims shrinking, crypto merchants are betting large on the FOMC odds.

- February’s U.S. producer costs had been lifeless flat, defying market forecasts.

- The slowing progress beneath the load of tariffs paints a dovish image total, with rumors of price cuts rising extra believable by the day..

The put up Is Powell About To Pump Crypto After FOMC Odds: CPI Data Sets Stage For Mega FOMC appeared first on 99Bitcoins.