Hyperliquid JELLY token saga with Binance, OKX listings shakes DeFi and crypto buying and selling. HYPE drops 10%—what’s subsequent?

Clashes are nothing new in crypto, and yesterday, everybody was intently monitoring occasions pitting Hyperliquid, a preferred decentralized futures trade, in opposition to Binance and OKX—two of the world’s largest centralized exchanges that wish to preserve their hegemony over crypto perpetual buying and selling.

JELLY Versus Hyperliquid: What’s Going On?

On the coronary heart of this saga was a low-market-cap Solana meme coin, Jelly, which skyrocketed by over 300% inside hours, practically triggering a catastrophic $230 million liquidation for Hyperliquid.

The 2-day occasion, beginning on March 25, uncovered vulnerabilities in DeFi, particularly Hyperliquid—which isn’t new to controversy—and raised extra questions on whether or not decentralized protocols are as decentralized as they declare to be.

Hyperliquid goals to alter how crypto merchants place positions away from centralized platforms. The platform has its layer-1 chain and is quick, processing tens of 1000’s of transactions each second. It’s all in a low-fee setting with a easy interface rivaling Binance, Coinbase, and Bybit.

Over the months, Hyperliquid has processed over $1 trillion in buying and selling quantity, typically exceeding $2 billion in common each day quantity. What units it aside is that the platform is designed to make sure liquidity by taking passive positions whereas paying liquidity suppliers from income and liquidations.

The Disaster Defined: Why Did Hyperliquid Crash?

This design turned the lynchpin of this disaster, what one nefarious dealer selected to do on March 25.

Concentrating on the JELLY vault on Hyperliquid, he dumped 124.6 million JELLY value round $4.85 million, crashing costs and forcing the vault to mechanically inherit an enormous 398 million JELLY quick place value $15.3 million.

(Supply)

Whereas he shorted on JELLY on Hyperliquid, the dealer concurrently took an extended place on Binance, pumping it from $0.0095 to $0.050, a 426% surge. The spike on Binance led to a brief squeeze on Hyperliquid, that means the vault and liquidity suppliers on the protocol held a $12 million unrealized loss.

(JELLYUSDT)

If JELLY costs continued rising, pumping to a market cap of over $150 million, then the JELLY vault on Hyperliquid may have been liquidated, inflicting huge losses.

Did Binance and OKX Need To Bury Hyperliquid?

Binance and OKX wished this as a result of as Hyperliquid tried to handle this clear value manipulation, they listed JELLY on their perpetual futures platform, aiming to trigger extra misery to liquidity suppliers on Hyperliquid.

By itemizing, JELLY costs rose, with market cap peaking at $50 million earlier than retracing to round $25 million.

Nevertheless, Hyperliquid turned decisive in managing this disaster.

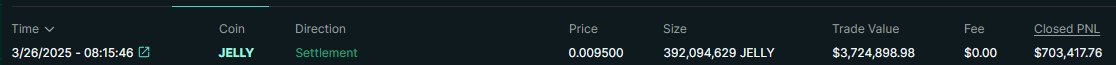

Not solely did its validators vote to delist JELLY perpetual, however it additionally closed all positions at $0.0095—the worth level at which the quick dealer had initiated its large quick. By doing this, they mechanically transformed a $12 million unrealized loss right into a $700,000 revenue.

(Supply)

Hyperliquid additionally stated it might reimburse liquidity suppliers apart from value manipulators. Whereas this was welcomed, HYPE costs fell sharply, sliding 10% within the final 24 hours, per Coingecko.

(HYPEUSDT)

HYPE Falls As Extra Questions Raised

The sell-off was as a result of fierce backlash from the neighborhood.

Arthur Hayes, the co-founder of BitMEX, stated Hyperliquid was centralized. In his view, HYPE costs would fall, underperforming a few of the greatest Solana meme cash to purchase in 2025.

$HYPE can’t deal with the $JELLY

Let’s cease pretending hyperliquid is decentralised

After which cease pretending merchants truly give a fuck

Guess you $HYPE is again the place is began briefly order trigger degens gonna degen

— Arthur Hayes (@CryptoHayes) March 26, 2025

In the meantime, Bitget CEO stated delisting JELLY was “immature, unethical, and unprofessional.” In her view, this can be the start of one other FTX 2.0 belief disaster.

#Hyperliquid could also be on observe to grow to be #FTX 2.0.

The way in which it dealt with the $JELLY incident was immature, unethical, and unprofessional, triggering person losses and casting severe doubts over its integrity. Regardless of presenting itself as an progressive decentralized trade with a…

— Gracy Chen @Bitget (@GracyBitget) March 26, 2025

Nonetheless, supporters of Hyperliquid accused Binance and OKX of amplifying volatility and capitalizing on its misery.

The timing of the JELLY itemizing was too handy. Onchain evaluation reveals the dealer shifting funds from Binance, OKX, and MEXC.

Furthermore, Hyperliquid, appearing swiftly and liquidating the quick on the entry level, managed to avert dangers, defending its customers from absorbing a $230 million liquidation.

The HyperLiquid $JELLY state of affairs is a lesson for CEX alternative onchain DEXs that we want extra resilience for issues like this.

In contrast to most individuals shitting on HL proper now for a way they dealt with the state of affairs, I truly assist their resolution. Most will say its centralized, 3… pic.twitter.com/6bbfTG7M3c

— Elite Crypto (@TheEliteCrypto) March 27, 2025

One person of X stated this was not a betrayal of DeFi rules however “effective crisis management.”

BREAKING: HYPERLIQUID FLIPPED A $12M DISASTER INTO PROFIT

this wasn’t only a liquidation—@HyperliquidX turned a black gap into revenue whereas @binance received caught within the crossfire.

purchased in? see why that is one in all defi’s most controversial strikes. pic.twitter.com/d1lJ9Vhhum

— trippie₊ (@kriqtay) March 27, 2025

DISCOVER: Subsequent 1000x Crypto – 10+ Cash That May 1000x in 2025

Hyperliquid JELLY Token Drama: Binance, OKX Listings Rock DeFi and HYPE

- JELLY Token Pump: Costs rally after manipulation try.

- Binance-OKX Listings: An try to bury Hyperliquid?

- Disaster administration raises questions on decentralization

- HYPE costs crash 10%

The publish Hyperliquid vs. Binance and OKX: JELLY Trading Rocks HYPE and DeFi appeared first on 99Bitcoins.