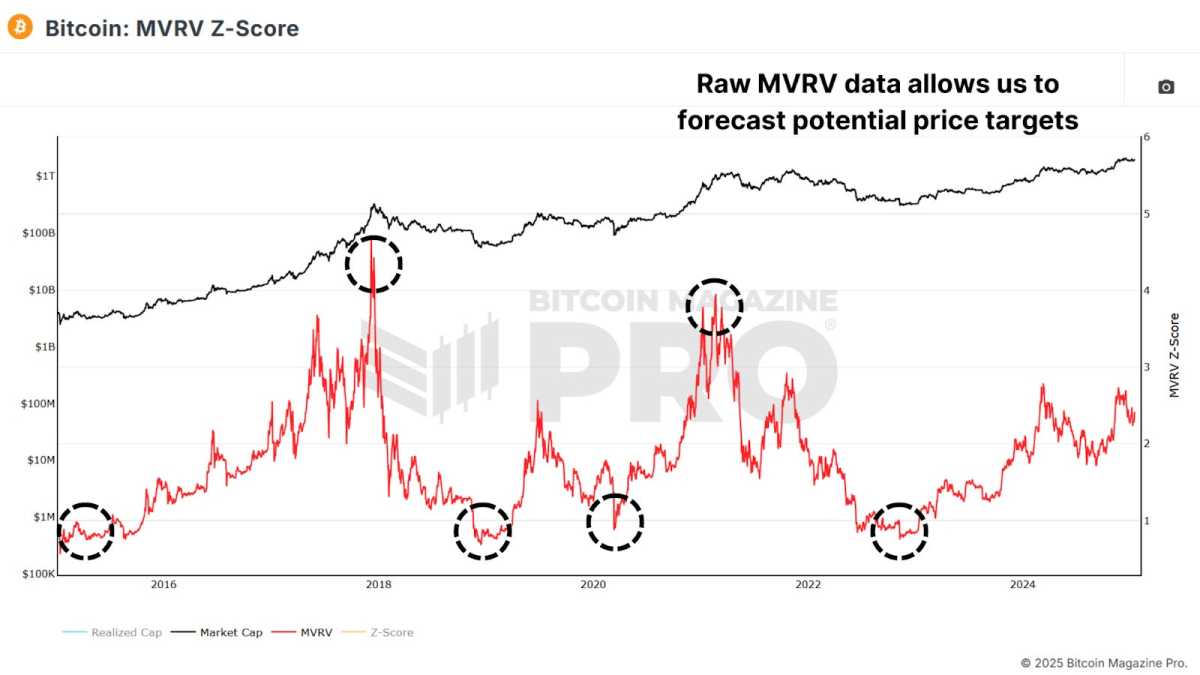

The Bitcoin MVRV Z-Score has traditionally been some of the efficient instruments for figuring out market cycle tops and bottoms in Bitcoin. In the present day, we’re excited to share an enhancement to this metric that makes it much more insightful for at the moment’s dynamic market situations.

What Is the Bitcoin MVRV Z-Score?

The MVRV Z-Score is derived by analyzing the ratio between Bitcoin’s realized cap (the common acquisition value of all Bitcoin in circulation) and its market cap (present community valuation). By standardizing this ratio utilizing Bitcoin’s value volatility (measured as the usual deviation), the Z-Score highlights durations of overvaluation or undervaluation relative to historic norms.

View Reside Chart 🔍

Peaks within the purple zone sign overvaluation, suggesting optimum profit-taking alternatives. Bottoms within the inexperienced zone point out undervaluation, typically marking sturdy accumulation alternatives. Traditionally, this metric has been remarkably correct in pinpointing main market cycle extremes.

Whereas highly effective, the standard MVRV Z-Score has its limitations. In previous cycles, the Z-Score reached values of 9–10 throughout market tops. However, within the final cycle, the rating solely reached round 7. This can be because of the rounded double-peak cycle as an alternative of the sharp blow-off prime we normally expertise. Regardless, there’s the need to issue within the evolving market dynamics, with rising institutional involvement and altering investor habits.

The Enhanced MVRV Z-Score

The MVRV Z-Score standardizes the uncooked MVRV information utilizing Bitcoin’s complete value historical past, which incorporates the acute volatility of its early years. As Bitcoin matures, these early information factors could distort its relevance to present market situations. To deal with these challenges, we’ve developed the MVRV Z-Score 2YR Rolling. As a substitute of utilizing Bitcoin’s complete value historical past, this model calculates volatility based mostly solely on the earlier two years of knowledge.

View Reside Chart 🔍

This strategy higher accounts for Bitcoin’s rising market cap and shifting dynamics and ensures the metric adapts to more moderen traits, providing higher accuracy for up to date market evaluation. It nonetheless excels at figuring out market cycle tops and bottoms however adapts to fashionable situations. Within the final cycle, this model captured the next peak worth than the standard Z-Score, aligning extra intently with 2017’s value motion. On the draw back, it continues to determine sturdy accumulation zones with excessive precision.

Uncooked MVRV Ratio

One other complementary strategy entails analyzing the MVRV ratio with out standardizing for volatility. By doing so, we are able to see the earlier cycle’s MVRV ratio peaked at 3.96, in comparison with 4.72 within the cycle earlier than that. These values counsel much less deviation, doubtlessly providing a extra secure framework for projecting future value targets.

View Reside Chart 🔍

Assuming a realized value of $60,000 (factoring within the present projected improve over the subsequent six months) and an MVRV ratio of three.96, a possible peak value could possibly be near $240,000. If diminishing returns scale back the ratio to three.0, the height value may nonetheless attain $180,000.

Conclusion

Whereas the MVRV Z-Score continues to be some of the efficient instruments for timing market cycle peaks and bottoms, we should be ready for this metric doubtlessly not reaching comparable highs as prior cycles. By adapting this information to raised issue within the altering market dynamics of Bitcoin, we are able to account for diminished volatility as BTC grows.

For a extra in-depth look into this matter, take a look at a current YouTube video right here:

Bettering The Bitcoin MVRV Z-Score

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, customized indicator alerts, and in-depth business reviews, take a look at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.