Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is buying and selling across the $1,600 degree after a number of days of failed makes an attempt to reclaim increased costs. Bulls are exhibiting indicators of life, however their momentum stays weak as bearish strain continues to dominate the market. Regardless of a quick restoration bounce final week, Ethereum’s broader construction nonetheless displays a transparent downtrend.

Associated Studying

The crypto market stays below the shadow of macroeconomic uncertainty, as ongoing tensions between america and China weigh closely on world monetary sentiment. No decision or settlement between the 2 financial giants has been introduced, leaving traders cautious and risk-averse.

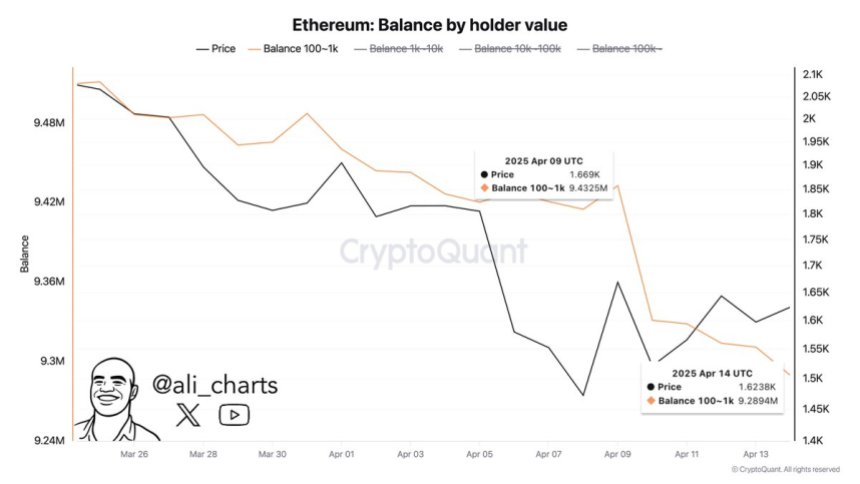

Including to the damaging sentiment, CryptoQuant knowledge exhibits that Ethereum whales have offloaded roughly 143,000 ETH over the previous week. This huge-scale distribution reinforces fears of additional draw back, with long-term holders and huge wallets selecting to scale back publicity moderately than accumulate.

Whereas some analysts nonetheless see potential for a turnaround if key ranges are reclaimed, the present market setting stays fragile. Until Ethereum can regain and maintain above short-term resistance ranges, the specter of one other leg down stays very actual. Merchants at the moment are intently watching value motion for indicators of a shift — however for now, warning continues to prepared the ground.

Ethereum Faces Selling Strain As Whales Exit

Ethereum is going through a crucial check as value motion continues to lack readability, and assist ranges stay fragile. Regardless of transient makes an attempt to rebound, ETH has failed to determine a transparent backside, and the downtrend construction stays intact. The market is struggling to outline a robust demand zone, making it troublesome for bulls to maintain upward momentum. As promoting strain mounts, analysts are warning that Ethereum could proceed to slip towards decrease demand ranges within the absence of sturdy shopping for curiosity.

Broader macroeconomic circumstances proceed to weigh closely on threat belongings like Ethereum. World commerce tensions, notably the unresolved tariff standoff between america and China, have created uncertainty throughout monetary markets. Mixed with fears of a slowing world financial system and lack of coordinated fiscal assist, crypto markets stay below strain.

Including to the bearish sentiment, high analyst Ali Martinez shared on-chain knowledge revealing that whales have offloaded roughly 143,000 ETH over the previous week. This huge-scale distribution by influential holders has considerably weakened Ethereum’s outlook, reinforcing considerations that good cash is getting ready for deeper draw back.

Since late December, ETH has remained in a chronic bearish pattern, with each try at restoration being met by renewed promoting. Until bulls reclaim key technical ranges and shift market sentiment, Ethereum could proceed to slip additional.

Associated Studying

ETH Worth Caught In Unstable Vary

Ethereum is at present buying and selling at $1,600 after enduring days of huge volatility and macroeconomic-driven uncertainty. Regardless of transient aid bounces, ETH stays locked in a bearish construction, unable to generate sustained momentum. For bulls to regain management, reclaiming the $1,850 resistance degree is crucial. This degree aligns with the 4-hour 200 MA and EMA round $1,800, making it a key zone to look at for affirmation of a short-term pattern reversal.

Holding above these transferring averages would sign renewed energy and probably mark the start of a restoration rally. Nonetheless, value motion continues to wrestle beneath them, and failure to push above these indicators would verify persistent weak point. In that case, Ethereum could retest the $1,500 degree and even dip beneath it if promoting strain intensifies.

Associated Studying

The present setting is formed by world tensions and macro uncertainty, with no clear catalysts to drive a breakout in both path. So long as ETH stays beneath its key transferring averages, the chance of one other leg down stays elevated. Bulls should act swiftly to flip sentiment and keep away from a deeper correction towards long-term demand ranges.

Featured picture from Dall-E, chart from TradingView