After a slight rebound on Tuesday to the $1,600 threshold, Ethereum‘s price was faced with notable resistance, which led to a sudden breakdown to $1,450. ETH’s persistent weak efficiency this 12 months has impacted investor conviction available in the market, triggering important promoting strain up to now few weeks.

Bearish Sentiment Towards Ethereum Grows On Binance

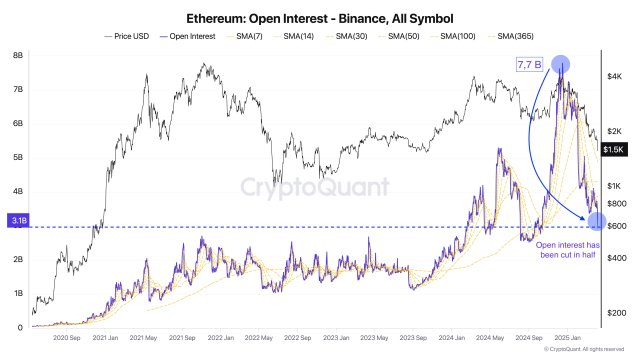

The bearish sentiment towards Ethereum has elevated in crypto exchanges, particularly on Binance, the world’s largest cryptocurrency alternate. Verified writer and on-chain skilled for CryptoQuant, Darkfost, revealed that ETH’s Open Interest (OI) on Binance continues to see a gentle decline.

The persistent drop in open curiosity on the crypto alternate signifies that ETH‘s derivatives market is cooling down. It additionally displays rising warning amongst buyers and merchants because the altcoin battles to maintain its bullish momentum.

Darkfost highlighted that the open curiosity on Binance continues to drop with out stopping and is now altering underneath its 365 Easy Shifting Common (SMA). This motion implies that speculative exercise is pulling again as buyers is perhaps ready for extra sure alerts earlier than making a forceful comeback to the market.

After hitting an all-time excessive of $7.78 billion in December, the open curiosity on Binance has decreased by virtually 50% between December and April, wiping out almost $4 billion throughout the interval. The chart reveals that ETH’s open curiosity on Binance is now valued at $3.1 billion, suggesting a large shift in investor sentiment on the platform.

In keeping with the on-chain skilled, Ethereum’s value has been considerably impacted by this sharp drop, and there aren’t any indications that the continuing downward pattern shall be stopping anytime quickly. Moreover, it displays the magnitude of latest liquidations in addition to a heightened aversion to threat amongst buyers.

Within the occasion that the pattern continues, Darkfost famous that “Ethereum’s price is still far from entering a period of stability.” Thus, Darkfost has urged merchants to observe buyers’ habits on Binance, which stays a beneficial indicator for the reason that largest commerce volumes throughout the market are often captured by the crypto platform.

ETH Is Poised For A Huge Upswing To New All-Time Highs

With ETH’s open curiosity lowering on the biggest crypto alternate and the market extraordinarily unstable, this raises issues about its value stability. Nonetheless, many crypto analysts are assured {that a} rebound may very well be on the horizon, which is more likely to push the altcoin towards new highs.

Market skilled and dealer Milkybull Crypto shared a submit on the X platform, outlining Ethereum’s potential to surge considerably within the upcoming weeks. On the time of the submit, ETH was buying and selling at $1,585, and the skilled acknowledged that the altcoin usually marks a macro backside at this degree. Ought to this degree maintain, Milkybull anticipates an enormous rally, placing his subsequent goal on the $10,000 milestone.

Featured picture from Unsplash, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.