Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has as soon as once more fallen under the $2,000 mark, a psychological degree it had briefly reclaimed earlier this week. The market-wide correction over the previous 24 hours has weighed on Ethereum’s restoration momentum, and the main altcoin has seen a dip in sentiment that would result in a deeper decline or a pointy mid-term rebound.

Brief-term sentiment is cautious, however a brand new evaluation from a well-followed crypto analyst has introduced consideration to a big technical occasion that opens up a bullish perspective for the Ethereum value.

Ethereum Hits 300-Week Shifting Common Once more: What Happened The Final Time?

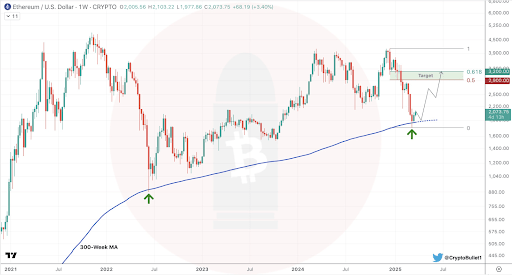

Taking to social media platform X, crypto analyst CryptoBullet identified that Ethereum has now touched the 300-week transferring common for under the second time in its historical past. The first occasion was in June 2022, in the course of the market-wide crash that noticed the Ethereum value plummet to as little as $880 earlier than starting an extended, gradual restoration.

Associated Studying

The second incidence has come this month, March 2025, simply as Ethereum continues to increase its struggles in gaining a footing above $2,000. With Ethereum touching the 300-week transferring common once more, we will solely look again to see what occurred final time to get a perspective of what to anticipate now.

In June 2022, Ethereum’s contact of the 300-week transferring common marked the start of a long-term restoration part. After the bounce from that degree, the Ethereum value surged greater than 140% over the subsequent eight weeks, ultimately pushing above $2,100 in August 2022 earlier than one other correction.

Mid-Time period Rebound In Focus For ETH, However Resistance Forward

CryptoBullet famous the importance of this transferring common, framing it as a key historic help zone. The analyst argued that no matter bearish sentiment within the quick time period, this sort of macro-level help usually units the stage for a significant bounce.

Associated Studying

“Even if you’re a bear, you can’t deny that we hit a very important support level,” he wrote, including that his value goal for the approaching bounce is between $2,900 and $3,200. Nonetheless, the bounce will rely upon how the Ethereum value reacts to the extent, as a continued draw back transfer would cancel out any bullish momentum.

For now, Ethereum’s value is trapped below bearish sentiment, and bulls might want to reclaim the $2,000 zone earlier than any sustainable bounce towards the $2,900 and $3,200 vary can start to materialize. Moreover, the latest value correction up to now 24 hours will increase the dangers of the Ethereum value closing March under the 3M Bollinger bands, which is at present simply round $2,000. An in depth under the 3M Bollinger bands may spell bother for the main altcoin.

Nonetheless, if CryptoBullet’s evaluation proves to be correct, Ethereum could quickly enter a interval of stronger value motion that performs out over the approaching weeks. On the time of writing, Ethereum is buying and selling at $1,907, down by 5.82% up to now 24 hours.

Featured picture from Unsplash, chart from Tradingview.com