Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum (ETH) has plunged 30% over the previous two weeks, reflecting broader weak point throughout the crypto market as the worldwide economic system reels from escalating tariff wars. Crypto analyst Ali Martinez warns that ETH may fall even additional within the close to time period, doubtlessly testing the $1,200 degree.

Extra Ache For Ethereum, However A Restoration Is Attainable

Ethereum continues to battle amid international financial pressures. The world’s second-largest cryptocurrency by market cap has dropped one other 8.3% up to now 24 hours and is at the moment buying and selling within the mid-$1,000 vary.

Associated Studying

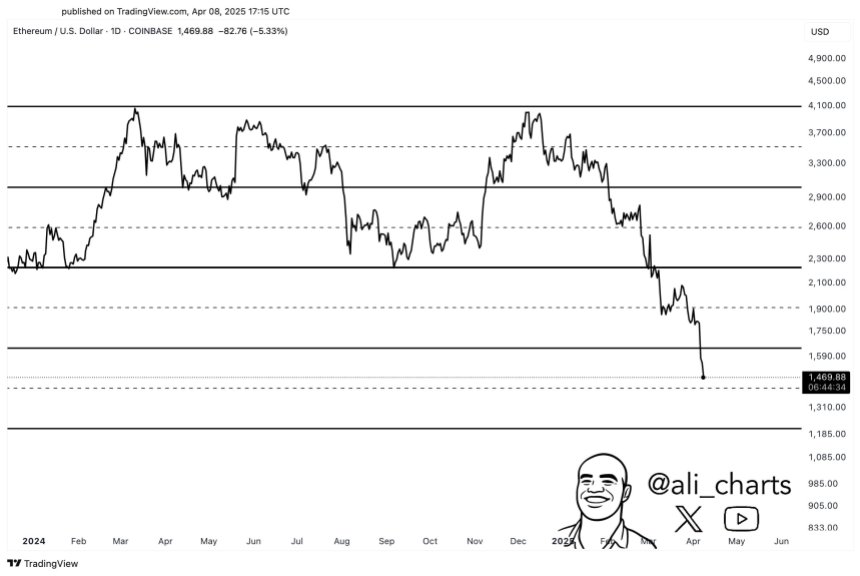

Commenting on the current worth motion, seasoned analyst Martinez highlighted that ETH may discover key assist on the $1,200 mark. He shared the next day by day chart of ETH, displaying how the digital asset has damaged by means of a number of assist ranges since December 2024, when it was buying and selling close to $4,000.

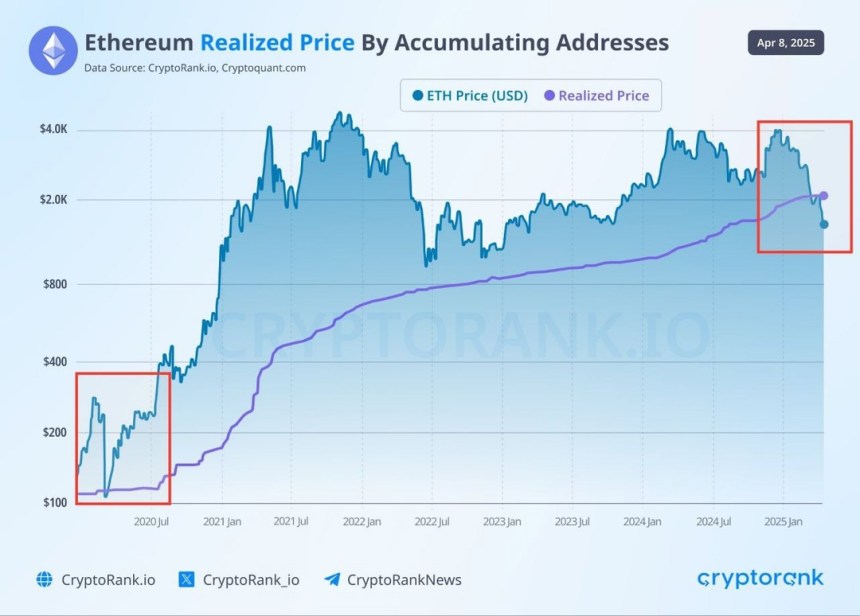

In the meantime, famend analyst Carl Moon famous that ETH is at the moment buying and selling under its realized worth of $2,000. He identified that the final time this occurred – again in March 2020 on the peak of the COVID-19 pandemic – ETH had dropped from $289 to $109.

On a extra optimistic observe, Moon added that ETH recovered swiftly after that steep decline. Primarily based on historic traits, the present worth degree may current a possible shopping for alternative for long-term buyers.

For these unfamiliar, the realized worth for accumulation addresses – as proven within the above CryptoRank chart – represents the common worth at which long-term holders acquired ETH. This metric has traditionally acted as a robust assist zone.

Is ETH About To Shock The Market?

With market sentiment approaching historic lows, confidence in ETH seems to be dwindling. The Ethereum Worry & Greed Index at the moment sits at 20, indicating “extreme fear” amongst buyers.

Associated Studying

Regardless of the bearish temper, some on-chain metrics and historic patterns recommend ETH could possibly be on the verge of a robust bullish reversal – doubtlessly catching buyers off guard.

For instance, crypto analyst Mister Crypto just lately drew a comparability between ETH’s present worth motion and that from 2020, suggesting that Ethereum may embark on a worth rally by Q2 2025.

Equally, Ethereum’s Market Worth to Realized Worth (MVRV) Z-score hints that ETH could also be undervalued at present worth. The final time it was this undervalued – in October 2023 – it witnessed a pointy rally of 160%.

That stated, not all indicators are bullish. Rising ETH alternate reserves proceed to lift issues about potential promote stress from holders. At press time, ETH is buying and selling at $1,457, down 8.3% over the previous 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com