The on-chain analytics agency Glassnode has revealed how the Ethereum futures market remains to be overheated regardless of the lengthy squeeze that simply occurred.

Ethereum Open Curiosity Nonetheless Notably Above The Yearly Common

In a brand new submit on X, Glassnode has mentioned about how the Ethereum futures market has modified in the course of the previous day. ETH, like different digital property, has witnessed vital volatility inside this window. Sharp value motion normally means chaos for the derivatives aspect of the sector and certainly, a considerable amount of liquidations have piled up on the assorted exchanges.

On condition that the worth motion has been majorly in the direction of the draw back for Ethereum, the lengthy buyers can be essentially the most closely affected. Beneath is the chart shared by the analytics agency that exhibits the development within the lengthy liquidations associated to ETH over the previous yr.

From the graph, it’s seen that the Ethereum futures market has simply witnessed an enormous quantity of lengthy liquidations. “Yesterday, $76.4M in ETH long liquidations hit the market, with $55.8M wiped out in a single hour – the second-largest spike in a year, just behind Dec 9’s $56M,” notes Glassnode.

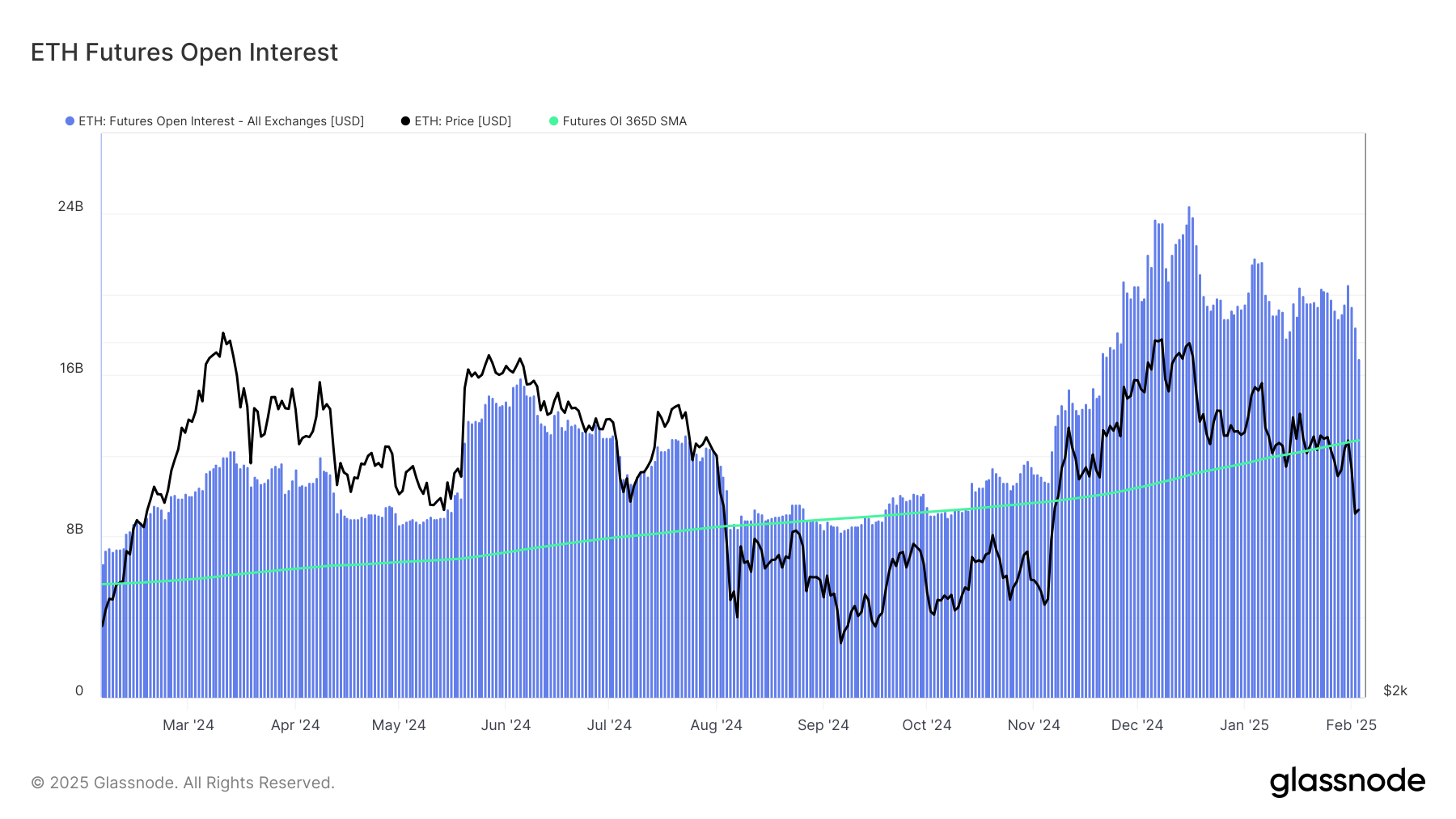

These liquidations have meant {that a} notable ETH leverage flush-out has occurred on the derivatives platforms. Right here is one other chart, this time for the Open Curiosity, which showcases the market deleveraging:

The “Open Interest” is an indicator that retains observe of the entire quantity of Ethereum-related futures positions which can be open on all centralized derivatives exchanges. At first of the month, this metric was sitting round $20.5 billion, however after the mass liquidation occasion, its worth has come all the way down to $15.9 billion.

This means $4.6 billion in positions have been worn out from the market. Whereas this represents a big lower, it has really not been sufficient to trigger a adequate cooldown within the Open Curiosity.

As displayed within the above chart, the 365-day shifting common (MA) of the Ethereum Open Curiosity is at the moment located at $13 billion. Thus, the metric’s every day worth is round 22% larger than the common for the previous yr.

This could possibly be a possible indication that the leverage within the sector remains to be at elevated ranges, regardless of the huge quantity of liquidations that the lengthy buyers have suffered.

Traditionally, an overheated futures market has typically unwound with volatility for the coin’s value, so it’s attainable that extra sharp motion might observe for ETH within the close to future.

ETH Worth

Ethereum noticed a crash in the direction of the $2,100 mark yesterday, however it might seem the cryptocurrency has seen a rebound as its value is now buying and selling round $2,800.