Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has struggled to achieve momentum, remaining caught beneath vital resistance for over a yr. Regardless of a number of makes an attempt, the second-largest cryptocurrency by market capitalization has been unable to interrupt by way of key technical ranges for the reason that starting of this yr.

Associated Studying

Ethereum’s value motion over the previous two weeks has proven extra weak spot. An fascinating evaluation from analyst Tony “The Bull” Severino reveals that the cryptocurrency just lately failed to interrupt above a resistance indicator and is now liable to extra catastrophic value drops.

Ethereum Fails To Breach Lengthy-Time period Resistance

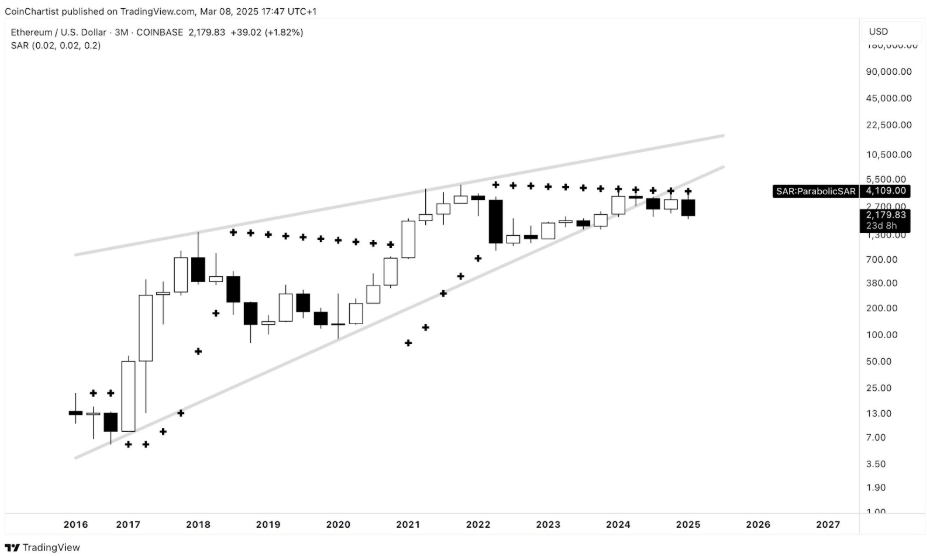

Tony “The Bull” Severino, in a technical evaluation shared on social media platform X, highlighted Ethereum’s persistent failure to beat main resistance ranges. He identified that Ethereum has been unable to tag the quarterly (three-month) Parabolic SAR regardless of greater than a yr of makes an attempt. This indicator, usually used to find out the course of an asset’s pattern, reveals that Ethereum is locked in a chronic battle in opposition to resistance on a bigger downtrend.

“This feels like it sends a message — resistance won’t be broken,” the analyst mentioned.

Picture From X: Tony “The Bull” Severino

Including to the failure to interrupt resistance, Tony Severino additionally famous in one other evaluation that Ethereum has repeatedly confronted rejection from the quarterly (3M) SuperTrend dynamic resistance, additional solidifying the case that consumers have been unable to regain management.

Picture From X: Tony “The Bull” Severino

A Monthly Close Below $2,100 Could Be Catastrophic

Ethereum’s incapacity to maintain key value ranges has been a dominant theme prior to now six months. Apparently, this incapacity was proven additional prior to now two weeks. After failing to carry above $2,800, the cryptocurrency has seen a gentle drop, shedding a number of help zones alongside the way in which.

At the moment, Ethereum is buying and selling beneath $2,200, edging dangerously shut to breaking beneath the essential $2,100 threshold. A drop beneath this degree is especially regarding, not simply because it signifies the lack of one more psychological help however as a result of technical indicators counsel {that a} month-to-month shut beneath $2,100 may have extreme penalties.

One of the vital important warning indicators comes from the quarterly Bollinger Bands indicator, which has tracked Ethereum’s value motion since February 2022. In keeping with this indicator, Ethereum has remained inside an outlined vary, with the higher Bollinger Band presently positioned at $4,190 and the decrease band at $2,098. The worrying half is {that a} month-to-month shut beneath $2,100 would successfully translate to breaking beneath the decrease Bollinger Band and eradicating a long-standing help degree.

Picture From X: Tony “The Bull” Severino

Associated Studying

On the time of writing, Ethereum is buying and selling at $2,178, having gained 2.2% prior to now 24 hours after beginning the day at $2,120. Ethereum’s sentiment is now at its lowest degree this yr. The following few weeks might be essential to see if Ethereum can reclaim misplaced floor and forestall a month-to-month shut beneath $2,100.

Featured picture from Tech Journal, chart from TradingView