- Ethereum ETFs inflows are outdoing Bitcoin ETF inflows.

- BlackRock’s iShares Ethereum Belief (ETHA) ETF leads with a $89.51M influx on Dec 23, 2024.

- This Market shift might sign an altcoin season in 2025.

In a shocking flip of occasions within the cryptocurrency market, Ethereum spot ETFs have been experiencing important inflows, overshadowing the outflows famous in Bitcoin ETFs.

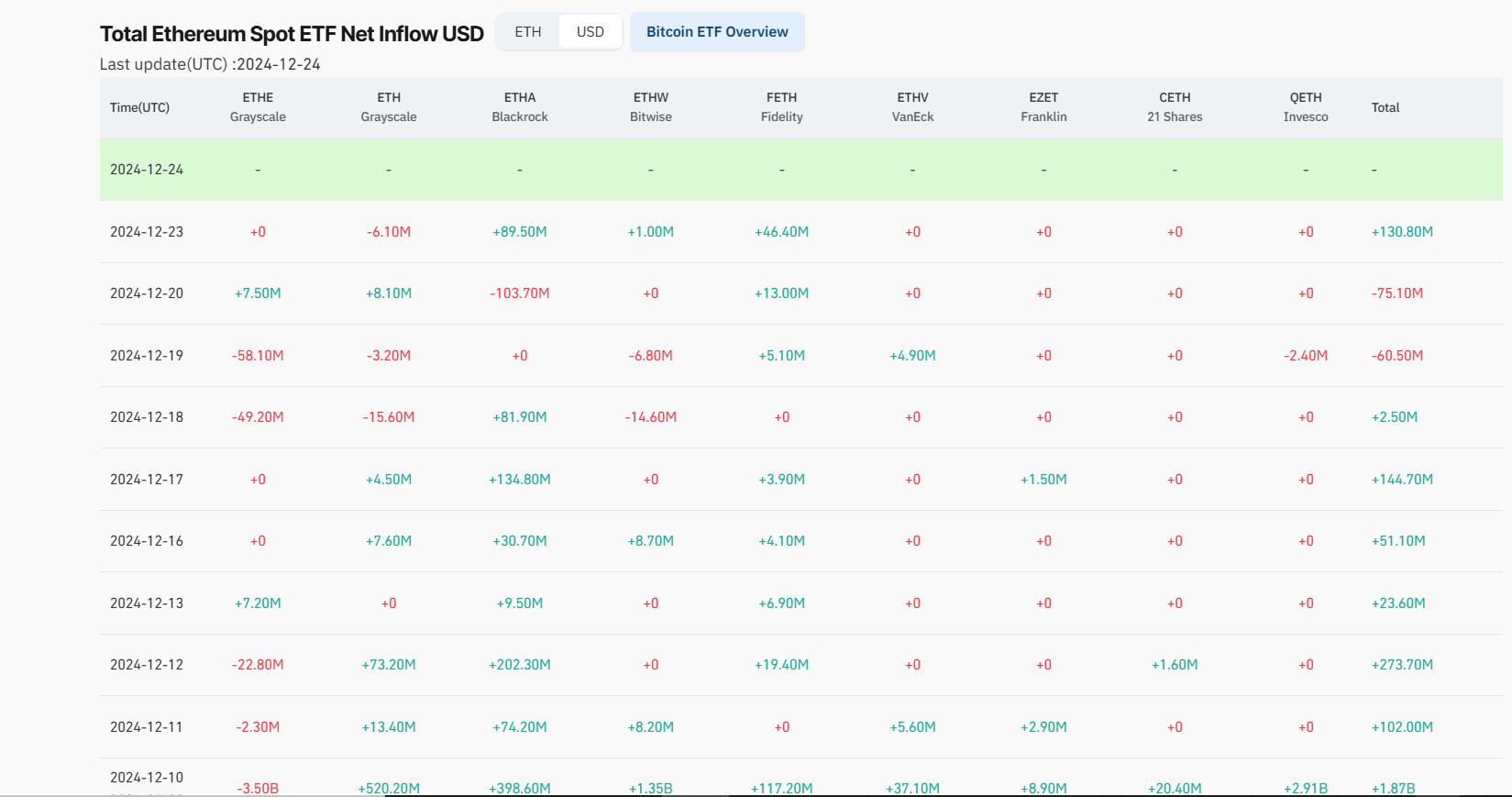

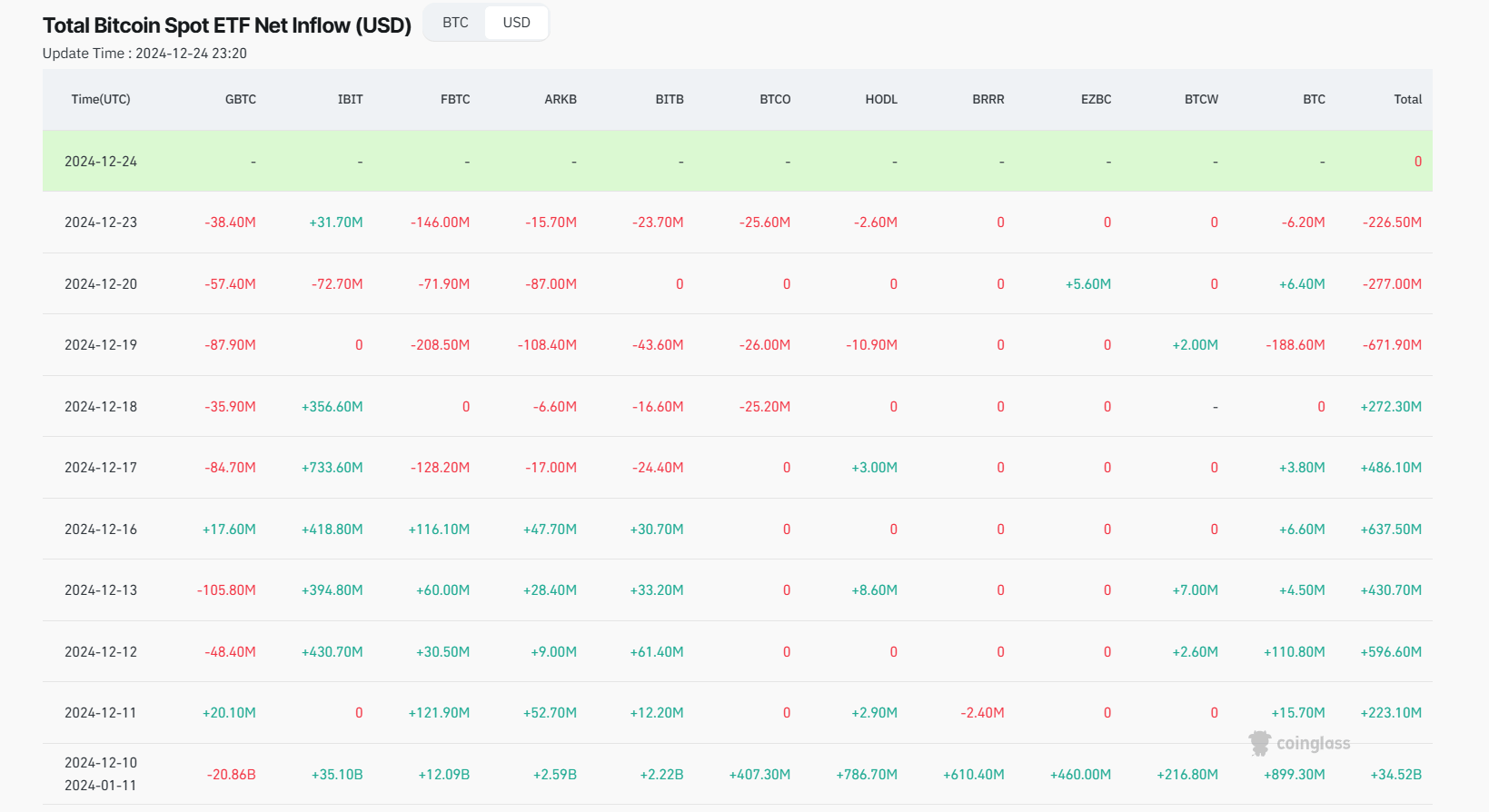

On December 23, 2024, Ethereum ETFs recorded a internet influx of $130.8 million, with BlackRock’s iShares Ethereum Belief (ETHA) ETF main with $89.50 million and Constancy’s Ethereum ETF (FETH) including $46.40 million in response to Coinglass knowledge. In stark distinction, Bitcoin ETFs noticed outflows totalling $226.50 million on the identical day.

This development has been constant over current weeks. As an illustration, on December 12, Ethereum spot ETFs had a cumulative internet influx of $273.70 million, persevering with their streak of 14 consecutive days with optimistic inflows. BlackRock’s ETHA ETF alone noticed a single-day internet influx of $202.30 million, whereas Grayscale’s Ethereum ETF (ETH) contributed $73.20 million.

The shift alerts a potential begin of an altcoin season

Bitcoin ETFs, regardless of having increased buying and selling volumes, have been dealing with outflows, suggesting a potential shift in investor sentiment in direction of Ethereum.

Market analysts speculate that this might sign the onset of an ‘altcoin season’, the place traders is perhaps diversifying their portfolios past Bitcoin, with ETH main the pack.

This shift in funding stream is especially notable because it comes at a time when Bitcoin has been dominating headlines with its worth efficiency, reaching over $108,000 earlier in December.

The underlying causes for this development may embrace Ethereum’s rising ecosystem, significantly in decentralized finance (DeFi) and non-fungible tokens (NFTs), which might be attracting traders on the lookout for dynamic development alternatives.

Moreover, the regulatory atmosphere beneath the incoming administration is perhaps perceived as extra beneficial for Ethereum, given its broader use-case purposes past simply being a retailer of worth like Bitcoin.

This improvement raises questions concerning the future route of crypto investments. Whereas Bitcoin has lengthy been the bellwether of the crypto market, Ethereum’s current efficiency within the ETF area may trace at a rebalancing of investor curiosity, doubtlessly resulting in extra balanced development throughout completely different cryptocurrencies in 2025.