Ethereum surged over 5% yesterday, pushing previous the important thing $2,700 stage and signaling renewed energy throughout the altcoin market. After weeks of sideways motion and uncertainty, this transfer marks a small however vital breakout, reigniting bullish sentiment amongst traders and merchants. The breakout comes as Bitcoin continues to consolidate under its all-time highs, permitting ETH and different altcoins to take the lead.

Associated Studying

Market members are intently watching Ethereum’s worth motion, as its actions typically set the tone for the broader altcoin area. Prime analyst Ted Pillows shared a technical view highlighting that ETH is as soon as once more buying and selling on the prime of its current vary. A breakout above this stage may affirm the start of a bigger enlargement section for altcoins.

With bullish momentum constructing and Ethereum holding sturdy above reclaimed help ranges, merchants have gotten more and more assured that the altcoin market could also be on the verge of a broader breakout. Nevertheless, key resistance nonetheless lies forward, and the following few days shall be essential in figuring out whether or not Ethereum has the energy to proceed increased and lead a brand new leg up within the crypto cycle.

Ethereum Trades at Range Highs: Breakout Looms

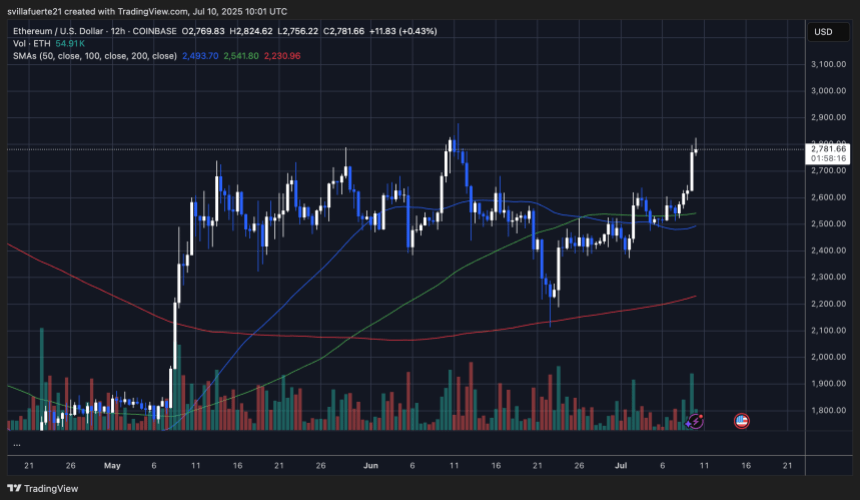

Ethereum has spent the previous a number of weeks consolidating in a well-defined vary between roughly $2,400 and $2,800, a construction that started forming in early Might. Regardless of short-term volatility, ETH has held key help ranges, suggesting that bulls stay in management. Now, with worth motion pushing towards the higher boundary of the vary as soon as once more, the market is watching intently to see whether or not Ethereum can break by means of resistance and provoke a sustained rally.

The broader macroeconomic backdrop has shifted in favor of danger belongings. Within the US, sturdy labor market information and wage development have helped ease issues of an financial slowdown. In the meantime, the decision of a number of international geopolitical tensions has diminished uncertainty, permitting markets to stabilize. This supportive atmosphere may give Ethereum the gasoline it wants to try a breakout.

Ted Pillows just lately highlighted that Ethereum is now buying and selling on the vary highs once more — a stage that has repeatedly capped worth advances in current months. In accordance with Pillow, a confirmed breakout above the $2,800 resistance would possible set off renewed momentum for ETH and doubtlessly spark a broader transfer throughout the altcoin market.

Associated Studying

$2,800 Resistance Now In Sight

Ethereum is displaying renewed energy because it breaks out of a multi-week consolidation vary, with the newest 12-hour candle closing above $2,760. The value motion has decisively reclaimed the $2,700 stage and is now testing the crucial $2,800 resistance zone. This breakout is supported by a transparent surge in quantity, confirming bullish momentum.

The 50, 100, and 200-period transferring averages are all trending upwards and at present sit effectively under the present worth, a robust technical signal of sustained momentum. ETH has moved above all three key SMAs, confirming that bulls are in management within the quick to medium time period. Notably, that is the best ETH has traded since early June, and the candle construction resembles a basic continuation breakout setup.

Associated Studying

A profitable every day shut above $2,800 would open the door for an enlargement towards the $3,000 stage and doubtlessly increased if momentum holds. Nevertheless, the important thing now lies in whether or not consumers can maintain this transfer with out rapid rejection at resistance. If ETH can maintain above $2,700 and construct help, the breakout may function a launchpad for altcoins, particularly as Ethereum typically leads broader market strikes.

Featured picture from Dall-E, chart from TradingView