Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

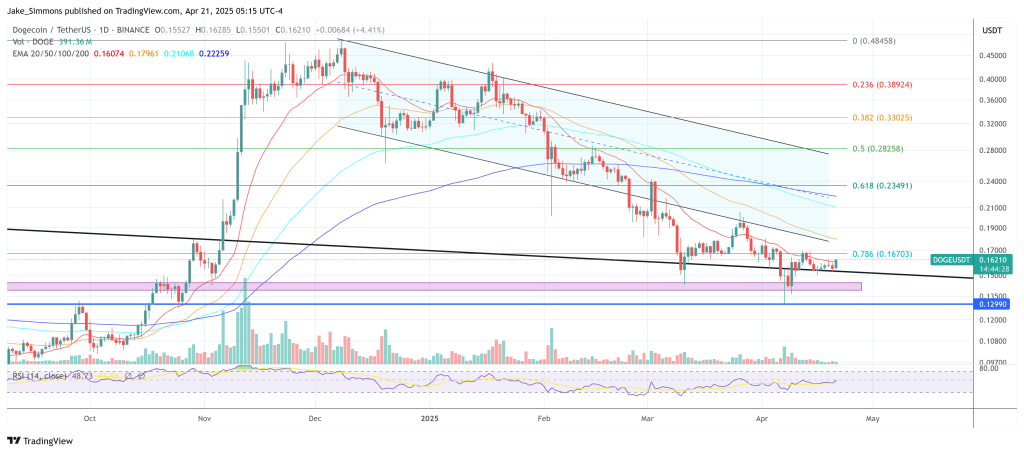

Dogecoin’s chart has became what impartial market analyst Kevin calls “literally doing nothing” for nearly a month and a half. In a broadcast on X, the veteran technician recounted that the memecoin’s final decisive transfer was a pointy promote‑off greater than six weeks in the past; since then value has compressed right into a slim band, threatening to lose the structural assist it reclaimed on the finish of March.

Dogecoin Momentum Nonetheless Weak

Kevin has been monitoring the identical horizontal ranges for “weeks.” The higher certain of the vary is the publish‑bear‑market breakout retest round $0.156, whereas the important thing Fibonacci retracement “macro 0.382” sits decrease at $0.138 — a zone he has repeatedly described as his “line in the sand.” Solely a weekly candle shut beneath that degree would persuade him that the rally that started in late 2023 has absolutely damaged down. “If Dogecoin breaks $0.138 on weekly closes, then it’s probably over,” he cautioned.

Momentum indicators are failing to offer early affirmation both approach. Commenting on the a lot‑watched 3-day MACD, Kevin pushed again in opposition to social‑media claims {that a} bullish cross is already in play. “People don’t know how to read this indicator properly,” he stated. “Technically, yes, by definition it’s a cross, but it’s really not a cross […] You have to have expansion of the moving averages in order to have a confirmed cross.” With out that enlargement, he warned, the fledgling uptick within the histogram may “easily just roll right over.”

With spot value inertia now stretching to 42 days, threat‑reward has compressed as effectively. Kevin frames the choice tree in stark phrases: maintain the $0.156–$0.138 congestion and Dogecoin retains its constructive medium‑time period construction; lose it and merchants should look right down to the psychological $0.10 shelf. Even there, he sees solely the potential of a counter‑pattern bounce towards $0.25–0.26.

Associated Studying

The broader-market backdrop gives little quick reduction. Utilizing Bitcoin as a number one indicator, Kevin reminds viewers that your complete advanced stays in what he calls a “major correctional phase,” triggered when the three‑day MACD crossed down in January 2025. Historic examine of Bitcoin’s macro pullbacks suggests they persist “anywhere from 114 to 174 days,” he famous.

“They operate the same way no matter what the economic circumstances are. They last anywhere from 114 to 174 [days]. Every single time whether it’s a bear market [or] bull market. Bad news, good news doesn’t matter. They always last the same amount of time. 174 days being the longest in history, 114 days being the average of every correct major correctional period in history,” Kevin defined.

Associated Studying

Ought to Bitcoin fail to defend $70,000, he argues, odds of a recent all‑time excessive within the quick run can be fairly low. “If Bitcoin breaks $70,000 and goes into the $60,000’s, we’re gonna get a huge bounce out of there. You get a huge countertrend rally. Everything will look rosy again, but the chances are that it makes a new high very slim. Same goes for Dogecoin. If dogecoin comes down to this $0.10 level and it gets a bounce, maybe it comes like a big counter trend rally back up to like $0.25 or $0.26 and then it just rolls over and that’s the end,” Kevin said.

For Dogecoin, due to this fact, the following decisive sign is prone to be a tough break of the $0.156–$0.138 hall or a confirmed momentum resurgence on the upper‑time‑body MACD — whichever comes first. Till then, the asset stays trapped in Kevin’s phrases: “We’ve done nothing… there’s not much to talk about.”

At press time, DOGE traded at $0.1621.

Featured picture created with DALL.E, chart from TradingView.com