Litecoin and Mantra rallied in double-digits this week. Technical and on-chain evaluation suggests the 2 altcoins are poised for additional positive aspects subsequent week. Bitcoin’s flash crash below $100,000 and its return above $104,000 have fuelled optimism amongst crypto merchants.

U.S. macroeconomic knowledge releases, efficiency of tech shares and equities, and developments in synthetic intelligence are the important thing market movers for Bitcoin. Altcoins like LTC and OM observe Bitcoin intently because the correlation stays excessive.

Litecoin and Mantra may lengthen positive aspects, technical evaluation exhibits

Technical evaluation helps positive aspects in LTC and OM, on the every day timeframe. Mantra (OM) consolidated in a range-bound method for a number of weeks between mid-December and January. OM broke out of the vary between $4.5352 and $3.1730.

On the time of writing, on Friday, OM trades at $5.6263, near its all-time excessive of $5.9500 as noticed within the TradingView chart beneath.

On the every day timeframe, OM fashioned a help zone between $4.443 and $4.069. It is a key imbalance zone and a correction may see MANTRA bouncing off this vary.

Two key technical indicators, the Relative power index and the transferring common convergence divergence indicator help a bullish thesis for OM. RSI reads 76 and is sloping upward. Whereas this sometimes generates a promote sign, when mixed with MACD’s inexperienced histogram bars above the impartial line, it highlights underlying optimistic momentum in OM worth development.

A retest of OM’s all-time excessive is probably going subsequent week if the token sustains its upward momentum.

Litecoin was consolidating inside the higher and decrease boundaries of the vary at $129.11 and $92.57. LTC ended its consolidation and broke out of the help zone, lower than 8% below its 2025 peak of $141.22.

Litecoin trades at $131.64 on the time of writing, early on Friday.

The LTC/USDT every day worth chart exhibits an imbalance zone between $102.57 and $114.04, two key ranges for Litecoin within the occasion of a correction within the altcoin.

RSI and MACD present underlying optimistic momentum in Litecoin’s worth development. RSI reads 61 and is sloping upwards and MACD exhibits inexperienced histogram bars above the impartial line.

Merchants want to look at for a re-test of the 2025 peak and an try to rally in direction of 2024 excessive of $147.06.

On-chain evaluation helps bullish thesis

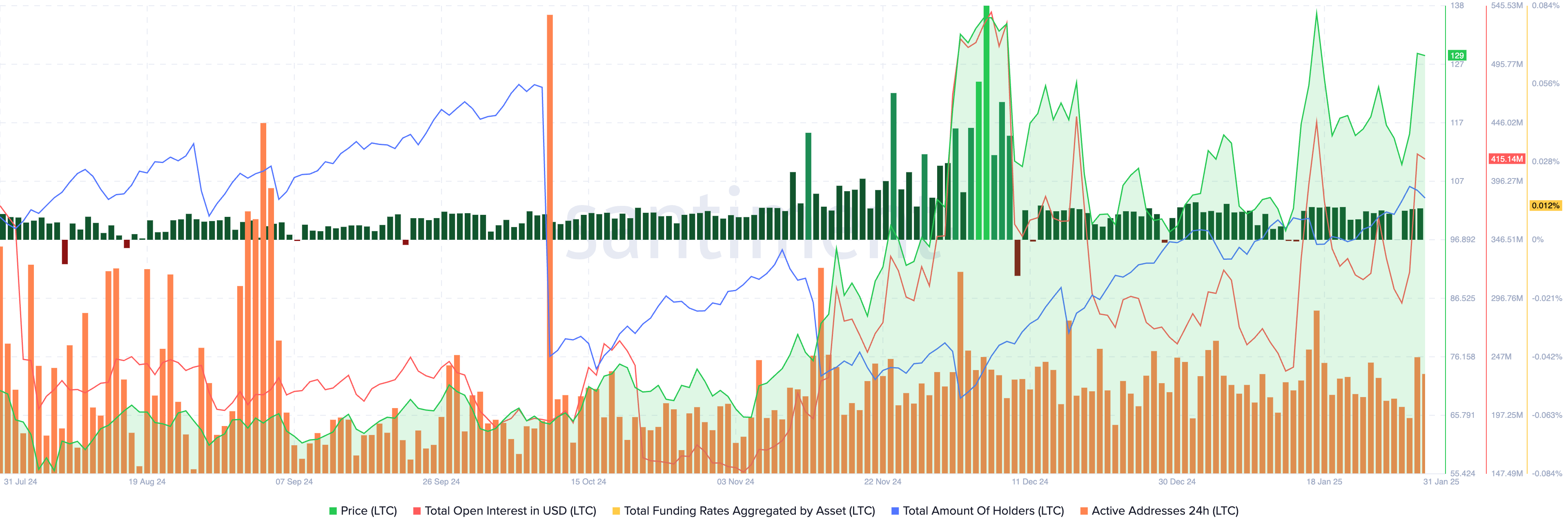

Santiment metrics spotlight the rising relevance and demand for Litecoin amongst merchants this week. The overall open curiosity throughout derivatives exchanges in LTC climbed to almost $420 million on January 30, marking a spike within the chart beneath.

The overall variety of LTC holders has climbed steadily between December 2 and January 31, in response to Santiment knowledge. On Friday, the metric climbed to eight.13 million.

The variety of lively addresses stays above the 2024 common, and complete funding charges aggregated by LTC learn optimistic, that means derivatives merchants keep a bullish bias on Litecoin.

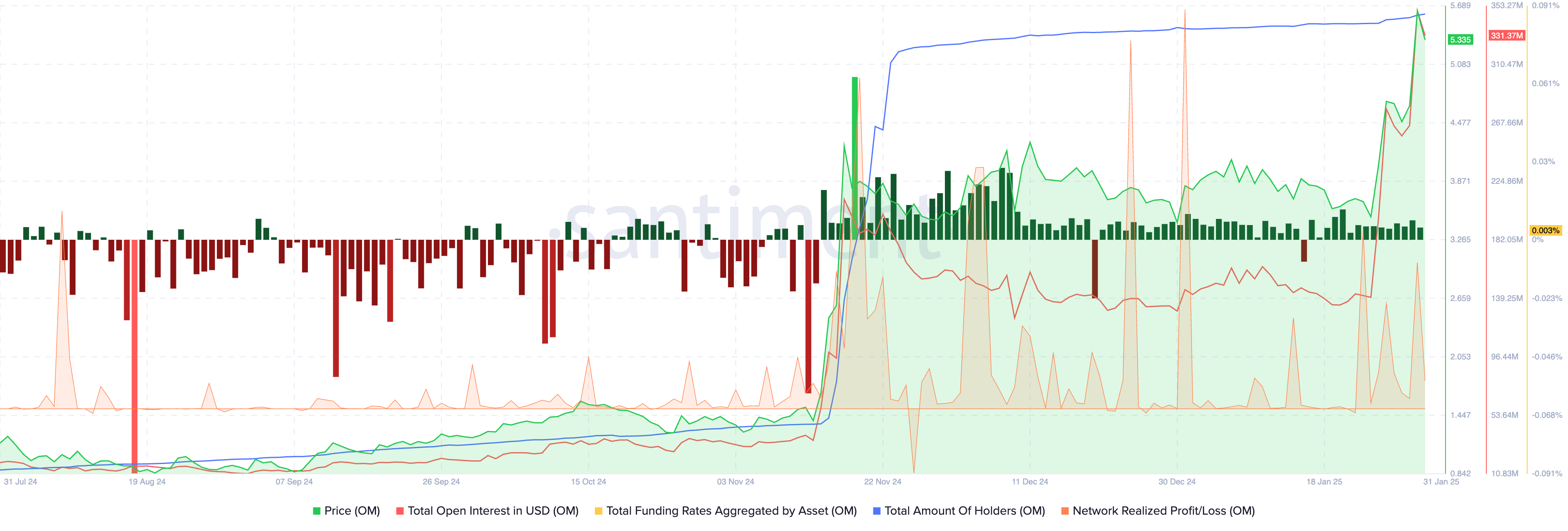

Within the case of Mantra (OM), the overall quantity of holders is climbing slowly, reached almost 44,000 on Friday. Key metrics like funding fee present a bullish bias and a optimistic worth for almost two weeks, confirming the token’s relevance and demand within the derivatives market.

The Community realized revenue/loss metric used to trace the web revenue/lack of all tokens moved on the chain on a given day exhibits a number of optimistic spikes in January, signaling profit-taking. Merchants want to look at for giant optimistic spikes as that may suggest massive quantity sell-off by merchants de-risking their portfolio, and this might lead to a correction in OM worth.

The overall open curiosity in OM hit its highest stage on January 30 above $348 million.

Market movers push Litecoin and Mantra greater

The anticipation of Litecoin Change traded fund approval within the U.S. is likely one of the key market movers that drove LTC worth greater this week. Because the SEC formally acknowledges the 19b-4 submitting from Canary Capital for a spot Litecoin ETF, merchants are hopeful of an approval.

Sometimes a spot ETF approval generates demand and curiosity amongst institutional buyers and huge pockets merchants. The developments within the ETF may gasoline additional positive aspects in Litecoin subsequent week.

Eric Balchunas, Bloomberg Intelligence Analyst commented on the event in a tweet on X:

Mantra’s latest announcement a couple of partnership with the DAMAC Group, a real-estate large, for tokenizing property on their chain is a key market mover for OM token this week. JP Mullin, co-founder and CEO of Mantra stated,

“This partnership with DAMAC Group is an endorsement for the RWA industry. We’re thrilled to partner with such a prestigious group of leaders that share our ambitions and see the incredible opportunities of bringing traditional financing opportunities on chain.”

The opposite key market mover is Bitcoin’s restoration from the flash crash below $100,000 on Monday. The correlation between the tokens and Bitcoin stays comparatively excessive, supporting their positive aspects.

Bitcoin catalyzes rally in Litecoin and Mantra

The three-month correlation between Bitcoin and Litecoin is 0.84, and between Bitcoin and Mantra is 0.87. The comparatively excessive correlation means that Bitcoin’s worth development influences the costs of LTC and OM, subsequently additional positive aspects in BTC may push the property greater.

A flash crash in Bitcoin may push merchants on edge as BTC may drag out property correlated with it, wiping out hundreds of thousands of {dollars} in market capitalization. U.S. macroeconomic releases, the motion of U.S. based mostly tech shares and equities and institutional investor exercise sometimes influenced Bitcoin worth.

LTC and OM holders want to look at Bitcoin’s every day worth development to foretell sudden actions within the two altcoins.

Strategic concerns

Merchants who collected LTC below the $100 stage may contemplate taking earnings on a proportion of their holdings, not less than 30% earlier than a correction in Litecoin. Staggered profit-taking is beneficial whereas Litecoin holds regular above the range-bound consolidation zone.

Merchants holding OM acquired below $3.87 ought to ideally contemplate staggered profit-taking whereas the altcoin trades above $5. Sidelined consumers can enter when OM is nearer to $4 and anticipate a re-test of the all-time excessive at $5.95 earlier than taking earnings.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.