Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The remaining months of a market cycle are normally characterised by exhilarating runs by numerous property within the altcoin market — a interval famously dubbed the “altcoin season.” Sadly, whereas the market cycle appears to have peaked, the story has been the other for this class of cryptocurrencies.

Particularly, the Chainlink value has declined by greater than 50% within the final three months, underscoring the dwindling local weather of the crypto market. Nevertheless, the longer term may not be all bleak, as the newest value outlook suggests a promising future for the LINK token.

Is Chainlink Price Gearing For A 100% Transfer?

In a latest submit on the X platform, a crypto analyst with the pseudonym Satoshi Flipper shared an thrilling evaluation of the Chainlink value. Referencing the present format of its every day value chart, the crypto pundit projected LINK to go as excessive as $31 over the subsequent few weeks.

Associated Studying

This bullish evaluation is predicated on the looks of the falling wedge sample on the Chainlink value chart. The falling wedge sample is a technical evaluation formation characterised by two descending and converging trendlines; an higher line connecting the decrease highs and the decrease line connecting the decrease lows.

Wedge formations — which could possibly be rising or falling — are thought of continuation or reversal patterns, relying on whether or not the value breaks down or breaks out. In the falling wedge, if the value breaks above the higher boundary because it narrows into the descending traces, a development reversal is recognized.

This state of affairs seems to be taking part in out on the every day Chainlink value chart, because the altcoin continues to persist within the present downtrend. Nevertheless, a break above the higher trendline would point out a shift to an upward development.

As proven within the chart above, the value of LINK appears to be testing the higher boundary line already. Satoshi Flipper expects the altcoin to surge to as excessive as $31 if a profitable shut happens exterior the falling wedge.

As of this writing, the worth of LINK is hovering across the $14 mark, reflecting an over 2% leap previously 24 hours. A Chainlink value transfer to $31 would signify a greater than 100% surge from the present level.

640,000 LINK Tokens Circulation Out Of Centralized Exchanges

In keeping with crypto pundit Ali Martinez, most LINK traders have been shifting their tokens off centralized exchanges. Current knowledge from Santiment exhibits that greater than 640,000 LINK have made their means off crypto exchanges previously 24 hours.

This magnitude of change outflow helps the present bullish prognosis for Chainlink value, because it implies that the token provide on exchanges (which provide buying and selling providers) contracts. With fewer tokens obtainable on the market within the open market, the altcoin’s value would face much less promoting strain.

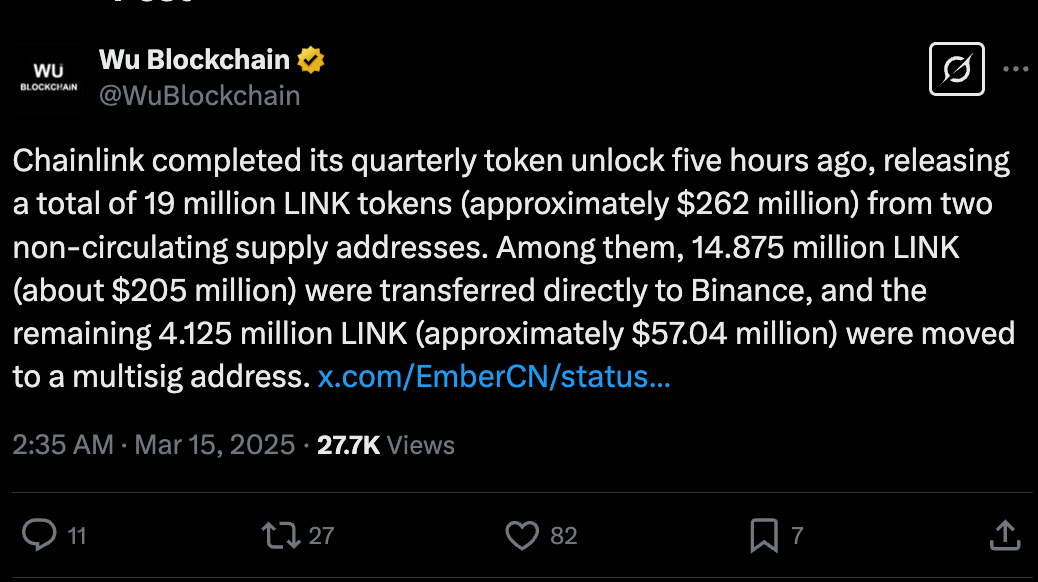

Nevertheless, it’s value mentioning that this important change outflow could possibly be linked to Chainlink’s quarterly token unlock, which noticed the discharge of 19 million LINK tokens on Friday, March 15.

Associated Studying

Featured picture from iStock, chart from TradingView