Bitcoin whale demand is surging, lifting Bitcoin costs. Is BTC USD set for $90,000? Within the final three months, costs plunged by almost 30% from all-time highs, triggering huge liquidations. As costs choose up momentum, the Bitcoin hash price can also be trending increased, lately reaching all-time highs.

Though the Bitcoin worth pulled again yesterday, dropping from $82,000, on-chain information factors to power. CryptoQuant analysts word that Bitcoin may be within the early stage of a better correction, lifting among the greatest Solana meme cash.

Of their findings, giant buyers, or Bitcoin whales, are eager to purchase extra cash. Their demand has accelerated as extra strong proof builds, exhibiting that these entities are positioning themselves for the subsequent large leg up.

Curiously, that is enjoying out simply as Bitcoin costs have been transferring sideways, shaking out weak palms. The involvement of enormous and long-term holders—more than likely establishments or billionaires—at spot charges is a large confidence enhance.

It could set the muse for the world’s most precious coin to race towards $90,000 and even to all-time highs of almost $110,000.

Bitcoin Whales Are Shopping for In Droves: How Will It Impact BTC USD

Per CryptoQuant, addresses holding between 1,000 and 10,000 BTC proceed to develop at a tempo far exceeding their 30-day common.

This growth signifies that whales have been scooping up extra cash over the previous months, surpassing the imply typical of earlier months.

Massive investor demand for Bitcoin is accelerating.

Balances of wallets holding 1K–10K BTC rising sooner than their 30-day common.

Sometimes bullish, alerts sturdy investor confidence. pic.twitter.com/hR5Rumj6A6

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

This bullish divergence is a transparent sign that high-net-worth people and establishments are accumulating cash at spot ranges, probably as a result of, of their evaluation, Bitcoin is undervalued.

CryptoQuant analysts added that costs have a tendency to maneuver increased each time this divergence varieties–a lift for altcoins and among the greatest cryptos to purchase.

Bitcoin is below stress, down 27% from January 2025 highs of almost $110,000. In current days, BTCUSD costs have been consolidating, caught in a decent vary between $84,000 and $74,000.

Whereas $90,000 is a key liquidation degree that should be convincingly damaged for Bitcoin bulls to focus on $100,000, the coin may plunge to Q2 2025 lows of round $74,500 or 2021 highs.

(BTCUSDT)

If Bitcoin whales are again and accumulating, shopping for on each dip, then a detailed above $88,000 and this week’s excessive may catalyze demand, lifting sentiment and costs. Nonetheless, if this can be a bluff, Bitcoin might find yourself crashing under 2021 highs, reversing all This fall 2024 features earlier than probably plunging to $50,000.

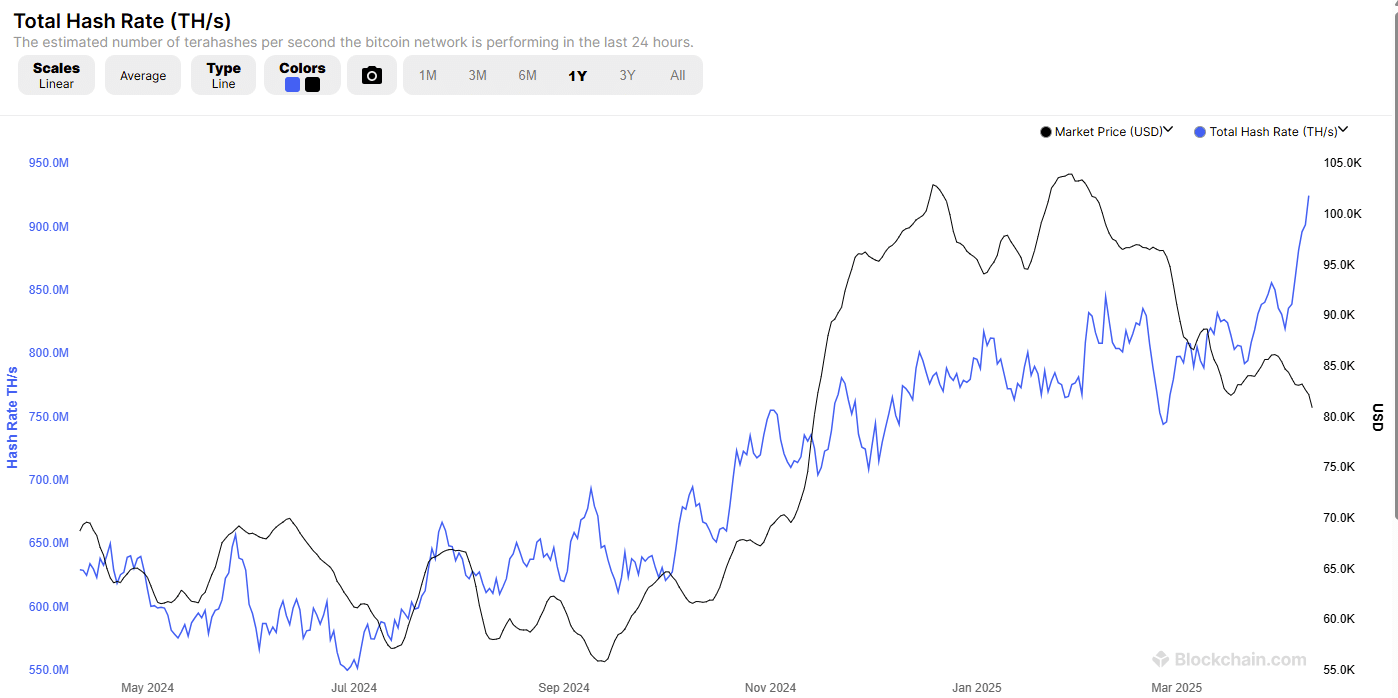

Bitcoin Hash Charge Rising: Miners Are Working Tougher Than Ever

The surge in hash price to all-time highs coincides with Bitcoin whale curiosity. This metric measures the computational energy devoted to the community. By April 9, it stood at over 100 EH/s, printing an all-time excessive, in line with Blockchain.com information.

Miners like Marathon Digital typically buy gear and channel computing energy to course of transactions and make sure blocks for a share of block rewards.

(Supply)

Regardless of the slowdown over the past three months, the divergence in hash price and costs means that miners are assured that costs will rise. For this motive, they’re doubling down on buying extra energy-efficient gear, positioning them to course of extra blocks and, thus, generate extra income.

The rising hash price amid falling costs additional reveals that the current sell-off and international market uncertainty sparked by Donald Trump’s tariffs may very well be a wholesome correction—a chance for good buyers to purchase the dip.

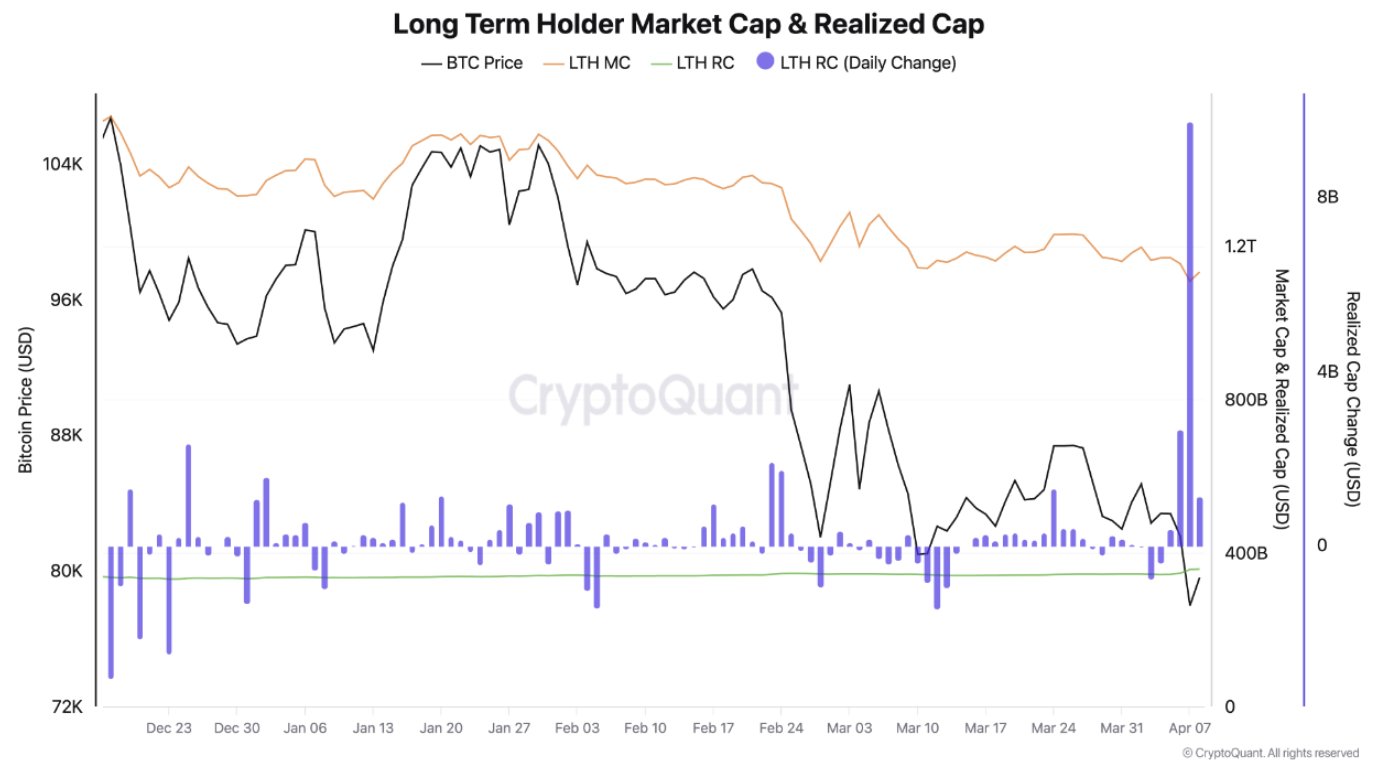

As information reveals, long-term holders are stepping in and shopping for the dip as speculators, largely short-term holders, are exiting, promoting at a loss.

(Supply)

Lengthy-term holders are sometimes establishments and veterans, and their involvement at spot charges factors to a “classic redistribution behavior,” as one analyst notes.

DISCOVER: 16 Subsequent Crypto to Explode in 2025: Professional Cryptocurrency Predictions & Evaluation

Bitcoin Whale Demand Surging: Is BTCUSD Concentrating on $90,000?

- Bitcoin worth agency as Bitcoin whales step in, shopping for the dip

- Bitcoin hash price rising, spikes to all-time highs regardless of current worth drop.

- Lengthy-term holders accumulating as speculators capitulate

- Is this the most effective time to purchase BTCUSD? Will costs hit $90,000?

The put up Bitcoin Whale Demand Accelerating, Is BTCUSD Ready For $90,000? appeared first on 99Bitcoins.