Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is buying and selling lower than 2.5% beneath its all-time excessive close to $112,000, signaling rising momentum and the potential begin of a brand new impulsive part in worth discovery. After weeks of regular positive aspects and robust consolidation above the $100K degree, BTC seems prepared to interrupt larger and lengthen its macro uptrend. The market is watching carefully, as a clear transfer above $112K may set off a wave of bullish continuation and renewed institutional curiosity.

Associated Studying

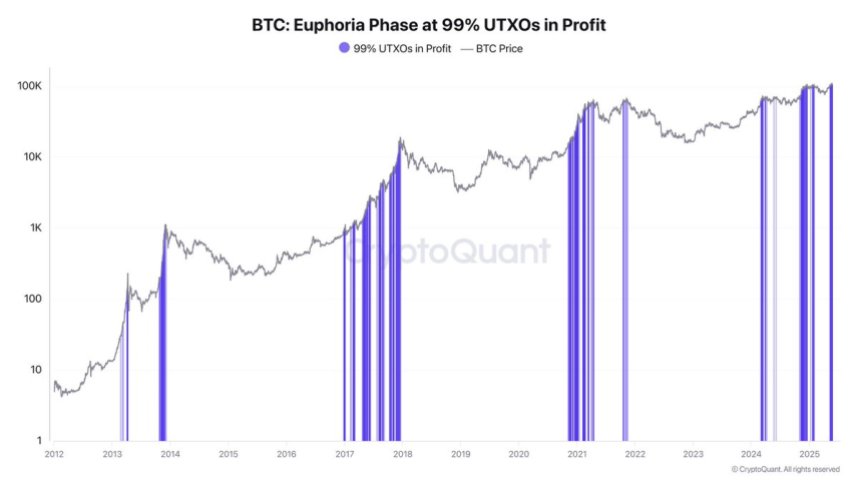

On-chain insights from CryptoQuant add necessary context to this second. Particularly, the evaluation of UTXOs—Unspent Transaction Outputs—supplies a deeper understanding of the state of unrealized earnings throughout the community. UTXOs are the core technical construction that ensures a single bitcoin can solely be spent as soon as. However past that, they provide essential perception into the profitability of held cash.

At present, the market is nearing the 99% threshold, which means 99% of all BTC holdings are in revenue. This degree traditionally aligns with intervals of market euphoria and robust uptrend, however may also sign potential overheating if sustained too lengthy. As Bitcoin inches towards new highs, this metric reinforces the power of the rally whereas reminding traders that such excessive profitability usually comes with elevated volatility.

Bitcoin Thrives In Risky Instances As Market Nears 99% Profit Threshold

Bitcoin is displaying exceptional power because it flirts with new highs this week, buying and selling slightly below $112,000. Whereas international markets react to rising U.S. Treasury yields and chronic inflation, Bitcoin seems to be thriving within the chaos, solidifying its position as each a threat asset and a macro hedge. As conventional markets face stress, BTC continues to steer with resilience, at the same time as geopolitical and policy-related uncertainty clouds investor sentiment.

Prime analyst Darkfost shared recent insights on Bitcoin’s on-chain situation, specializing in the utility of UTXOs (Unspent Transaction Outputs). UTXOs are the technical mechanism that ensures a single BTC can solely be spent as soon as on the blockchain. However past that, they function a robust instrument for assessing unrealized earnings throughout all held BTC.

One key metric derived from UTXOs is the share of BTC provide in revenue. At present, Bitcoin is approaching the essential 99% threshold, which means practically all cash are in unrealized acquire territory. Traditionally, this degree is related to intervals of market euphoria and sustained uptrends, nevertheless it additionally comes with a warning: elevated unrealized earnings usually precede spikes in profit-taking.

Whereas BTC’s construction stays bullish, macro uncertainty—particularly across the Trump administration’s coverage route—retains risk-on conviction muted. As Darkfost notes, “We’re not fully euphoric yet, but we’re entering a zone where late buyers should be cautious.”

If the 99% revenue sign drops, it might set off a wave of promoting as positive aspects shrink and weaker palms capitulate. For now, although, Bitcoin stays robust, and the uptrend is undamaged. The market is watching carefully as a result of in instances like these, BTC tends to maneuver first.

Associated Studying

BTC Holds Regular Close to Highs As Momentum Builds

Bitcoin is presently buying and selling at $109,679 on the 4-hour chart, consolidating slightly below its all-time excessive after reclaiming short-term help. The worth just lately bounced off the 100 SMA ($105,586) and is now hovering above the 34 EMA ($108,280), signaling continued bullish momentum. All key transferring averages are aligned to the upside, reflecting a powerful and wholesome pattern.

Quantity has remained comparatively secure in the course of the pullback and restoration, suggesting no main distribution part is underway. The 50 SMA ($107,679) additionally acted as dynamic help in the course of the latest dip, reinforcing the power of the $107K–$108K zone.

The $103,600 degree, beforehand a serious resistance, continues to function stable structural help. So long as BTC stays above this zone, the broader uptrend stays intact. Brief-term resistance now sits close to the $110,200–$112,000 vary. A breakout above this degree would doubtless set off the subsequent leg larger, doubtlessly towards the $120,000 mark.

Associated Studying

With Bitcoin holding above key EMAs and transferring averages on the 4-hour timeframe, bulls stay in management. If worth continues to construct above $108K, the probability of retesting and surpassing all-time highs grows considerably within the coming periods.

Featured picture from Dall-E, chart from TradingView