Bitcoin is presently buying and selling slightly below its all-time excessive of $112,000, caught in a decent vary as each bulls and bears battle to take management. Whereas patrons have proven power by persistently defending key help ranges, they’ve but to muster the momentum wanted to interrupt into value discovery. On the similar time, sellers have didn’t pressure a deeper correction, highlighting the market’s resilience.

Analysts stay cautiously optimistic, with many leaning bullish amid bettering macroeconomic circumstances and risk-on sentiment in conventional markets. The latest power in US equities has spilled into crypto, giving BTC a tailwind, but not sufficient to set off a decisive breakout.

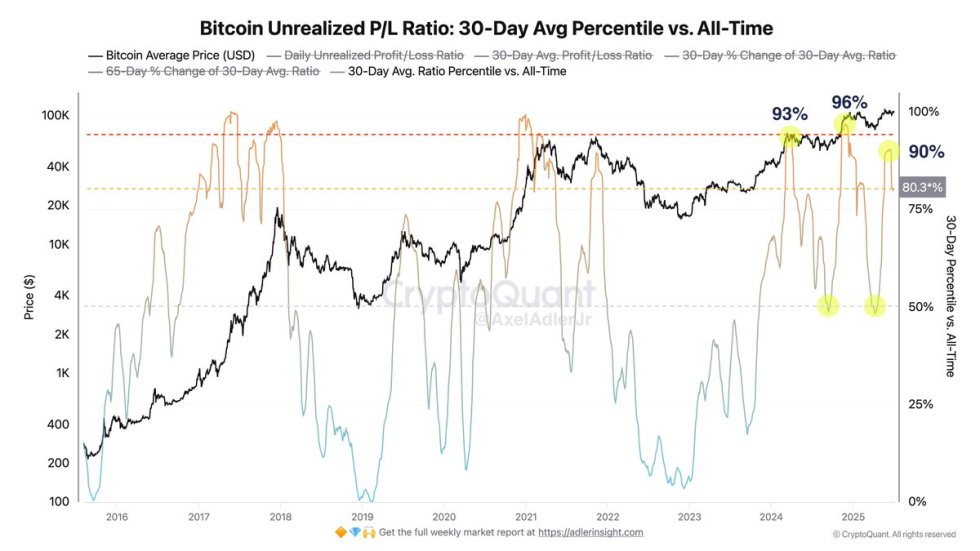

On-chain information provides additional perception into this pivotal second. In accordance with CryptoQuant, the 30-day percentile of the Unrealized Profit/Loss (P/L) Ratio presently stands at 80%. This metric signifies {that a} important majority of BTC holders are sitting on earnings; but, we stay beneath the traditionally excessive 90–100% zone related to main promoting strain. This implies that Bitcoin nonetheless has room to rally earlier than holders start aggressively taking earnings.

BTC Nears Breakout As Profits Accumulate

Bitcoin is on the verge of a serious breakout, rising 47% since its April lows and buying and selling just below 2% away from its all-time excessive at $112,000. The broader market is heating up as macroeconomic uncertainty begins to fade — US equities proceed to climb, bond volatility is dropping, and investor urge for food for threat is returning. This has created a good backdrop for BTC, which has steadily reclaimed floor over the previous two months.

Bulls stay firmly in management, however a breakout into value discovery remains to be wanted to verify the beginning of a brand new expansive section. Analysts extensively agree that the approaching days might be pivotal. A clear transfer above resistance might open the door for a rally to new highs, whereas a failure to carry key ranges might pressure BTC into one other consolidation.

Prime analyst Axel Adler shared a vital on-chain sign supporting the bullish outlook. In accordance with Adler, the 30-day percentile of Bitcoin’s Unrealized Profit/Loss (P/L) Ratio presently stands at 80%. This implies the ratio of cash held in revenue to these in loss is considerably elevated — most holders are within the inexperienced. Traditionally, profit-taking accelerates solely when the metric enters the 90–100% vary.

Since BTC remains to be beneath that overheated threshold, there’s further room for upside earlier than the market faces heavy promote strain. As revenue margins rise, so does the danger of volatility — however at this level, the information nonetheless favors the bulls. If the breakout comes quickly, it might mark the start of a contemporary leg increased and push BTC firmly into uncharted territory.

BTC Pushes Towards Worth Discovery

Bitcoin continues to press in opposition to its all-time excessive resistance zone close to $112,000, exhibiting power because it consolidates above the $109,000 degree. The chart reveals BTC making increased lows since mid-June, signaling that patrons stay firmly in management. The three-day candle construction displays a sustained uptrend following a clear bounce from the $103,600 help — a vital space that has now been examined a number of occasions since April.

The 50-day easy shifting common (SMA) at $95,449 has persistently supplied dynamic help all through this section, whereas the 100-day and 200-day SMAs are trending steadily upward, reinforcing the broader bullish momentum. Quantity stays wholesome, though not but explosive, indicating {that a} breakout above $112,000 might require stronger conviction or a catalyst.

If Bitcoin manages to shut decisively above the $109,300–$112,000 resistance band, it will open the door for a brand new leg into value discovery. On the draw back, failure to carry above $109,000 might see a retest of the $103,600 zone. Total, the construction stays bullish, with consolidation close to highs suggesting accumulation relatively than distribution. So long as BTC maintains this ascending sample, the percentages favor an eventual breakout, probably prior to anticipated.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.