Este artículo también está disponible en español.

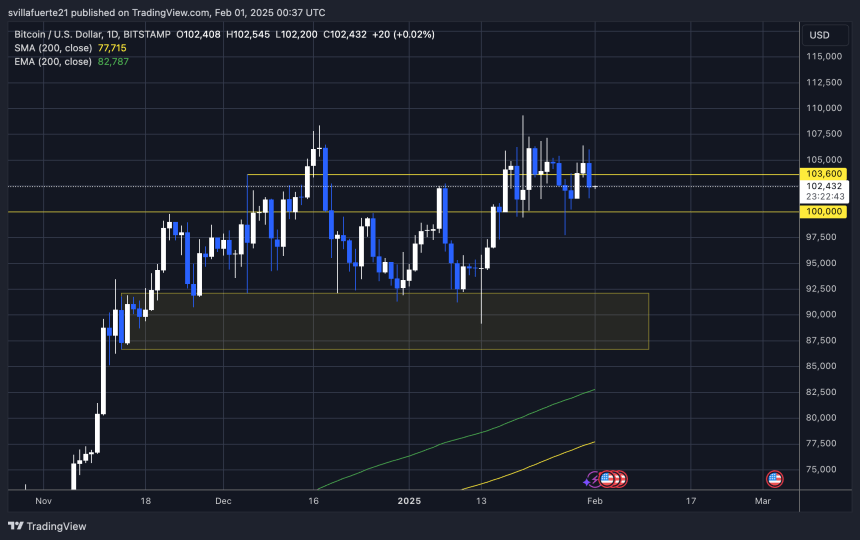

Volatility stays the norm within the Bitcoin market, with aggressive worth swings defining the previous few days. On Monday, BTC dropped to $97K earlier than surging to $106K yesterday. Nevertheless, the worth has since retraced and now consolidates across the $102K mark, retaining buyers on edge about its subsequent transfer.

Associated Studying

High analyst Daan shared key insights from Coinglass, revealing that Bitcoin has largely traded with a Coinbase low cost over the previous month, as indicated by the Coinbase premium index. This implies that different spot exchanges are pricing BTC increased than Coinbase, signaling elevated promoting stress from US buyers. A Coinbase premium sometimes signifies sturdy demand from institutional and ETF consumers, reinforcing bullish sentiment. Nevertheless, with the index at the moment flat, the US market appears indecisive.

As Bitcoin consolidates beneath all-time highs, merchants are intently watching whether or not it may well reclaim key resistance ranges or face one other wave of promoting stress. If BTC breaks above $106K once more, a take a look at of the all-time excessive may comply with. Nevertheless, dropping the $100K help degree may result in additional draw back and prolonged consolidation. The coming days might be essential in figuring out the subsequent part for Bitcoin.

Bitcoin At A Essential Stage As Market Awaits Subsequent Transfer

Bitcoin is at a pivotal second after failing to retest its all-time excessive (ATH) and now looking for help to gas the subsequent leg up. The $110K degree stays the important thing psychological goal above ATH, and as soon as BTC breaks and holds above it, the whole market may enter a brand new bullish part.

Associated Studying

Regardless of latest upside momentum, BTC has struggled to achieve a transparent breakout, resulting in uncertainty amongst buyers. Analysts stay divided—some see this as a pure consolidation earlier than Bitcoin makes its subsequent large transfer, whereas others fear a couple of deeper correction if BTC fails to carry key help ranges.

High analyst Daan shared key insights from Coinglass, revealing that Bitcoin has largely traded with a Coinbase low cost over the previous month. This implies that BTC is priced decrease on Coinbase in comparison with different spot exchanges, indicating that promoting stress is coming primarily from US buyers.

Traditionally, a Coinbase premium has signaled sturdy institutional demand, notably from ETFs and main monetary gamers. Nevertheless, with the index at the moment flat, the US market appears cautious. For BTC to verify a bullish breakout, holding above $102K and reclaiming $106K is essential. If Bitcoin loses these ranges, a retest of $100K help may very well be imminent, delaying a breakout into worth discovery.

Bitcoin Worth Consolidates Under Key Ranges

Bitcoin is at the moment buying and selling at $102,400, exhibiting indicators of consolidation as the worth stays bounded between the $106K resistance and the $100K help ranges. This vary has outlined Bitcoin’s short-term actions, and a breakout in both path will probably dictate the subsequent development.

A breakdown beneath $100K may result in additional consolidation or perhaps a deeper correction, delaying Bitcoin’s bullish breakout. If BTC fails to carry this psychological degree, promoting stress may improve, pushing costs decrease earlier than any try at restoration.

Then again, reclaiming and holding above $106K can be a significant bullish sign, suggesting that worth discovery is imminent. This would clear the trail for Bitcoin to check its all-time excessive (ATH) and goal the $110K mark, probably triggering a contemporary rally.

Associated Studying

For now, uncertainty stays the dominant theme because the market waits for a decisive worth transfer to verify short-term path. With volatility rising, merchants are intently monitoring these key ranges, figuring out {that a} clear breakout or breakdown will set the tone for Bitcoin’s subsequent main transfer.

Featured picture from Dall-E, chart from TradingView