Ark Invest, a fund administration firm, has sharply raised its worth forecasts for Bitcoin, predicting the cryptocurrency might attain $2.4 million on the finish of 2030 in its most bullish situation.

The brand new goal, set in an April 24 report by analysis analyst David Puell, is an enormous improve from the agency’s former bull case goal of $1.5 million.

Institutional Cash Set To Gasoline Development

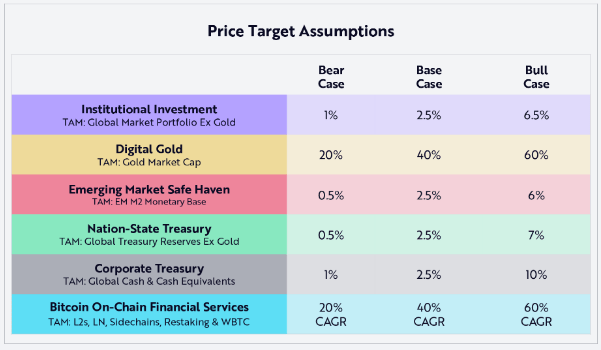

Massive monetary establishments would be the greatest driver of Bitcoin’s future worth development, as per the report of ARK. Within the best-case situation, estimates the agency, Bitcoin can seize 6.5% of the $200 trillion non-gold international monetary market. This institutional adoption is the spine of ARK’s constructive imaginative and prescient.

Bitcoin’s worth is at the moment at round $93,700, having bounced again from a 2025 low of $75,150. For Bitcoin to hit ARK’s bull case goal, it must improve greater than 25 occasions its present worth inside the subsequent 5 years.

Supply: Ark Invest

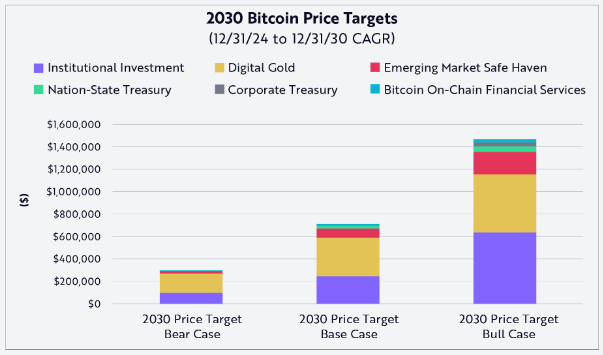

Bitcoin may attain between $300,000 and $1.5 million by 2030 underneath ARK Investment’s bear, base, and bull case eventualities, in line with its Large Concepts 2025 report. The projections are based mostly on anticipated capital inflows from institutional funding, adoption as digital gold, demand…

— Wu Blockchain (@WuBlockchain) April 24, 2025

Digital Gold Standing May Enhance Worth

The second key driver in ARK’s worth thesis is the rising acceptance of Bitcoin as “digital gold.” The corporate expects Bitcoin to doubtlessly declare as much as 60% of gold’s $18 trillion market cap by 2030.

This may be an enormous change in traders’ notion of the cryptocurrency, putting it in competitors with the world’s oldest retailer of worth. If this happens, it might make an enormous contribution to the worth appreciation of Bitcoin, as said within the report.

Supply: Ark Invest

Rising Markets Supply Development Potential

ARK’s estimates that the worth appreciation being pushed by Bitcoin as a “safe haven” in rising economies might symbolize as much as practically 14% of the price development in its bull case projection.

Puell cited this as having “the greatest potential for capital accrual,” referring to the truth that Bitcoin can retailer wealth protected from inflation and devaluation of cash in unstable financial regimes.

The report additionally takes into consideration nation-state adoption and company treasury methods as different components that may contribute to the worth of Bitcoin sooner or later.

BTCUSD buying and selling within the $93,812 area on the 24-hour chart: TradingView.com

Even Bear Case Sees Vital Development

Though the $2.4 million bull case has been making headlines, ARK’s extra modest estimates nonetheless point out important development. The corporate elevated its “bear case” from $300,000 to $500,000 and its “base case” from $710,000 to $1.2 million.

These targets would imply Bitcoin would want to extend at compound annual charges of 32% to 53% over to 2030. Such extended development charges could be uncommon for an asset that has already reached trillion-dollar market capitalization.

If Bitcoin breaks the $2.4 million barrier, then its market capitalization would hit virtually $49 trillion based mostly on about 20 million provide of bitcoins till 2030.

This can place Bitcoin’s market cap virtually on a par with each the US and China’s mixed GDP, in addition to able to overtaking gold as the biggest asset class on this planet.

Featured picture from Alexander Mils/Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.