Bitcoin is buying and selling slightly below the $100,000 mark after reaching an area excessive of $97,938, signaling rising bullish momentum. After weeks of consolidation, final week’s surge has flipped sentiment throughout the market, with bulls now firmly in management. Analysts are more and more optimistic, pointing to the tightening provide dynamics as a possible catalyst for additional upside.

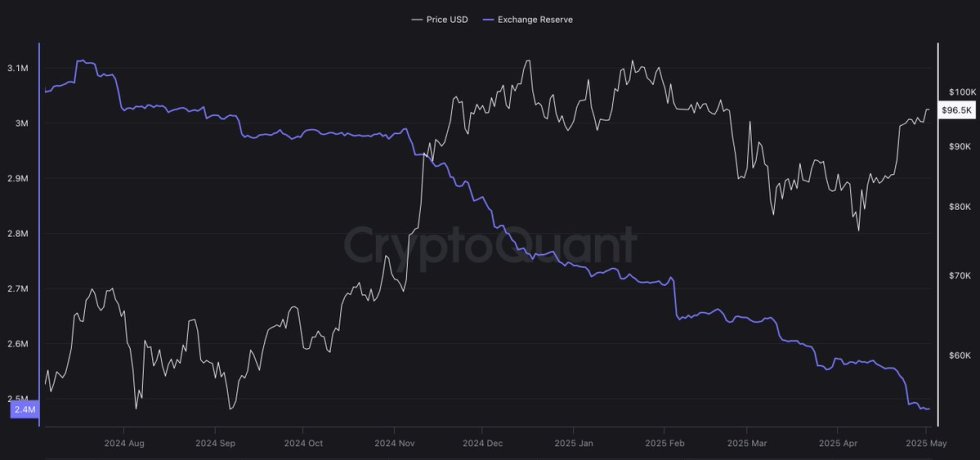

High analyst Daan shared insights displaying that Bitcoin alternate reserves proceed to say no quickly. This pattern highlights a major shift in investor habits. As cash are pulled off exchanges, promoting strain usually decreases, usually a precursor to prolonged rallies.

With BTC now holding above earlier resistance and urgent towards a historic milestone, the supply-side squeeze may set the stage for a pointy leg greater. The $100K degree stays a psychological and technical barrier, but when damaged with sturdy quantity, it could set off a broader rally throughout the market. As liquidity tightens and long-term holders accumulate, all eyes are on whether or not Bitcoin can maintain this momentum and once more enter worth discovery.

Bitcoin On-Chain Information Indicators Power

Bitcoin is at present consolidating above vital liquidity ranges, buying and selling slightly below the $100,000 mark after a multi-week surge that started with a decisive break above $90,000. The bulls are in short-term management, however they now face the problem of sustaining momentum. Holding above this vary is crucial to substantiate a brand new leg of the rally and stop a deeper pullback. Regardless of sturdy good points, the market stays fragile, formed by world uncertainty and chronic commerce tensions, significantly between the US and China.

After months of heavy promoting strain from all-time highs, Bitcoin is displaying renewed energy and trying to ascertain a broader bullish construction. The current worth motion indicators that traders are starting to rotate again into danger property. But, macroeconomic instability and potential recession dangers nonetheless loom massive, suggesting that worth motion may stay risky.

Daan shared on-chain knowledge that helps the bullish thesis. Bitcoin alternate reserves proceed to say no quickly, a pattern that has accelerated for the reason that final US election and throughout the current worth consolidation. This drop in alternate balances traditionally precedes provide crunches, which might gasoline aggressive rallies. Ought to central banks reintroduce large-scale liquidity injections, Bitcoin would doubtless reply with a strong breakout. For now, bulls should maintain the road.

BTC Value Motion Particulars: Key Ranges To Watch

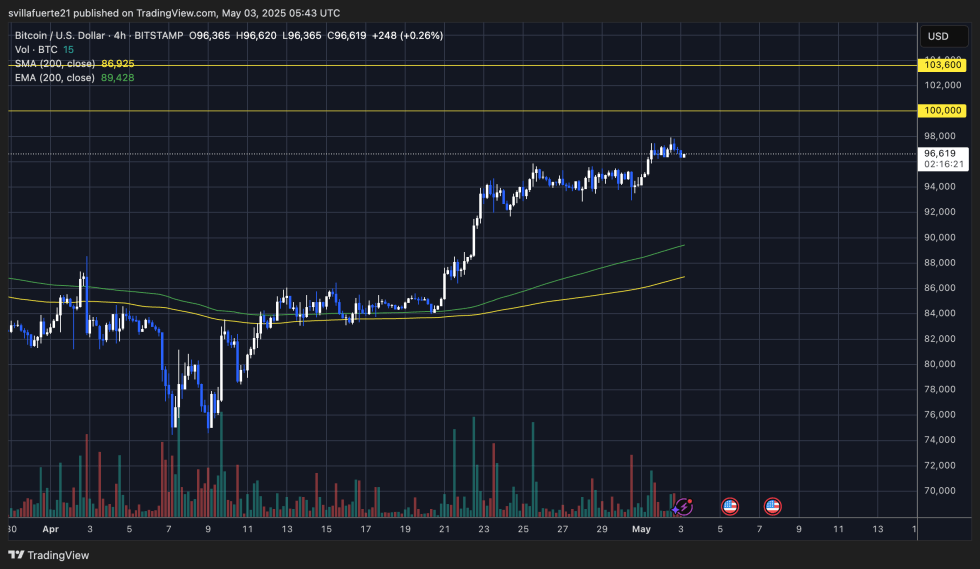

Bitcoin (BTC) is at present buying and selling round $96,600 after a robust multi-week rally that started close to the $84,000 degree. The 4-hour chart exhibits a transparent bullish construction, with greater highs and better lows forming since mid-April. Value motion stays firmly above each the 200-period Easy Transferring Common (SMA) and the 200-period Exponential Transferring Common (EMA), which sit at $86,925 and $89,428, respectively. This implies sturdy help and continued momentum on the short-term pattern.

Nonetheless, BTC has now entered a decent consolidation vary slightly below the psychological $100,000 resistance degree, with short-term resistance forming close to $97,900. Quantity is displaying some decline on current candles, hinting at potential purchaser exhaustion or a pause earlier than the following leg. If bulls can break by way of $98,000 with quantity affirmation, a clear sweep above $100K is very doubtless, concentrating on the $103,600 zone as the following main resistance.

On the draw back, any drop beneath $95,000 may invalidate short-term bullish momentum and set off a retracement again towards the $90,000-$91,000 vary—an space of excessive liquidity and former consolidation. Total, BTC stays technically sturdy, however the subsequent decisive transfer will come from the way it handles the $97K–$100K vary within the coming periods.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.