Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

On-chain knowledge reveals the Bitcoin whales have seen their inhabitants develop not too long ago, regardless of the bearish motion that the worth has been dealing with.

Bitcoin Whales Have Seen Notable Development In Previous 5 Weeks

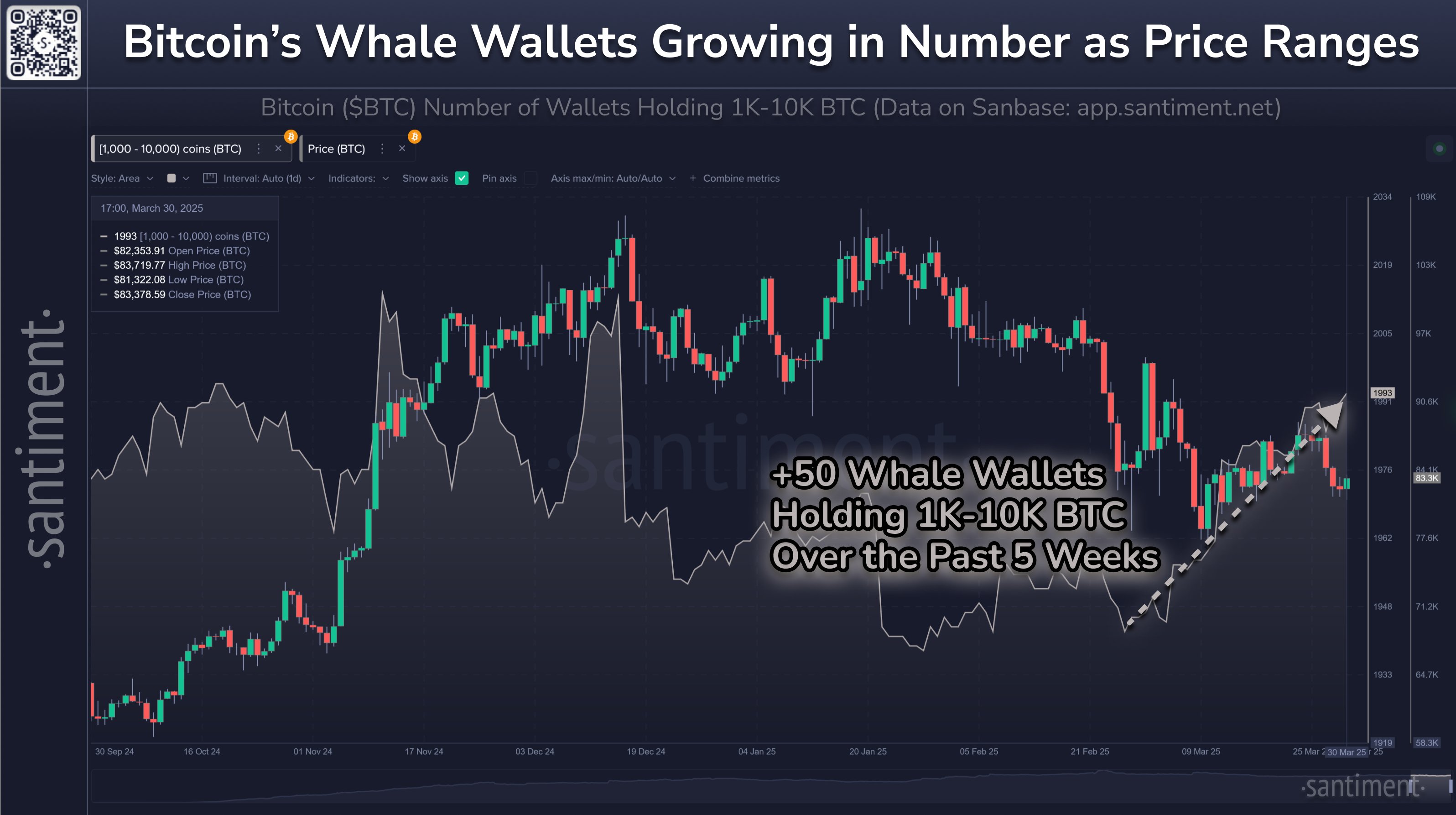

Based on knowledge from the on-chain analytics agency Santiment, whale-sized Bitcoin wallets have not too long ago climbed to their highest level since December of final yr.

The indicator of relevance right here is the “Supply Distribution,” which tells us, amongst different issues, the variety of wallets that belong to a specific coin vary. The metric’s worth for the 1 to 10 cash vary, for instance, represents the variety of buyers or addresses who personal between 1 and 10 tokens.

Associated Studying

Within the context of the present subject, the vary of curiosity is 1,000 to 10,000 cash. The buyers of this dimension ($84.2 million to $842 million in USD phrases) are popularly often known as the whales.

As a result of huge scale of their holdings, these buyers can carry a point of affect available in the market. Naturally, every of them on their very own is probably not related for the cryptocurrency, however the group as an entire could be. The Provide Distribution helps observe precisely this collective conduct.

Now, right here is the chart shared by the analytics agency that reveals the development within the Bitcoin Provide Distribution for the 1,000 to 10,000 cash group over the previous couple of months:

As displayed within the above graph, the Bitcoin Provide Distribution for the whales noticed a plummet alongside the December worth peak, implying a considerable amount of these humongous buyers exited the market.

The identical sample was additionally witnessed through the January prime, albeit at a a lot smaller scale. This could point out that the promoting from the whales as soon as once more obstructed the BTC rally.

Throughout most of February, the metric consolidated at its lows, however beginning with the final week of the month, its worth started to rise. The surge continued all through March and at the moment, there are 1,993 whale-sized addresses on the community, the best degree for the reason that December prime.

Associated Studying

From the chart, it’s seen that this progress in whale entities has come whereas Bitcoin has been struggling round its lows, a possible signal that big-money buyers have been trying on the latest worth ranges as worthwhile entry factors into the cryptocurrency.

“There are many factors contributing to the polarizing crypto markets right now, but it can be taken as a slight sign of confidence that one of the most important key stakeholder tiers in cryptocurrency has grown by +2.6% in the past five weeks alone,” notes Santiment.

It now stays to be seen whether or not this shopping for from the Bitcoin whales will repay or not.

BTC Value

Bitcoin has continued its sideways motion not too long ago as its worth continues to be caught across the $84,000 degree.

Characteristic picture from Dall-E, Santiment.web, chart from TradingView.com